Are there any questions about what Form 1045: Application for Tentative Refund is or how to file it?

What is Form 1045?

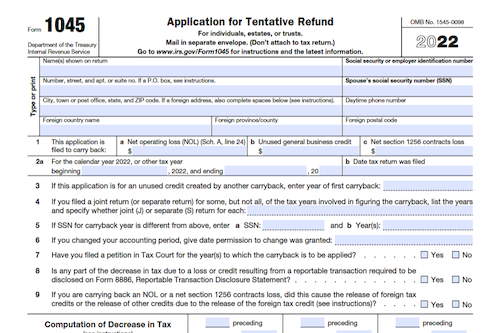

Form 1045: Application for Tentative Refund is an IRS form used by individuals, estates, and trusts to request a quick tax refund when the basis for the refund is one of four reasons – carryback of a net operating loss (NOL), carryback of an unused general business credit, carryback of a net section 1256 contracts loss, or an overpayment of tax due to a claim of right adjustment under section 1341(b)(1). Form 1045 can only be filed within one year of the NOL occurring and can be filed by the taxpayer or taxpaying entity. It does not need to be attached to an income tax return and is filed separately or in a separate envelope. This form, available on the IRS website, must include relevant personal information, questions about the nature of the carryback, and the amount of the decrease in tax. Two pages of Form 1040, Form 4952, and all Schedules K-1 must also be filed with Form 1045.

IRS Form 1045 – Who Needs to Fill It Out?

IRS Form 1045, Application for Tentative Refund, is to be filled out by individuals, estates, and trusts who are looking to apply for a quick tax refund due to a net operating loss, an unused general business credit,a net section 1256 contracts loss, or an overpayment of tax due to a claim of right adjustment. The form and the required documentation must be filled out within one year of the NOL’s occurence, along with the first two pages of Form 1040, any Form 4952, and all Schedules K-1. Taxpayers must note that filing Form 1045 does not mean a final and correct refund; it is only a tentative refund.

Step-by-Step: Form 1045 Instructions For Filling Out the Document

Filling out Form 1045: Application for Tentative Refund starts with basic personal information including name, address, and Social Security number. After that, taxpayers will need to provide information about their net operating loss, unused credit, net section 1256 contracts loss, or claim of right adjustment that forms the basis of their refund. After specifying the amount of their decrease in tax from the carryback, claimants must sign and date the form, as well as include pages 1 & 2 of Form 1040, Form 4952, and all Schedule K-1s. Form 1045 can be filed within 1 year of its triggering incident, and must be received by the IRS within 90 days. It’s important to note that any refunds given via Form 1045 are ‘tentative’ – but it offers much faster refunds than either Form 1040-X or Form 1041.

Below, we present a table that will help you understand how to fill out Form 1045.

| Information Required for Form 1045 | Details |

|---|---|

| Name | Individual’s full name |

| Address | Current mailing address |

| Social Security Number | Unique identification number |

| Net Operating Loss | Loss amount from business operations |

| Unused Credit | Credits not used in previous returns |

| Net Section 1256 Contracts Loss | Loss from section 1256 contracts |

| Claim of Right Adjustment | Adjustment amount based on claims |

| Decrease in Tax from Carryback | Amount of tax reduction from carryback |

| Signature and Date | Sign and date the form |

| Additional Documents | Include pages 1 & 2 of Form 1040, Form 4952, and all Schedule K-1s |

| Filing Deadline | File within 1 year of triggering incident; IRS must receive it within 90 days |

| Refund Status | ‘Tentative’ refund, faster than Forms 1040-X or 1041 |

Do You Need to File Form 1045 Each Year?

Do You Need to File Form 1045: Application for Tentative Refund Each Year? No, Form 1045 is used by individuals, estates, and trusts to apply for a quick tax refund, and must be filed within one year of the NOL occurring. It is not required for any other tax year and should only be used when the basis for a refund request is for one of the four reasons outlined in the form instructions. The refund processing time is much faster than with other forms, and taxpayers must include the first two pages of Form 1040, any Form 4952, and all Schedules K-1 with the filing.

Download the official IRS Form 1045 PDF

On the official IRS website, you will find a link to download Form 1045. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1045

Sources:

https://www.irs.gov/forms-pubs/about-form-1045

https://www.irs.gov/pub/irs-pdf/i1045.pdf