Businesses dealing in goods or services subject to federal excise taxes must complete and file form 720 with the IRS on a quarterly basis. The form details how much excise tax is owed per type of product or service and must be submitted by the last day of the month following the end of the quarter.

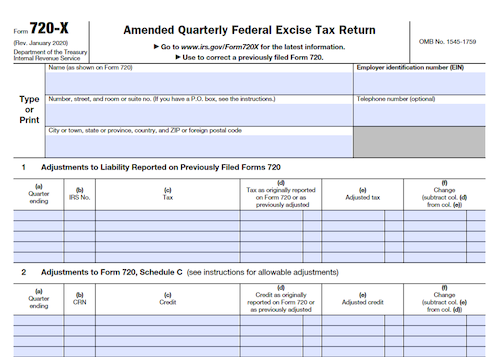

What is Form 720-X?

Form 720 is a Quarterly Federal Excise Tax Return which is filed with the IRS. It is filed by business owners who sell goods and services that are subject to excise tax, such as indoor tanning services, gasoline, airline tickets, and coal products. This form must be completed each calendar quarter and is due on the last day of the month following the end of the quarter. It includes a line for each type of excise tax that may be due and payment amounts are calculated based on the number of units sold or the weight of the product.

IRS Form 720-X – Who Needs to Fill It Out?

Businesses dealing in goods and services subject to excise tax must fill out an IRS Form 720 and submit it to the IRS four times a year. The Form includes a variety of goods and services, from gasoline for cars and indoor tanning to airline tickets and coal products. Those responsible for collecting the excise taxes stated on the Form 720 must complete and submit a return for each calendar quarter, ending on the last day of the following month. When filling out the Form, one simply has to input the number of units sold and then multiply it by the per-unit rate stated. Doing so helps ensure that the correct excise tax is collected and reported to the IRS.

Step-by-Step: Form 720-X Instructions For Filling Out the Document

If you are responsible for collecting excises taxes on goods and services, such as gas, diesel fuel, tanning, and airline tickets, then you must fill out Form 720. This documents must be filed quarterly, with deadlines being the last day of the month following the end of the quarter. When completing the form, you must include each type of excise tax you are responsible for paying and provide the details required to calculate the total amount owed, such as the number of gallons for diesel fuel, multiplied by the rate per gallon. The IRS provides two tests to determine whether you must file, so be sure to be aware of the requirements.

Below, we present a table that will help you understand how to fill out Form 720.

| Information Required for Form 720 | Details |

|---|---|

| Taxable Goods and Services | List the types of excise taxes you are responsible for |

| Calculation Details | Provide necessary details to calculate total amount owed |

| Filing Deadlines | File quarterly by specified deadlines |

| Filing Requirements | Meet the IRS requirements for filing |

Do You Need to File Form 720-X Each Year?

Yes, businesses that deal in goods and services subject to the federal excise tax must prepare a Quarterly Federal Excise Tax Return on Form 720 up to four times per year. The last day of the month following the end of each quarter is the due date. For instance, April 30 is the due date for the Form 720 covering the quarter ending on March 31. The form will include a line for each type of excise tax you may be responsible for paying, such as on airline tickets, gasoline, coal, and indoor tanning, and fees are collected according to the unit sales or weight of the product.

Download the Official IRS Form 720-X PDF

On the official IRS website, you will find a link to download Form 720-X. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 720-X

Sources: