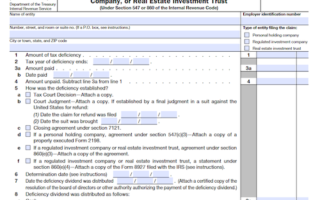

With unearned income over $2,300, parents must use Form 8615 to figure the child’s taxes if the parent’s rate is higher than the child’s. To do this, parents must understand when to use Form 8615, who qualifies for it, and how to calculate taxable income.

What is Form 8615?

Form 8615 is a form used to figure taxable income for a child whose unearned income (income other than from employment) is more than $2,300. This includes income from taxable interest, dividends, capital gains, rent, scholarship and fellowship grants, pension and annuity income, and more. For a child to be required to use Form 8615, they must meet certain criteria, such as being under 18, or being a full-time student under 24 and not having earned income more than half their support. For a married couple filing separately, the form must list the parent with the higher taxable income. In some cases, a parent may elect to report the child’s income on their return instead of the child having to file Form 8615. For more information, read the instructions on Form 8615.

IRS Form 8615 – Who Needs to Fill It Out?

Form 8615 needs to be filled out by any child with unearned income over $2,300 who is required to file a tax return, is under 18 years old (or is 19-24 and a full-time student) and has parents that are alive at the end of the year. To use Form 8615, the child must not be filing a joint return and the support they receive must also be taken into account depending on the parents’ filing statuses. If these requirements are not meet, then an alternative option might be available – using their parent’s tax return to report the child’s income instead.

Step-by-Step: Form 8615 Instructions For Filling Out the Document

Filing Form 8615 is necessary to figure the tax for children under 18 years of age (or certain older children) who have more than $2,300 of unearned income. The parent with the greater taxable income must use their return, or, if the parents do not file a joint return, the custodial parent’s return must be used. An extension to file can be requested if the necessary information cannot be obtained, and the child must use the parent’s information for the tax year that ends in the child’s tax year. If the parent’s taxable income changes, the child must refigure the tax using Form 1040-X. The child may also be subject to the Alternative Minimum Tax and the Net Investment Income if applicable.

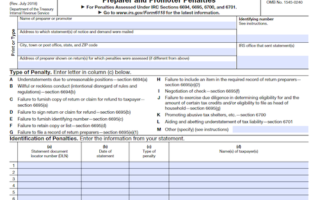

Below, we present a table that will help you understand how to fill out Form 8615.

| Form 8615 | Instructions |

|---|---|

| Filing Form 8615 is necessary to figure the tax for children under 18 years of age (or certain older children) who have more than $2,300 of unearned income. |

|

Do You Need to File Form 8615 Each Year?

Form 8615 must be filed if a qualifying child has unearned income that exceeds $2,300 and other criteria is met. The parent with the greater taxable income should be the one used to figure the child’s tax. Extensions are available if the parents’ information is unavailable. If the parents’ income changes, the child’s tax should be refigured, as the child may also be subject to the Alternative Minimum Tax and the Net Investment Income Tax.

Download the official IRS Form 8615 PDF

On the official IRS website, you will find a link to download Form 8615. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8615

Sources: