For lower-income taxpayers seeking to become homeowners, they may be eligible for a tax credit available through Form 8396, which is used to claim a credit for a portion of …

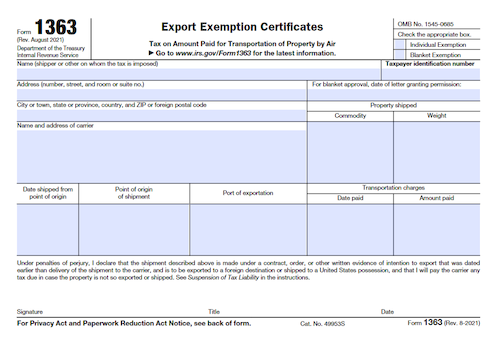

Form 1363: Export Exemption Certificates

Filing Form 1363 with a carrier may help taxpayers suspend the liability of the 6.25% tax on transportation of property by air that begins and ends in the United States. …

Form 8288-B: Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests

Non-US sellers of US real estate are subject to a withholding tax at the time of sale, but the tax often exceeds the actual federal income tax owed by the …

Form 8848: Consent to Extend the Time to Assess the Branch Profits Tax Under Regulations Sections 1.884-2T(a) and (c)

Form 8848 must be filed on or before the due date of the corporation’s income tax return and attached to the return, and signed by an authorized person. Executing a …

Form 8827: Credit for Prior Year Minimum Tax – Corporations

Form 8827 allows employers to claim a credit for providing child care facilities and services to their employees. The credit is calculated based on the amount of qualified expenses paid …

Form 1040-ES: Estimated Tax for Individuals

Form 1040-ES is used to pay estimated tax for those with income not subject to withholding, such as self-employment earnings, rent, dividends, and alimony. It must be filed if you …

Form 11-C: Occupational Tax and Registration Return for Wagering

Form 11-C is an important form for individuals and businesses engaging in wagering activities, allowing them to register with the IRS and obtain an occupational tax number. It has several …

Form 8282: Donee Information Return (Sale, Exchange or Other Disposition of Donated Property)

Form 8282 reporting requirements provide accounting for donated property exceeding $5,000. This lead provides an introduction to filing requirements for donee organizations and outlines two exceptions where Form 8282 is …

Form 3949-A: Information Referral

Form 3949-A is an important document for reporting suspected violations of federal tax laws. It is used by individuals to report alleged tax law violations, including false exemptions or deductions, …

Filing Taxes for a Hobby Farm: Guide

Filing taxes for a hobby farm can be a daunting task, but with proper organization and knowledge of the process, it can be done with confidence and ease. This article …

Form 1041-V: Payment Voucher

If you are the fiduciary of an estate or trust, you may have to use Form 1041-V when sending payments for the balance due on their 2022 taxes. It allows …

Filing Income Taxes for a Fictitious Name Business

Filing income taxes for a fictitious name business can be a straightforward process if you follow the right steps. By understanding the unique tax requirements for this type of business …

Submitting Estimated Taxes for Corporations to the IRS

Submitting estimated taxes for corporations is crucial to avoid any last-minute surprises when it comes to tax payments. This article provides a comprehensive guide on how to submit estimated taxes …

Form 6197: Gas Guzzler Tax

Anyone importing a gas guzzling automobile to the US may be liable for the gas guzzler tax. This guide outlines the requirements and procedures for filing and payment, including IRS …

Deduction of Workers’ Compensation from Federal Tax Form 1040

Small businesses have the opportunity to deduct workers’ compensation costs from their federal and state taxes. However, the rules and requirements for these deductions vary from state to state. This …

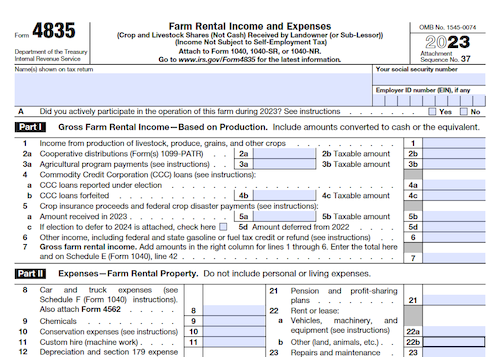

Form 4835: Farm Rental Income and Expenses

IRS Form 4835 is a tax form used to report income and expenses for rental real estate, royalties, partnerships, S corporations, trusts, estates, and certain qualified joint ventures. It is …

Form 8838: Consent to Extend the Time to Assess Tax Under Section 367 – Gain Recognition Agreement

Form 8838 is an Internal Revenue Code document used for claiming qualified electric vehicle credits. It requires the taxpayer to provide information such as name, address, Social Security number, make …

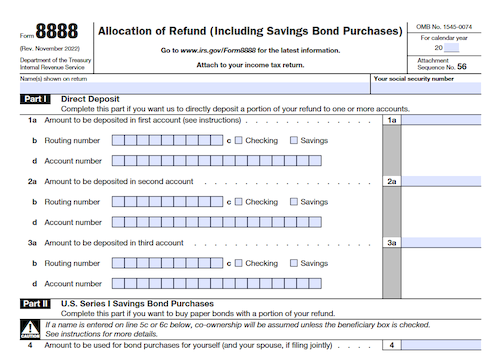

Form 8888: Allocation of Refund (Including Savings Bond Purchases)

Form 8888 allows U.S. taxpayers to directly deposit their refund to two or three accounts at a bank or financial institution, or buy up to $5,000 in paper or electronic …

Form 8718: User Fee for Exempt Organization Determination Letter Request

Organizations applying for federal income tax exemption other than Form 1023, 1023-EZ, or 1024-A should file Form 8718 using the Internal Revenue Service’s mailing address. Paperwork Reduction Act Notice must …

Form 8811: Information Return for Real Estate Mortgage Investment Conduits (REMICs)and Issuers of Collateralized Debt Obligations

Form 8811 must be filed by REMICs and issuers of CDOs for the purpose of providing information, including the CUSIP number, and to publish the information in Pub. 938. Form …