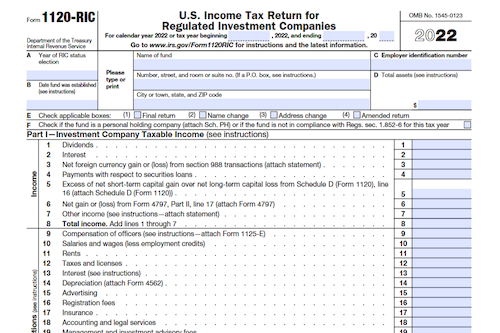

Regulated Investment Companies (RICs) must fill out Form 1120-RIC to report their income, gains, losses, deductions, and credits to determine their income tax liability.

What is Form 1120-RIC?

Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies, is a form used to report the income, gains, losses, deductions, and credits of a RIC as defined by the Internal Revenue Service. This form is used to accurately figure the income tax liability of a regulated investment company. It is important to correctly fill out this form when filing taxes so that the correct taxable income for the RIC can be determined.

IRS Form 1120-RIC – Who Needs to Fill It Out?

Any RIC that meets the definition of a regulated investment company must fill out IRS Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies. This form is used by the RIC to report their income, gains, losses, deductions, credits, and income tax liability in order to comply with the IRS regulations outlined in Section 851.

Step-by-Step: Form 1120-RIC Instructions For Filling Out the Document

Furnishing Form 1120-RIC requires following a step-by-step approach. Firstly, the purpose of the form must be determined; it is used to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a regulated investment company (RIC) as defined in section 851. Be sure to read through the entire form to make sure that all the requisite information has been filled out properly.

Below, we present a table that will help you understand how to fill out Form 1120-RIC.

| Information Required for Form 1120-RIC | Details |

|---|---|

| Purpose of Form | Report income, gains, losses, deductions, credits, and calculate tax liability for a regulated investment company (RIC) as defined in section 851. |

| Additional Information | Read through the entire form to ensure all required information is filled out properly. |

Do You Need to File Form 1120-RIC Each Year?

Generally, regulated investment companies must file Form 1120-RIC each year to report their income, gains, losses, deductions, credits, and to calculate their income tax liability. This form can help RICs determine how much tax they owe and how much should be submitted to the IRS. Additionally, filing Form 1120-RIC helps RICs keep accurate records of their finances and business activities for the IRS and other entities.

Download the official IRS Form 1120-RIC PDF

On the official IRS website, you will find a link to download Form 1120-RIC. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download Form 1120-RIC

Sources: