Form W-3SS is an essential requirement for employers in American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands to accurately report wage and tax information for Social Security, Medicare, and withheld income tax. It also serves to track the total wages and taxes of employees subject to the grand scheme of the Internal Revenue Code.

What is Form W-3 SS?

Form W-3SS is used to report wage and tax information for Social Security, Medicare, and withheld income tax to the Internal Revenue Code for employees of American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. It is also used to report the total wages and taxes for the calendar year for each employee. This form is essential for ensuring the appropriate taxation of employees who fall under the protection of the Internal Revenue Code.

IRS Form W-3 SS – Who Needs to Fill It Out?

Form W-3SS is used to report wage and tax information for Social Security, Medicare, and withheld income tax for employees of American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. This form must be filled out by employers or businesses that have employees that are subject to federal wage withholding requirements. The form is used to report the total wages and taxes for each employee for the calendar year.

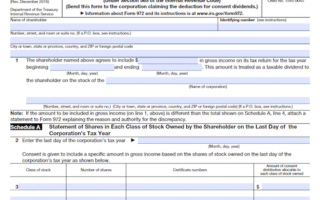

Step-by-Step: Form W-3 SS Instructions For Filling Out the Document

Forms W-3SS is used to report the wage and tax information for Social Security, Medicare, and withheld income tax for employees of American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. To fill out the form, state your employee’s income, Social Security wages, Social Security taxes withheld, Medicare wages, Medicare taxes withheld, and federal income taxes withheld. The withholding amounts are aggregated for the calendar year to show the total amount paid to each employee and total taxes withheld. Additionally, include the employer’s name and address, employee name and Social Security number, and other important details. Once the form is filled out and completed correctly, you can submit it to the IRS.

| Instructions for Filling out Forms W-3SS | Details |

|---|---|

| Employee Information | State employee’s income, Social Security wages, Social Security taxes withheld, Medicare wages, Medicare taxes withheld, and federal income taxes withheld. |

| Aggregated Withholding | Aggregate withholding amounts for the calendar year to show the total amount paid to each employee and total taxes withheld. |

| Additional Details | Include employer’s name and address, employee name and Social Security number, and other important details. |

| Submission | Submit the completed form to the IRS once filled out correctly. |

Do You Need to File Form W-3 SS Each Year?

Form W-3SS must be filed annually in order to report wage and tax information for Social Security, Medicare, and withheld income tax for employees of American Samoa, Guam, the Commonwealth of the Northern Mariana Islands, and the U.S. Virgin Islands. These forms must be filed for each employee subject to the wage withholding requirements of the Internal Revenue Code, reporting details of wages and taxes for the calendar year. Furthermore, the form must also be filed to report the total wages and taxes for employees subject to the wage withholding requirements.

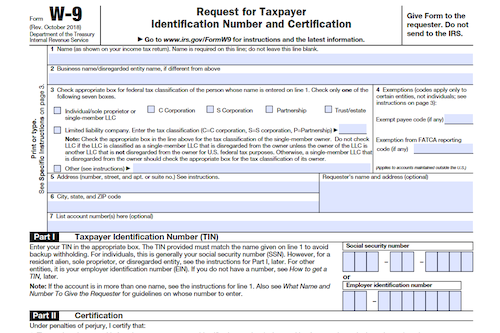

Download the official IRS Form W-3 SS PDF

On the official IRS website, you will find a link to download Form W-3 SS. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form W-3 SS

Sources: