This article outlines the requirements for correcting administrative errors on a previously filed Form 945, including when to use the adjustment or claim processes, the applicable deadline, and filing instructions. Form 945-X is used specifically for this purpose.

What is Form 945-X?

Form 945-X is used to correct administrative errors reported on a previously filed Form 945. This form is used to correct errors such as mathematical or transposition errors, under- or over-reported amounts, or interest-free adjustments under sections 6205 and 6413 or claims for refund or abatement under sections 6402, 6414, and 6404. Filing Form 945-X is the only way to ensure that the corrections made are not subjected to any penalty or interest charges. The due date for filing Form 945-X depends on the nature of the error, so it is important to familiarize yourself with the instructions before submitting. If the form is sent late, an amended Form 945-A may be required. If you are unsure, it is best to reach out to the IRS for help.

IRS Form 945-X – Who Needs to Fill It Out?

Form 945-X needs to be filled out by any person or business who has previously filed Form 945 and discovered that the amount of federal income tax (including backup withholding) was not the correct amount. This usually occurs due to a mathematical or transposition error. Form 945-X should be filed separately and not with Form 945. It can be filed up to 3 years after Form 945 was filed, if the taxpayer is correcting underreported taxes, or up to 2 years after taxes were paid if overreported taxes are being corrected. Form 945-X is only used to correct administrative errors; for any other adjustments use the corresponding “X” form (Form CT-1 X, 941-X, 943-X, and 944-X). Individuals or businesses who have a question about filing Form 945-X can get help by calling their toll-free Business and Specialty Tax Line or by visiting the IRS website.

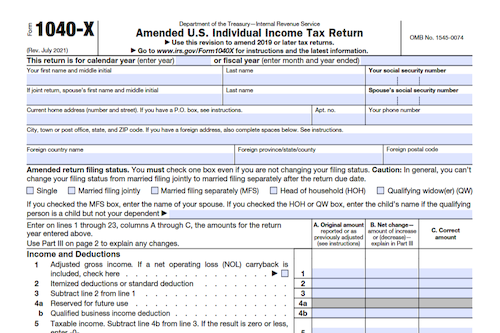

Step-by-Step: Form 945-X Instructions For Filling Out the Document

Form 945-X is used to correct administrative errors only on a previously filed Form 945. The due date for filing Form 945-X depends on when the error is discovered (for underreported tax, the due date of the return; for overreported tax, the period of limitations) and if an interest-free adjustment or claim for refund/abatement is needed. To complete the form, one must enter their EIN, name, and address in the spaces provided. Be sure to use one Form 945-X for each year being corrected and to give a detailed explanation for each correction. When filing Form 945-X, use the corresponding address depending on what state the filer is in, and pay any owed taxes when filing if underreported amounts are being corrected. If filing after the due date, be sure to attach an amended Form 945-A for underreported tax. Follow the instructions closely to ensure the form is filed on time.

Below, we present a table that will help you understand how to fill out Form 945-X.

| Form 945-X | Instructions |

|---|---|

| Form 945-X is used to correct administrative errors only on a previously filed Form 945. |

|

Do You Need to File Form 945-X Each Year?

Filing Form 945-X each year is an important step in ensuring your federal income tax is properly reported. Depending on when you discover an administrative error, it must be filed within 3 years of when the form is filed, or within 2 years of when the tax has been paid, whichever is later. It’s also important to note that if you are correcting for over reported tax, you can choose to either make an interest-free adjustment or file a claim for refund or abatement. Make sure to give the IRS a detailed explanation of the correction on line 7. Finally, if you’re making corrections to under reported taxes, you must file Form 945-X by the due date of the return, and pay the amount you owe at the same time to avoid penalties and interest.

Download the official IRS Form 945-X PDF

On the official IRS website, you will find a link to download Form 945-X. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 945-X

Sources: