Parents who file Form 1040 or 1040-SR can make the election to report their child’s interest and dividend income on their return if the child meets certain criteria, such as age and gross income. This article covers the detailed conditions necessary to make this election and related tax considerations.

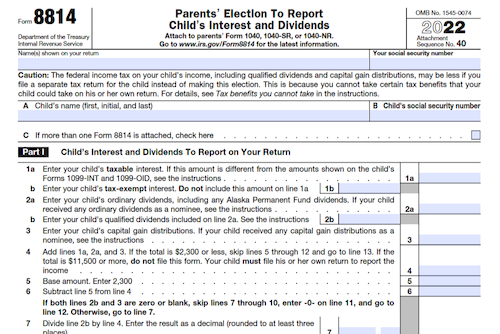

What is Form 8814?

Form 8814 is used by parents who elect to report their child’s income on their own tax return. To qualify, the child must have been under the age of 19 or 24 if a student, and have had only interest and dividend income with a gross income of less than $11,500. The parent must also qualify based on their marital status, filing status, and taxable income. Making this election can lead to reduced deductions or credits on their return as well as penalties for underpayment of estimated tax. Comparing this election to a separate return can determine which results in the lower tax.

IRS Form 8814 – Who Needs to Fill It Out?

The IRS FORM 8814 is necessary to report a child’s income on a parent’s return, if the child meets certain conditions including being under the age 19 or 24 (as a full-time student), having only income from dividends and interests, having a gross income of less than $11,500 for 2022, and not filing a joint return with the other parent. The parent filing must also meet certain criteria. It is important to note that not all deductions or credits may be taken, and there may be additional tax liabilities or penalties due to the election. Neglecting to file a change of address (if necessary) may also incur penalties.

Step-by-Step: Form 8814 Instructions For Filling Out the Document

To fill out and attach Form(s) 8814, you must meet certain conditions for both yourself and your child, and make sure to consider the effects making this election may have on other deductions, credits, and taxes such as Net Investment Income Tax and the Alternative Minimum Tax. You will also need to carefully determine the impact this election may have on your taxes and the taxes of your child, and consider any foreign financial accounts or trusts. By following the necessary steps outlined in these instructions and paying close attention to details, you can successfully submit Form(s) 8814 to report your child’s income on your return.

Below, we present a table that will help you understand how to fill out Form 8814.

| Key Information for Form 8814 | Details |

|---|---|

| Conditions | Specific conditions for electing to report a child’s income on your return |

| Considerations | Consider effects on other deductions, credits, and taxes |

| Reporting | Report your child’s income on your return following the provided instructions |

Do You Need to File Form 8814 Each Year?

You may need to file Form 8814 each year if you elect to report your child’s income on your return, your child meets the applicable conditions, and you qualify to make the election. Refer to the source text for full details, including restrictions, tax benefits that cannot be claimed and reduced deductions or credits. Penalty for underpayment of estimated tax may apply, and you may need to adjust your withholding and estimated tax payments. See Pub. 505 for additional information.

Download the official IRS Form 8814 PDF

On the official IRS website, you will find a link to download Form 8814. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8814

Sources: