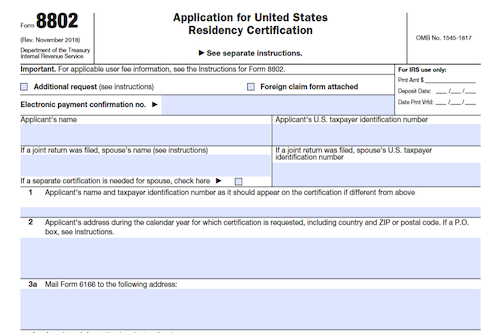

Individuals and entities looking to claim benefits under income tax treaties or VAT exemption must submit Form 8802 to the IRS to request Form 6166, a letter of U.S. residency certification. Find out what the user fee is, when and how to file, and who is eligible or ineligible.

What is Form 8802?

Form 8802 is an application for Form 6166, a letter of U.S. residency certification for purposes of claiming benefits under an income tax treaty or VAT exemption. Eligibility depends on whether the individual or entity is subject to U.S. tax by residence or other criteria. An individual or entity must pay a fee in order for Form 8802 to be processed, and there are different fees depending on the type of applicant. Treated properly, Form 8802 also allows for applicants to receive certifications for up to three years.

IRS Form 8802 – Who Needs to Fill It Out?

Who needs to fill out Form 8802? Individuals, non-individuals, partnerships, S corporations, grantor trusts, other fiscally transparent entities, processed through the custodial accounts of an individual or non-individual. Applicants must provide proof, such as a tax return from the previous year, that they are considered United States residents and subject to U.S. tax. Estates, employee benefit plans/trusts, and exempt organizations can submit a Form 8802 that covers up to 3 years. Individuals must pay a user fee of $85, while a non-individual must pay $185. Payment can be made by check, money order, or electronic payment.

Step-by-Step: Form 8802 Instructions For Filling Out the Document

Filling out Form 8802 is not a difficult task – simply provide your information, attach the necessary documents, and pay the user fee. Depending on whether the applicant is an individual or a nonindividual, they must pay a user fee of either $85 or $185 per Form 8802. This fee will need to be submitted with the application and can be paid by check, money order, or an electronic payment. To ensure your application is processed without delay, it should be mailed at least 45 days before the required submission date. When submitting multiple Forms 8802, it is recommended that they are all sent together with one fee payment. Note that the 3-year procedure for estates, employee benefit plans/trusts, and exempt organizations requires that a Form 8802 is submitted for each year, with any subsequent years attaching a copy of the original signed document.

Below, we present a table that will help you understand how to fill out Form 8802.

| Form 8802 | Instructions |

|---|---|

| Filling out Form 8802 is not a difficult task – simply provide your information, attach the necessary documents, and pay the user fee. Depending on whether the applicant is an individual or a nonindividual, they must pay a user fee of either $85 or $185 per Form 8802. This fee will need to be submitted with the application and can be paid by check, money order, or an electronic payment. To ensure your application is processed without delay, it should be mailed at least 45 days before the required submission date. When submitting multiple Forms 8802, it is recommended that they are all sent together with one fee payment. Note that the 3-year procedure for estates, employee benefit plans/trusts, and exempt organizations requires that a Form 8802 is submitted for each year, with any subsequent years attaching a copy of the original signed document. |

|

Do You Need to File Form 8802 Each Year?

Form 8802 must be filed each year in order to obtain Form 6166, U.S. residency certification, needed to claim certain benefits under an income tax treaty or VAT exemption. The accompanying user fee is $85 or $185 depending on the status of the applicant, and payment can be made by check, money order, or electronic payment. Eligibility for the Form 6166 depends on whether the applicant has filed their appropriately required U.S. tax return, with exceptions for those who are not required to do so. Entities may also utilize the 3-year procedure to receive a single certification covering up to 3 years, but must include the applicable penalties of perjury statement in the first year and pay the applicable user fee each year.

Download the official IRS Form 8802 PDF

On the official IRS website, you will find a link to download Form 8802. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8802

Sources: