Form 8453-EMP allows taxpayers to authenticate an electronic Form 940, 941, 941-PR, 941-SS, 943, 943-PR, 944, or 945, authorize an ERO or ISP to transmit, and provide consent to authorize an electronic funds withdrawal. EROs can use it or Form 8879-EMP to obtain authorization to file. A PTIN may be required to file Form 8453-EMP.

What is Form 8453-EMP?

Form 8453-EMP is an IRS form that must be used by taxpayers filing an employment tax return through an electronic return originator (ERO) or an intermediate service provider (ISP). The purpose of Form 8453-EMP is to authenticate the electronically filed returns, provide the taxpayer’s consent to authorize an electronic funds withdrawal for payment of federal taxes, and authorize the ERO, ISP, or third-party transmitter to transmit the return. Any paid preparer of the return must enter their preparer tax identification number (PTIN) in Part III, and EROs who aren’t paid preparers have the option to enter either their PTIN (after September 27, 2010) or their social security number. After the IRS has accepted the return, the refund should be issued within 3 weeks; however, for the latest information about developments related to Form 8453-EMP and its instructions, visit www.irs.gov/form8453emp.

H2-2 IRS Form 8453-EMP – Who Needs to Fill It Out?

Form 8453-EMP must be filed if an employment tax return is being filed through an Internet Service Provider (ISP) and/or transmitter without an Electronic Return Originator (ERO). Those who are filing through an ERO may choose to use Form 8453-EMP or Form 8879-EMP to authorize transmission, obtain authentication, and allow electronic funds withdrawal. Both taxpayers and EROs must provide information such as name, employer identification number, signature, and preparer tax identification number or social security number. After the IRS has accepted the return, most refunds should be issued within 3 weeks.

Step-by-Step: Form 8453-EMP Instructions For Filling Out the Document

Filling out Form 8453-EMP is simple. Begin by going to www.irs.gov/form8453emp for the latest information regarding the form and any related legislation updates. Depending on your filing method, you may need to fill out Part II: Declaration of Taxpayer to authorize the ERO, if applicable, to transmit via a third-party or provide your consent to electronic funds withdrawal for payment. The taxpayer’s signature allows the IRS to disclose processing information and an acknowledgement of filing. If using an ERO, Part III: Declaration of ERO and Paid Preparer must also be completed. All paid preparers must enter their PTIN, while EROs have the option to enter PTIN or a social security number. Once done, scan the completed form into a PDF file and transmit it with the electronically filed return. Refunds will be issued after the IRS has accepted the form and should come within 3 weeks.

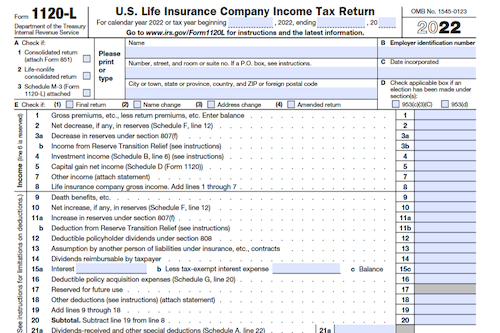

Below, we present a table that will help you understand how to fill out Form 8453-EMP.

| Information Required for Form 8453-EMP | Details |

|---|---|

| Electronic Filing Authorization | Authorizing electronic filing and payment of employment taxes |

| Submission Process | Steps for filling out and transmitting the form electronically |

Do You Need to File Form 8453-EMP Each Year?

Yes, if filing Form 940, 940-PR, 941, 941-PR, 941-SS, 943, 943-PR, 944, or 945, you must file Form 8453-EMP. You can use this form to authenticate an electronic return, authorize the ERO/ISP to transmit, provide consent for an electronic funds withdrawal payment, and/or to obtain authorization with a PIN for the return. For up-to-date information on the form, go to www.irs.gov/form8453emp. On the form, you will need to provide the name & EIN as stated on the return, the taxpayer’s signature with EFTPS details (if needed), ERO & paid preparer declarations, and applicable PTIN information. After processing, refunds should be received in 3 weeks.

Download the official IRS Form 8453-EMP PDF

On the official IRS website, you will find a link to download Form 8453-EMP. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8453-EMP

Sources: