This article will provide an overview of General Instructions for Forms 1094-B and 1095-B, including who must file, eligibility for certain types of minimum essential coverage, and information about reporting coverage for nonemployees.

What is Form 1094-B?

Form 1094-B and 1095-B are used to report certain information to the IRS and taxpayers about individuals who are covered by minimum essential coverage. This includes government-sponsored programs, eligible employer-sponsored plans, individual market plans, and other coverage types designated by the Department of Health and Human Services. All persons providing minimum essential coverage must file Form 1095-B and submit with Form 1094-B. Employers or carriers responsible for self-insured plans can choose to file Form 1095-B or 1095-C depending on the number of employees. Forms 1094-B and 1095-B also report coverage in individual market qualified health plans and Small Business Health Options Program (SHOP). However, coverage under Children’s Health Insurance Program (CHIP), Medicaid, Medicare (including Medicare Advantage), or the Basic Health Program provided through health insurance companies is reported by the government.

IRS Form 1094-B – Who Needs to Fill It Out?

Form 1095-B is required to be filed by employers, healthcare issuers and carriers, and government-sponsored programs who offer minimum essential health coverage to individuals. Such coverage includes eligible employer-sponsored plans, individual market plans, and other types of coverage as designated by the Department of Health and Human Services. Nonemployees with employer-sponsored self-insured health coverage are required to fill out Form 1095-B, while employers with 50 or more full-time employees should use Form 1095-C. Health insurance issuers and carriers must use Form 1095-B for most health insurance coverage, excluding CHIP, Medicaid, Medicare, and Basic Health Program coverage which must be reported by government sponsors, and forms 1095-A for individuals enrolled in qualified health plans through the Health Insurance Marketplace.

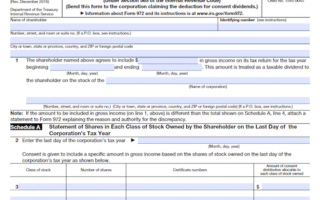

Step-by-Step: Form 1094-B Instructions For Filling Out the Document

Follow the step-by-step instructions to fill out Forms 1094-B and 1095-B in order to report certain information to the IRS and taxpayers about individuals who are covered by minimum essential coverage. Depending on the type of coverage provided, the filer may use either Form 1095-B (for individuals enrolled in eligible employer-sponsored plans, individual market plans, or other coverage as designated by the Department of Health and Human Services) or Form 1095-C Part III. Insured coverage including individual market coverage and employer-sponsored plans must be reported on Form 1095-B, with the exception of CHIP, Medicaid, Medicare and the Basic Health Program, which are reported by the government sponsors of those programs. Marketplaces report qualified health plans on Form 1095-A, but health insurance issuers report employer coverage through the SHOP program on Form 1095-B. For 2022 coverage, forms 1095-B is encouraged but not required in order to report coverage in catastrophic health plans enrolled in through the Marketplace.

Below, we present a table that will help you understand how to fill out Form 1094-B.

| Form Name | Information Required | Details |

|---|---|---|

| Form 1094-B | Step-by-Step Instructions for Form 1094-B | Step-by-step instructions for completing Forms 1094-B and 1095-B to report information about individuals covered by minimum essential coverage. |

Do You Need to File Form 1094-B Each Year?

Yes, Form 1094-B and 1095-B are required to be filed each year by most providers of minimum essential coverage, such as employers sponsoring self-insured group health plans, including individual coverage health reimbursement arrangements (HRAs), and health insurance issuers and carriers for most health insurance coverage, excluding certain government-sponsored programs, like the Children’s Health Insurance Program (CHIP), Medicare, Medicaid, and the Basic Health Program. Small employers with 50 or fewer full-time employees, however, are required to file only the 1094-B and 1095-B. In addition, Marketplaces are required to file Form 1095-A instead of 1095-B.

Download the official IRS Form 1094-B PDF

On the official IRS website, you will find a link to download Form 1094-B. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1094-B

Sources: