Understand the tax implications of Employee Stock Purchase Plans (ESPPs), which offer a fringe benefit to employees the option to purchase a company’s stock at a discounted rate. ESPPs often go through four phases including Grant, Offering, Transfer, and Disposition. Knowing how to include the gains in your tax plan can help you determine whether ESPPs are a good option for you.

What is Form 3922?

An employee stock purchase plan (ESPP) is a fringe benefit offered by businesses to their employees. This plan grants them the ability to purchase company stock at a discounted rate with after-tax deductions from their pay. In order to meet the rules set by the Internal Revenue Code, these plans must offer no more than a 15% discount on the purchase price of stock. By understanding how to include the gains in your taxes, you can decide if an ESPP is right for you. In addition to tax implications, ESPPs are divided into four phases: grant, offering, transfer, and disposition, each impacting how the stock is purchased and sold. Knowing how to report an ESPP on your taxes for accurate compensation income and capital gains can make or break your bank account.

IRS Form 3922 – Who Needs to Fill It Out?

Employees may experience a number of tax implications when they participate in an employee stock purchase plan (ESPP). These plans are set up to use after-tax earned income for stock purchases, with subsequent taxes collected upon sale of the stock. Form 3922 is used to transfer and document the stock, but other documents and forms such as 1099-B may also be necessary to record capital gains or losses and compensation income when selling the stock. There are two holding periods used to determine a transaction’s classification, which, in turn, dictate the tax treatment. Qualifying and non-qualifying dispositions and long-term and short-term sales may all apply, which is why it is important to understand how to properly include ESPPs in your tax plan.

Step-by-Step: Form 3922 Instructions For Filling Out the Document

Understanding how to fill out forms and include gains in your tax plan is key to determining whether an employee stock purchase plan (ESPP) is a good option for you. This process consists of four phases – grant, offering, transfer and disposition. The grant phase includes the employer granting its workers the option to purchase stock at a set price. The offering period is when workers save for the purchase of the stock by deducting a percentage or a fixed dollar amount from each paycheck, which happens after taxes and FICA taxes are already withheld from their pay. During the transfer phase, the saved money is used to purchase the stocks, and is then transferred to the employee with two copies of Form 3922. The disposition phase allows the worker to do what they please with the stocks – often it is selling, trading, exchanging, transferring or donating. The tax treatment of the stock depends on the period of ownership, the selling price, and the number of shares sold. The key to correctly reporting ESPPs on your tax return is calculating compensation income, basis, long-term or short-term sales, and understanding Form 3922.

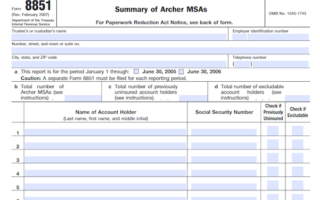

Below, we present a table that will help you understand how to fill out Form 3922.

| Phase | Description |

|---|---|

| Grant | The employer grants employees the option to purchase stock at a set price. |

| Offering | Employees save for stock purchase by deducting a percentage or a fixed dollar amount from each paycheck, after taxes and FICA taxes. |

| Transfer | Saved money is used to purchase stocks, and two copies of Form 3922 are transferred to the employee. |

| Disposition | Employees can sell, trade, exchange, transfer, or donate the stocks. Tax treatment depends on ownership period, selling price, and number of shares sold. |

Do You Need to File Form 3922 Each Year?

Compensatory income earned from an ESPP can impact your taxes greatly, depending on whether the sale of the stocks is considered a qualifying or non-qualifying disposition. Once the stocks are purchased and transferred, this is determined by two factors: the length of time you have owned the stock, and the selling price. The amount of income you earn from the sale is tied to the selling price and quantity of shares sold, collectively referred to as the gross proceeds. Depending on the length of ownership, you may need to pay long- or short-term capital gain taxes. This data is typically found on IRS Form 3922, which your employer must provide to you when stock is transferred.

Download the official IRS Form 3922 PDF

To understand how to correctly document and report your gains and losses from selling employee stock purchase plan (ESPP) shares, it’s important to understand the various phases of the process including purchasing, transferring, and disposing of the stock. By downloading IRS Form 3922, you can ensure that all your information is accurate and the correct amount of tax is paid. On the official IRS website, you will find a link to download Form 3922. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 3922

Sources:

https://www.irs.gov/forms-pubs/about-form-3922

https://www.irs.gov/instructions/i3921