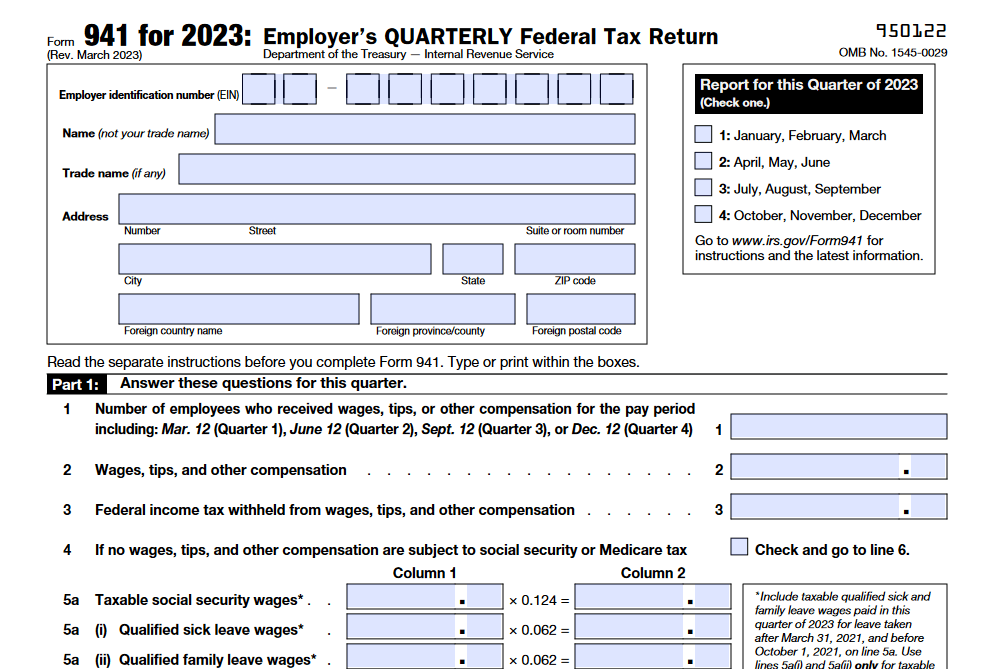

IRS Form 941 is the quarterly federal tax return for employers, who need to report withheld taxes such as federal income tax, and the employer and employee share of Social Security and Medicare taxes. Filing Form 941 involves six pages and five parts, and requires an employer to provide information including their employer identification number and filing period.

What is Form 941?

IRS Form 941, the Employer’s Quarterly Federal Tax Return, is used by employers to report their withheld federal income tax, and the employer and employee share of Social Security and Medicare taxes quarterly. Form 941 is comprised of five parts, the most important of which are Part One (reporting the number of staff employed, their compensation, and the taxes owed) and Part Two (the tax deposit schedule). There are special considerations when filing Form 941 for small employers, and an adjusted form, Form 941-X, can be used for corrections. Understanding the importance of filing the correct Form 941 and any accompanying amendments is a key responsibility for employers.

IRS Form 941 – Who Needs to Fill It Out?

An employer filing Form 941, Employer’s Quarterly Federal Tax Return, must provide their name, address, and employer identification number (EIN) in Part One of the form, as well as report the number of employees, their compensation, and taxes due for the quarter. They must also indicate whether an overpayment applies to the next quarter or is to be refunded. Parts Two and Three provide further details on the tax deposit schedule and any seasonal filing details. Parts Four and Five gather information on designees and the employer’s or paid preparer’s details, respectively. Small employers who owe $1,000 or less may file Form 944 with IRS permission. Errors can be corrected with Form 941-X. It is important to understand taxable payments and employment taxes to make sure the correct returns are filed.

Step-by-Step: Form 941 Instructions For Filling Out the Document

Employer’s Quarterly Federal Tax Return involves providing identifying information such as business name, address, and EIN at the top of page 1 as well as the filing period, entering number of staff employed, their compensation, and taxes owed into Part One, detailing deposit schedule for taxes in Part Two, and answering questions in Part Three. Parts Four and Five involve authorizing a designee and signing the form, while payment can be made with Form 941-V. Taxpayers also need to be aware of taxes reported on the form, including federal income tax, Social Security, and Medicare taxes, as well as special considerations for small employers filing Form 944, and using Form 941-X for amended forms.

Below, we present a table that will help you understand how to fill out Form 941.

| Information Required for Employer’s Quarterly Federal Tax Return | Details |

|---|---|

| Business Name | Name of the employer’s business |

| Business Address | Address of the employer’s business |

| EIN (Employer Identification Number) | Unique identification number for the employer |

| Filing Period | Timeframe for which the return is being filed |

| Number of Staff Employed | Total count of employees working for the employer |

| Employee Compensation | Total compensation paid to employees |

| Taxes Owed | Total taxes owed by the employer |

| Deposit Schedule for Taxes | Schedule for depositing taxes |

| Questions in Part Three | Answers to questions in Part Three of the return |

| Authorization of Designee | Authorization of a designated representative |

| Signature | Signature of the employer |

| Payment Form | Form used for making payments (Form 941-V) |

| Taxes Reported | Details of taxes reported, including federal income tax, Social Security, and Medicare taxes |

| Special Considerations for Small Employers | Information regarding special considerations for small employers filing Form 944 |

| Amended Forms | Use of Form 941-X for amended forms |

Do You Need to File Form 941 Each Year?

Do You Need to File Form 941 Each Year? Generally, employers must file Their Form 941 Quarterly Federal Tax Return each year. The form includes five parts, with information on taxed wages, Social Security taxes, Medicare taxes, and more. Additionally, Part Three includes two questions relating to closure or seasonal employees, Part Four authorizes a third-party to speak with the IRS on the employer’s behalf, and Part Five includes information for the employer and paid preparer. Payment can be included with the form if taxes are owed. Special considerations when filing form 941 apply to small employers, who may be allowed to file Form 944 instead, and amended forms are required if errors are detected after filing. Be sure to read IRS Publications 15 and 15-B to learn more.

Download the official IRS Form 941 PDF

On the official IRS website, you will find a link to download Form 941: Employer’s Quarterly Federal Tax Return. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 941

Sources:

https://www.irs.gov/forms-pubs/about-form-941

https://www.irs.gov/instructions/i941