Businesses using Forms 941, 943, or 944 who made an election on their income tax return to claim the qualified small business payroll tax credit for increasing research activities must file Form 8974 in order to claim the credit.

What is Form 8974?

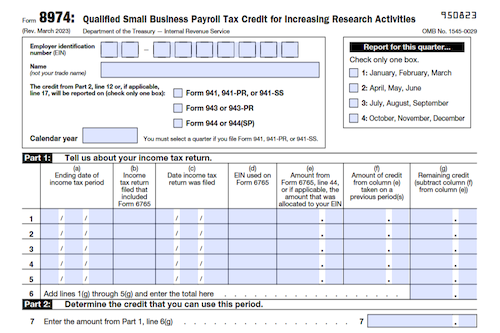

Form 8974 is used by employers to determine the amount of the qualified small business payroll tax credit for increasing research activities that they can claim on applicable federal tax forms, such as Form 941, 943, and 944. To take advantage of this credit, employers must make an election on their income tax return on Form 6765, and then file Form 8974 with the applicable tax form. Additionally, section 3504 agents, CPEOs, and other third-party payers may have to complete additional paperwork if any of their clients are taking the credit. For errors on already-filed Form 8974, employers must file an adjusted tax return with a corrected Form 8974 attached. Lastly, employers can claim the credit for the quarter that begins after they file the income tax return on Form 6765, or for the year that includes that quarter for annual filers.

IRS Form 8974 – Who Needs to Fill It Out?

You must file Form 8974 and attach it to Form 941, 943, or 944 if you have previously made an election on your income tax return to claim the qualified small business payroll tax credit for increasing research activities. The credit must have been elected on an original income tax return that was filed on time. Also, third-party payers (such as non-certified PEOs) must file Schedule R as well as Form 8974 if any of their clients are claiming the credit. The form must be attached to the Form 941, 943, or 944; however, you can’t do so unless you’ve first made the election on Form 6765. Lastly, the required quarter or year to take the credit is determined on Form 8974.

Step-by-Step: Form 8974 Instructions For Filling Out the Document

Form 8974 is an important document that must be filled out and attached to Form 941, 943 or 944 if a taxpayer elects to claim the qualified small business payroll tax credit for increasing research activities on their income tax return. To be eligible for the credit, the election must be made on Form 6765 and the return must be timely filed with the election. After filing the return, the Form 8974 can be filled out and claimed on the Form 941, 943 or 944 on the quarter or year that follows the filed return. Aggregate Form 941 or Form 943 filers, such as certified professional employers, must also complete additional forms and attach a Form 8974 for each client claiming the credit. If an error is discovered on the previously filed Form 8974, it can be corrected by filing Form 941-X, Form 943-X, or Form 944-X and attaching a corrected Form 8974.

Below, we present a table that will help you understand how to fill out Form 8974.

| Key Information for Form 8974 | Details |

|---|---|

| Purpose | Claim the qualified small business payroll tax credit for increasing research activities |

| Election | Must be made on Form 6765 and filed with the income tax return |

| Correction | If errors are discovered, correct with Form 941-X, 943-X, or 944-X |

Do You Need to File Form 8974 Each Year?

If you’ve made an election to claim the qualified small business payroll tax credit for increasing research activities on your income tax return, you must then file Form 8974 each year – either with Form 941, 943, or 944 depending on your filing. When filing an aggregate Form 941 or 943, you must complete and file Schedule R if any of your clients are claiming the payroll tax credit. Additionally, if you need to correct a previously filed Form 8974, you must attach a corrected Form 8974 to an amended return filed using Form 941-X, 943-X, or 944-X, respectively. Finally, when you can first claim the credit will depend on your filing frequency – quarterly Form 941 filers can claim the credit on the Form 941 for the quarter that begins after they file their income tax return making the election, while annual Form 943 or 944 filers can claim the credit on the Form 943 or 944 for the year that includes that quarter.

Download the Official IRS Form 8974 PDF

On the official IRS website, you will find a link to download Form 8974. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8974

Sources: