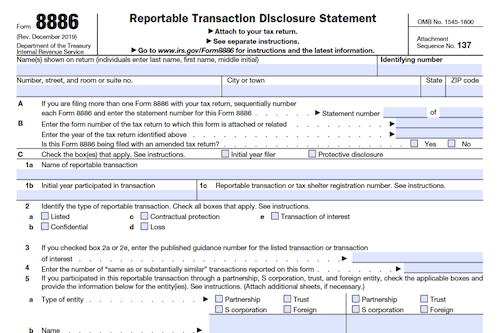

Individuals, trusts, estates, partnerships, S corporations, and other corporations that participate in reportable transactions for federal tax purposes must file Form 8886. This form helps disclose information regarding the tax treatment of the transaction, and is required even if the tax benefits are not disallowed.

What is Form 8886?

Form 8886 is a form that must be used to disclose information regarding reportable transactions in which a taxpayer participated. Generally, the taxpayer must file a separate Form 8886 for each transaction, but more than one can be reported on one form if the transactions are the same or substantially similar. The filing of this form does not mean that any tax benefits from the transaction will be disallowed. Prohibited tax shelter transactions – such as listed transactions, transactions with contractual protection, or confidential transactions – may require an additional form to be filed, Form 8886-T. Any taxpayer that is required to file a federal tax return or information return and who has participated in a reportable transaction must file Form 8886.

IRS Form 8886 – Who Needs to Fill It Out?

Generally speaking, anyone required to file a federal tax return or information return who participated in a reportable transaction must fill out Form 8886. This includes individuals, trusts, estates, partnerships, S corporations, or any other corporation. It is important to note that a regulated investment company or investment vehicle owned by one or more RICs is exempt from filling out Form 8886 for any transaction other than a listed transaction or a transaction of interest. The form must be filled out for each reportable transaction, but transactions that are the same or substantially similar may be reported on a single form. It is also important to note that although the form must be filled out, it does not mean the tax benefits from the transaction will be disallowed.

Step-by-Step: Form 8886 Instructions For Filling Out the Document

Filling out Form 8886 is the first step in disclosure to the IRS of information related to any reportable transaction in which you participated. You must include details and tax information about the transaction such as the factual elements, tax benefits, and the tax structure. Form 8886 must be filed by any taxpayer who is required to file a federal tax return or information return, such as individuals, trusts, estates, partnerships, S corporations, or other corporations. A regulated investment company or a related investment vehicle may be exempt from filing, except when it is a listed transaction or transaction of interest. Generally, each transaction requires a separate form but you can include multiple transactions if they are substantially similar. The form itself does not mean that the tax benefits of the transaction are disallowed.

Below, we present a table that will help you understand how to fill out Form 8886.

| Instructions for Form 8886 | Details |

|---|---|

| Form purpose | Disclosure to the IRS of information related to any reportable transaction |

| Filing requirements | Required for taxpayers filing federal tax returns or information returns, including individuals, trusts, estates, partnerships, S corporations, and other corporations |

| Exceptions | Exemption for regulated investment companies or related investment vehicles, except for listed transactions or transactions of interest |

| Multiple transactions | Each transaction typically requires a separate form, but multiple similar transactions can be included |

| Tax benefits | Filing the form doesn’t automatically disallow tax benefits of the transaction |

Do You Need to File Form 8886 Each Year?

Generally, if you are a taxpayer required to file a federal tax return or information return, you must file Form 8886 each year for each reportable transaction in which you participate. You can report more than one transaction on one form if the transactions are the same or substantially similar. A transaction is substantially similar if it is expected to obtain the same or similar types of tax consequences and is either factually similar or based on the same or similar tax strategy. Note that filing Form 8886 does not necessarily mean the tax benefits from the transaction will be disallowed. However, those participating in Prohibited Tax Shelter Transactions may be required to file Form 8886-T in addition to Form 8886.

Download the official IRS Form 8886 PDF

On the official IRS website, you will find a link to download Form 8886. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8886

Sources: