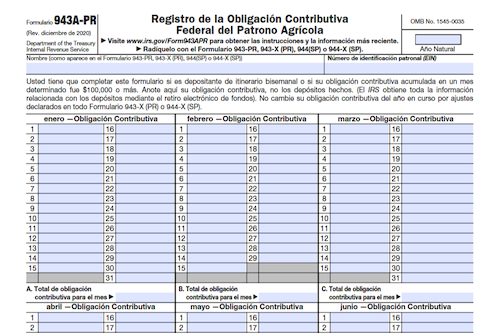

Federal tax filers in Puerto Rico must use Form 943A-PR to report their tax obligation when they are biweekly schedule depositors. This form must be included with Form 943-PR, 943-X …

Form W-7A: Application for Taxpayer Identification Number for Pending U.S. Adoptions

Use Form W-7A to apply for an IRS adoption taxpayer identification number for a child placed in your home for adoption purposes. However, this isn’t necessary if a social security …

Form 8804: Annual Return for Partnership Withholding Tax (Section 1446)

This article covers forms 8804, 8805 and 8813 which help pay and report US income tax for foreign partners based on their Effective Connected Taxable Income. It also explains how …

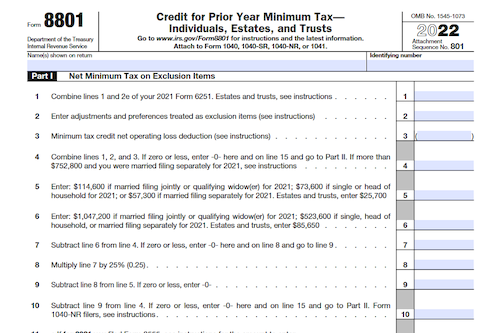

Form 8801: Credit for Prior Year Minimum Tax – Individuals, Estates, and Trusts

Have you paid alternative minimum tax (AMT) in a prior year? If so, make sure to calculate your minimum tax credit with IRS Form 8801, which can help you figure …

Form 5300: Application for Determination for Employee Benefit Plan

Form 5300 is used to request a Determination Letter from the IRS to check that a defined benefit or defined contribution plan, as well as any related trust, meets the …

Form 8835: Renewable Electricity Production Credit

Enter Form 8835 to claim the renewable electricity production credit for qualified energy resources and qualified facilities eligible for the credit in the US or US territories. Recapture of the …

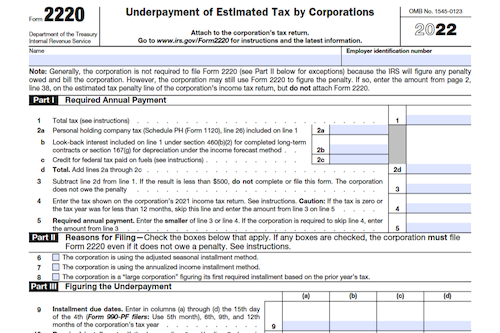

Form 2220: Underpayment of Estimated Tax By Corporations

Tax-paying corporations, tax-exempt organizations subject to the unrelated business income tax, and private foundations require Form 2220 to determine if they are subject to a penalty for underpayment of estimated …

Form 8933: Carbon Oxide Sequestration Credit

This article provides an overview of Form 8933 that can be used to claim the section 45Q carbon oxide sequestration credit. It outlines how to calculate the credit, applicable dollar …

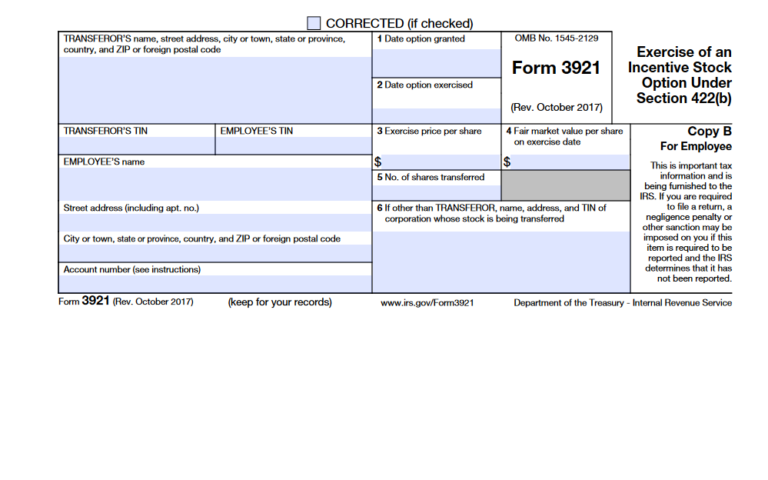

Form 3921: Exercise of an Incentive Stock Option Under Section 422(b)

Employees granted Incentive Stock Options (ISOs) can purchase stock in their employer’s corporation at a predetermined price, called the “strike price”. To understand ISOs taxation, one must consider the date …

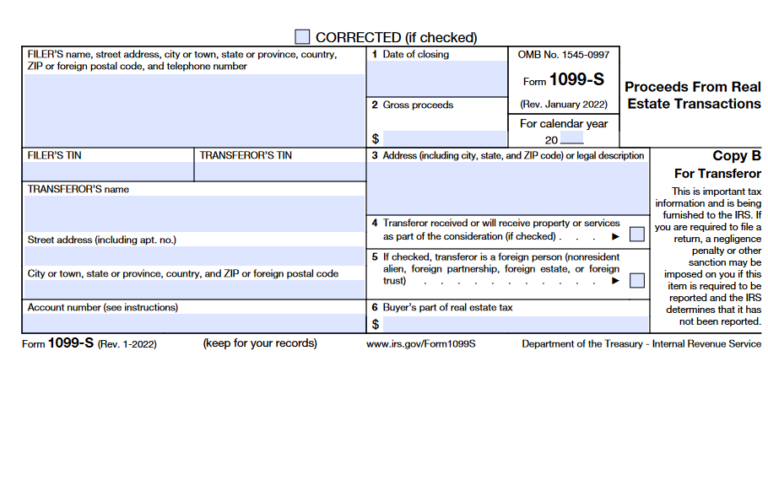

Form 1099-S: Proceeds from Real Estate Transactions

The 1099 form is used to report non-employment income to the IRS. Whether you’ve received interest payments from a bank account, stock dividends, freelance earnings, unemployment benefits, or other types …

Form 1120-X: Amended U.S. Corporation Income Tax Return

Form 1120X allows corporations to adjust their returns by filing a claim for refund or election after the prescribed deadline, or to correct an originally filed return. It should not, …

Form 8815: Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989

This article provides detailed information about form 8815, which can be used to determine the amount of any interest that can be excluded from the taxpayer’s income for cashing series …

Form 1116: Foreign Tax Credit (Individual, Estate, or Trust)

The foreign tax credit is a credit U.S. taxpayers can use to offset income taxes paid to a foreign government, preventing double taxation on income earned in both the U.S. …

Form 1128: Application to Adopt, Change or Retain a Tax Year

Understanding a business’s fiscal and tax year is important for filing taxes correctly. This article outlines how to determine a fiscal year, how a business fiscal year is different from …

Form 3922: Transfer of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(c)

Understand the tax implications of Employee Stock Purchase Plans (ESPPs), which offer a fringe benefit to employees the option to purchase a company’s stock at a discounted rate. ESPPs often …

Form 2553: Election by a Small Business Corporation

Form 2553 is an election used to have a business entity recognized as an S corporation for tax purposes—from incorporating to filing—all within deadline or with “reasonable cause”. Learn more …

Form 1098-T: Tuition Statement

Form 1098 is a document used by lenders and businesses to report mortgage interest payments of $600 or more to the IRS. It can also be used to report tuition …

Form 1098-C: Contributions of Motor Vehicles, Boats, and Airplanes

IRS Form 1098 is used to report mortgage interest payments ($600 or more) to the IRS. It’s issued by mortgage lenders to homeowners, as well as businesses that have received …

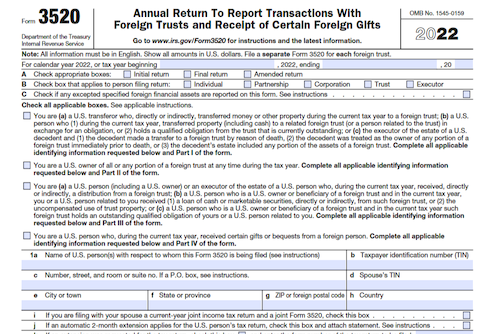

Form 3520: Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

In the U.S., gifts or inheritances from foreign estates, corporations, or partnerships can be subject to some special rules – including the need to file IRS Form 3520. Understanding the …

Form 3468: Investment Credit

From motor vehicles to solar energy, businesses can save on costs while still taking advantage of tax credits and deductions for eco-friendly investments. Get the details here on how to …