For recipients of Form 1097-BTC from a bond issuer or their agent, such as brokers, nominees, mutual funds, or partnerships, who are further distributing tax credits from New Clean Renewable …

For recipients of Form 1097-BTC from a bond issuer or their agent, such as brokers, nominees, mutual funds, or partnerships, who are further distributing tax credits from New Clean Renewable …

Owners of low-income rental buildings can get a low-income housing credit for each building over a 10-year period, with Form 8609 being used to claim allocations from the housing credit …

For businesses with long-term contracts of certain types, Form 8697 is used to determine the amount of interest due or refundable under the look-back method of taxation. Learn who must …

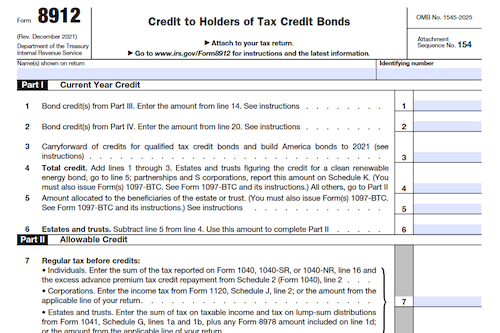

Form 8912 can be used to claim a tax credit from six different types of tax credit bonds – Clean Renewable Energy Bonds, New Clean Renewable Energy Bonds, Qualified Energy …

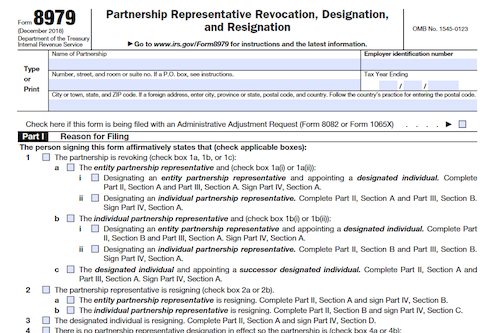

Form 8979 is used to designate or revoke a partnership representative or designated individual with the IRS. It can be filed by a partnership, partnership representative, or designated individual in …

Form 1096 is used to send to the IRS certain paper forms such as the 1097, 1098, 1099, 3921, 3922, 5498, and W-2G, and is accompanied by relevant instructions on …

Paid tax return preparers and enrolled agents (EAs) must obtain and renew a Preparer Tax Identification Number (PTIN) annually. This form outlines who must file, and the information required to …

Form 1066 is required to be filed by entities that elect to be treated as a Real Estate Mortgage Investment Conduit (REMIC) for their first tax year, meeting certain criteria. …

Organizations that issue specified securities must file Form 8937 with the IRS if an organizational action affects the basis of a security or class of the security. Examples include cash …

Form 5310-A must be filed by any sponsor or plan administrator of a pension, profit-sharing or deferred compensation plan if they are involved in a merger, spinoff or transfer of …

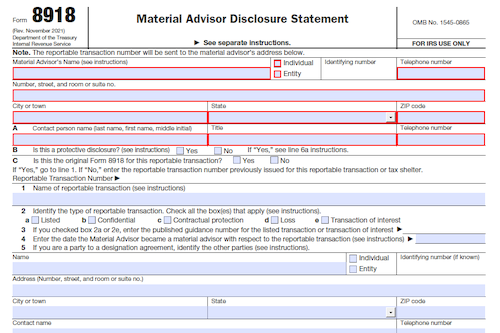

Filing Form 8918 with the IRS is now required by material advisors to any reportable transaction in order to disclose certain information related to the transaction and receive a reportable …

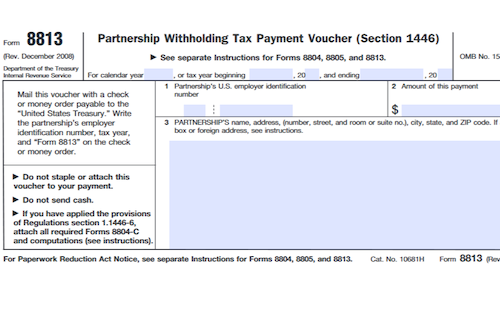

Ever wondered what forms to use to report and pay withholding tax under section 1446? This article will cover General Instructions, Purpose of Forms, Taxpayer Identification Numbers (TINs), Applying for …

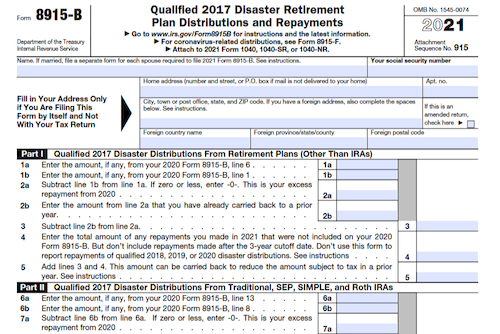

Individuals adversely affected by a 2017 disaster who received a qualifying distribution may need to file Form 8915-B to report repayments of qualified 2017 disaster distributions made in 2021. What …

With Form 8804, 8805, and 8813, partnerships must pay and report the section 1446 withholding tax based on effectively connected taxable income (ECTI) allocated to foreign partners per U.S. regulations. …

Business credits can be claimed by filing Form 3800. Partnerships, S Corporations, Estates, Trusts, and Cooperatives have special filing exceptions depending on the type of credit being claimed. All other …

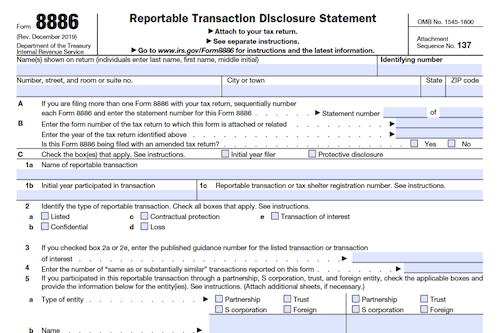

Individuals, trusts, estates, partnerships, S corporations, and other corporations that participate in reportable transactions for federal tax purposes must file Form 8886. This form helps disclose information regarding the tax …

Organizations that operate private foundations or claim private foundation status (including charitable trusts treated as private foundations) must file Form 990-PF to figure their tax based on investment income and …

Expatriates must file Form 8854 to comply with their initial and annual information reporting obligations and taxation requirements when relinquishing or terminating their U.S. citizenship or residency on or after …

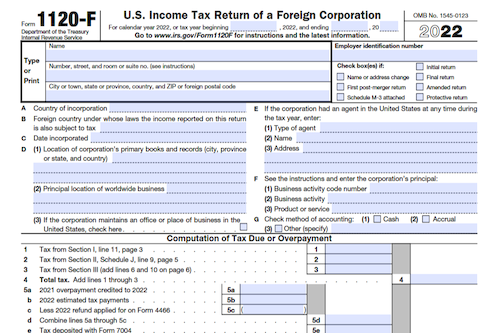

For foreign corporations conducting business in the United States, Form 1120-F must be filed to report income, deductions, credits, and figure U.S. tax liability. Unless one of the exceptions applies, …

U.S. persons filing Form 8865 must provide information about the entity’s Controlled Foreign Partnership (CFP) activities, as required under sections 6038, 6038B, and 6046A. Depending on the category of which …