Domestic corporations and individual shareholders of controlled foreign corporations making a section 962 election must use Form 8993 to determine the deduction under section 250 of the Tax Cuts and Jobs Act of 2017 for eligible foreign-derived income.

What is Form 8993?

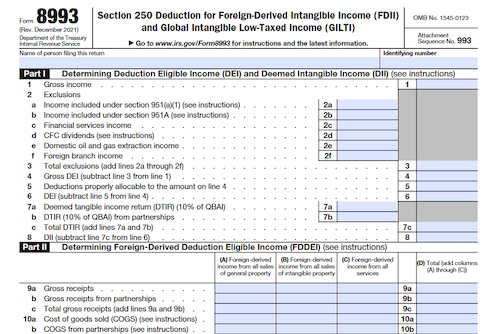

Form 8993 is used to calculate and figure the amount of an eligible deduction under section 250 of the Tax Cuts and Jobs Act of 2017. This deduction is available to domestic corporations (not including REITs, RICs, and S corporations) and section 962 electing individuals. The form must be attached to an individual’s income tax return and is used to determine the allowable deduction, as well as potential limits based on FDII, GILTI, and taxable income. Various specific definitions and computations must also be made in order to complete the form accurately.

IRS Form 8993 – Who Needs to Fill It Out?

Form 8992, US Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI), must be filed by domestic corporations (not including REITs, RICs, or S corporations) and by section 962 electing individuals. Form 8993 is used to figure the deduction amount for FDII and GILTI under section 250. Attach Form 8993 to the income tax return and file both by the due date (including extensions). The terms “sold”, “sells”, and “sale” include any lease, license, exchange, or other disposition of property. Special rules apply when determining foreign use for related party transactions. Additional documentation may be required and limitations may apply if the sum of FDII and GILTI exceeds taxable income. Corrections to Form 8993 must be made through an amended tax return. Computer-generated forms must also receive prior approval from the IRS.

Step-by-Step: Form 8993 Instructions For Filling Out the Document

Filling out the document require all domestic corporations (excluding REITs, RICs, and S corporations) and individuals making a section 962 election to use the form in order to determine the allowable deduction under section 250. This form must be attached to an individual’s income tax return and filed before the due date. Definitions and overview of this form include ascertainment of Deemed Tangible Income Return, Deemed Intangible Income, Foreign-Derived Deduction Eligible Income, Foreign-Derived Ratio, and Foreign-Derived Intangible Income. Rules for determining a foreign sale and foreign use are provided, as are rules for calculating Qualified Business Asset Investment, partnership information, and substantiation requirements. Additionally, limitations for the section 250 deduction and instructions for correcting the form are included. Computer-generated formsor forms approved by the IRS must also be utilized.

Below, we present a table that will help you understand how to fill out Form 8993.

| Form 8993 | Instructions |

|---|---|

| Filling out the document require all domestic corporations (excluding REITs, RICs, and S corporations) and individuals making a section 962 election to use the form in order to determine the allowable deduction under section 250. This form must be attached to an individual’s income tax return and filed before the due date. Definitions and overview of this form include ascertainment of Deemed Tangible Income Return, Deemed Intangible Income, Foreign-Derived Deduction Eligible Income, Foreign-Derived Ratio, and Foreign-Derived Intangible Income. Rules for determining a foreign sale and foreign use are provided, as are rules for calculating Qualified Business Asset Investment, partnership information, and substantiation requirements. Additionally, limitations for the section 250 deduction and instructions for correcting the form are included. Computer-generated forms or forms approved by the IRS must also be utilized. |

|

Do You Need to File Form 8993 Each Year?

Do You Need to File Form 8993 Each Year? Yes, all domestic corporations (not including REITs, RICs, and S corporations) and section 962 electing individuals are required to use Form 8993 each year in order to determine the allowable deduction under section 250 of the Public Law 115-97 (Tax Cuts and Jobs Act of 2017). The form should be filed and attached to the income tax return by the due date (including extensions) for that return. Depending on the amount of FDII and GILTI, the deduction under section 250 may be subject to limitation, as further explained in the instructions. If an incomplete or incorrect Form 8993 is mistakenly filed, a corrected Form 8993 must be submitted by filing an amended return, following the instructions of the original return. Generally, computer-generated forms must receive prior approval from the IRS.

Download the official IRS Form 8993 PDF

On the official IRS website, you will find a link to download Form 8993. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: the IRS Form 8993