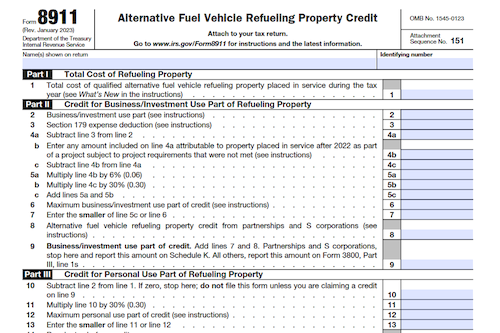

Form 8911 is used by taxpayers to claim credits for the purchase of alternative fuel vehicle refueling property, either as a general business credit or personal credit. Depending on the date placed in service, taxpayers are eligible for credits up to $100,000 for business/investment use property and up to $1,000 for personal use property.

What is Form 8911?

Form 8911 is an IRS document used to figure the credit for alternative fuel vehicle refueling property placed in service during your tax year. The property must meet certain requirements to qualify, including being placed in service during the tax year and having its original use began with you. For property subject to an allowance for depreciation, the credit is generally the smaller of 30% of the cost of the property or $30,000. Businesses and S corporations must file Form 8911 to claim the credit, and revisions of the form can be found at IRS.gov/Form8911.

IRS Form 8911 – Who Needs to Fill It Out?

Partnerships and S corporations must fill out FORM 8911 to figure their credit for alternative fuel vehicle refueling property placed in service during their tax year. Any other taxpayers who have obtained the credit from either of these entities do not need to submit this form, instead reporting it on Part III of Form 3800. All revisions of FORM 8911 are available on IRS.gov/Form8911, and the December 2022 revision must be used for tax years beginning in 2022 or later. The amount of the credit depends on several factors, such as the type of property, if the property is subject to an allowance for depreciation, and if the property is placed in service in an eligible census tract. If the property meets the specific requirements, the taxpayer may be eligible for the credit.

Step-by-Step: Form 8911 Instructions For Filling Out the Document

Filing Form 8911 is the necessary step to calculating your credit for alternative fuel vehicle refueling property which was placed in service during your tax year. Partnerships and S corporations are required to file the form, while all other taxpayers can report the credit directly on Form 3800 if their only source is a partnership or S corporation. The form should be completed using the December 2022 revision if the tax year is 2022 or later, and prior revisions are to be used for earlier tax years. The credit amounts are generally 30% of the cost of the property, or $30,000/$1,000 pre/post 2022 for depreciable/non-depreciable properties. Additionally, the property must satisfy alternative fuel, location, and wage/apprenticeship requirements. Failure to meet these requirements may result in a recapture of the credit.

Below, we present a table that will help you understand how to fill out Form 8911.

| Form 8911 | Instructions |

|---|---|

| Filing Form 8911 is the necessary step to calculating your credit for alternative fuel vehicle refueling property placed in service during your tax year. |

|

Do You Need to File Form 8911 Each Year?

Partnerships and S corporations must file Form 8911 each year to claim the credit, while other taxpayers are not required to complete or file the form if their only source of credit is a partnership or S corporation. Taxpayers must use the December 2022 revision of Form 8911 for tax years beginning in 2022 or later, and must use prior revisions of the form for earlier tax years. The credit for all property placed in service before 2023 at each location is generally the smaller of 30% of the property’s cost or $30,000/$1,000 (business/investment/personal use property), or the smaller of 30% of the property’s cost or $100,000/$1,000 (business/investment/personal use property) for each item of property placed in service after 2022. To qualify for the credit, individuals must meet certain requirements and must be located in an eligible census tract. Credit sellers must provide written disclosure to their buyer of how much tentative credit they are eligible for. Taxpayers may also be subject to wage and apprenticeship requirements, as well as a basis reduction and recapture of the credit if it is no longer eligible.

Download the official IRS Form 8911 PDF

On the official IRS website, you will find a link to download Form 8911. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8911

Sources: