In the U.S., gifts or inheritances from foreign estates, corporations, or partnerships can be subject to some special rules – including the need to file IRS Form 3520. Understanding the estate tax, gift tax, and federal income tax implications of gifts from foreign persons is important.

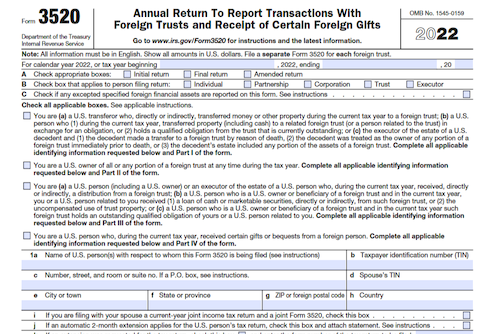

What is Form 3520?

IRS Form 3520 is a form used to report gifts and bequests from foreign entities, such as a nonresident alien, foreign estate, foreign corporation, or foreign partnership to U.S. citizens or resident aliens. As of 2021, the form must be filed when the value of the gift exceeds $100,000 from a nonresident alien or foreign estate, or $16,815 from a foreign corporation or foreign partnership. If given a gift or inheritance without filing this form, you could face penalties up to 25%, so it’s important to consult with tax professionals of your own country and the U.S. to understand your obligations and documentation needed for such transfers.

IRS Form 3520 – Who Needs to Fill It Out?

IRS Form 3520 must be filled out by U.S. citizens or resident aliens who receive a gift with a value greater than $100,000 from a nonresident alien or a foreign estate, or a gift with a value greater than $16,815 from a foreign corporation or foreign partnership. This form must be filed on or before April 15 , and late filings may be subject to a penalty. Further information, including exemptions and form instructions, can be found on the IRS website.

Step-by-Step: Form 3520 Instructions For Filling Out the Document

Filing IRS Form 3520 is an important step for US citizens and resident aliens who have received a gift or bequest valued at over $100,000 USD from a foreign person or entity. It is important to distinguish between taxable gifts (which can include tangible and intangible personal property) and nontaxable income (such as qualified tuition or medical bills). Other conditions also exist, such as potential spouse exemptions and gift tax treaties with certain countries, so consulting the IRS website and IRS Form 3520 instructions is recommended. Penalties may apply if this form is not properly and accurately filed with the designated timeline.

Below, we present a table that will help you understand how to fill out Form 3520.

| Information Required for IRS Form 3520 | Details |

|---|---|

| Name | Recipient’s full name |

| Gift/Bequest Value | Value of the gift or bequest received |

| Gift/Bequest Source | Foreign person or entity providing the gift or bequest |

| Taxable or Nontaxable | Specify whether the gift/bequest is taxable or nontaxable |

| Qualified Tuition or Medical Bills | If nontaxable, specify the nature of the nontaxable income |

| Spouse Exemption | Indicate if spouse exemption applies |

| Gift Tax Treaties | Check if there is a relevant gift tax treaty with the country |

| Filing Deadline | Due date for filing Form 3520 |

| Penalties | Penalties for improper or inaccurate filing |

Do You Need to File Form 3520 Each Year?

It is important to be aware of the gift and inheritance tax laws when a U.S. citizen or resident alien receives a gift or inheritance from a foreign person or entity. In some cases, such as when a gift is not “U.S. situs” property, no gift tax applies. Form 3520 must be filed if the gift or inheritance from a foreign person or entity exceeds $100,000 or $16,815, adjusted annually for inflation. This form should typically be filed by April 15th or October 15th if the recipient has requested an extension. Failing to file, or filing incomplete or inaccurate documents, may subject the recipient to a penalty of up to 25% of the foreign gift’s or bequest’s value. Forms, instructions, and more information are available at the IRS website.

Download the official IRS Form 3520 PDF

On the official IRS website, you will find a link to download Form 3520: Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 3520

Sources:

https://www.irs.gov/forms-pubs/about-form-3520

https://www.irs.gov/instructions/i3520