Learn how to correct errors on filed W-2 forms, how to get the forms you need, and the penalties imposed for incorrect information on those forms.

What is Form W-3-C?

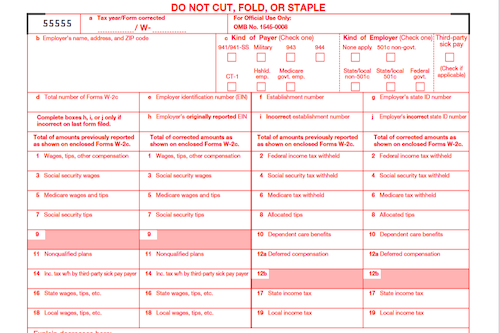

IRS Forms W-2 and W-3 are used by employers to report employees’ annual income and the amounts of taxes withheld. Form W-2c is used to make corrections to employees W-2 forms after they have been submitted to the Social Security Administration (SSA). The W-2c and a W-3c transmittal form totaling the information on all W-2c correction forms must be sent to the SSA if corrections are necessary. Common Types of errors requiring a W-2c include incorrect employee name or Social Security Number, missing or incorrect business EIN, errors in an amount, mistakes with employer-sponsored health coverage, and mistakes with retirement contributions. Filing forms W-2c and W-3c must follow a detailed process and occurs via mail or SSA’s Business Services Online site. The IRS enforces penalties for incorrect W-2s, missing tax identification numbers, and other errors, so make sure to submit forms on time.

IRS Form W-3-C – Who Needs to Fill It Out?

Employers must fill out the IRS Form W-2 to report employee wages and withholdings to the Social Security Administration. Form W-2 must be filled out for all of the employees of a company, and a transmittal Form W-3 must be included if filing by mail. Corrections can be made with Forms W-2c and W-3c, and must be filed with the SSA if the original forms have been already sent in. Both forms must be filed to the SSA by January 31 of the year following the tax year reported. Penalties may be imposed for incorrect or missing information, and employers should make sure to catch and fix errors quickly.

Step-by-Step: Form W-3-C Instructions For Filling Out the Document

To ensure that any corrections to W-2 forms are processed correctly, use Form W-2c and include a W-3c transmittal form if you are filing by mail. Common errors can range from including the wrong employer ID number, money amounts, or omitting a decimal point when entering numbers, and must all be corrected using the W-2c. Also, be aware of IRS penalties imposed for incorrect or late filing of W-2s. For faster processing, take advantage of the SSA’s Business Services Online website, or make sure to submit your forms before the January 31 deadline.

Below, we present a table that will help you understand how to fill out Form W-3-C.

| Correction Information | Details |

|---|---|

| Form for Corrections | Form W-2c |

| Transmittal Form | W-3c (if filing by mail) |

| Common Errors |

|

| IRS Penalties | Penalties for incorrect or late filing of W-2s |

| Faster Processing | Use SSA’s Business Services Online or submit before January 31 |

Do You Need to File Form W-3-C Each Year?

Yes, employers are required to file Form W-2 each year with the Social Security Administration (SSA). It’s important to double-check for accuracy before submitting the form, as corrections can be difficult and mistakes can come with hefty penalties. You will need to use the Form W-2c to make any needed corrections, and if multiple corrections are necessary, you may need to submit Form W-3c in addition. You may also need to file the Form 941c for further corrections. Follow the instructions on the General Instructions for Forms W-2 and W-3 for guidance and make sure to send your W-2 forms to employees before the due date to avoid penalties.

Download the official IRS Form W-3-C PDF

On the official IRS website, you will find a link to download Form W-2c and W-3c. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form W-3c

Sources:

https://www.irs.gov/forms-pubs/about-form-w-3-c

https://www.irs.gov/instructions/iw2w3