Are you a partner in a TEFRA or BBA partnership, S corporation shareholder, beneficiary of an estate or trust, owner of a foreign trust, or residual interest holder in a REMIC? Use Form 8082 to notify the IRS of any inconsistency between your tax treatment of an item and the way the pass-through entity treated and reported the same item.

What is Form 8082?

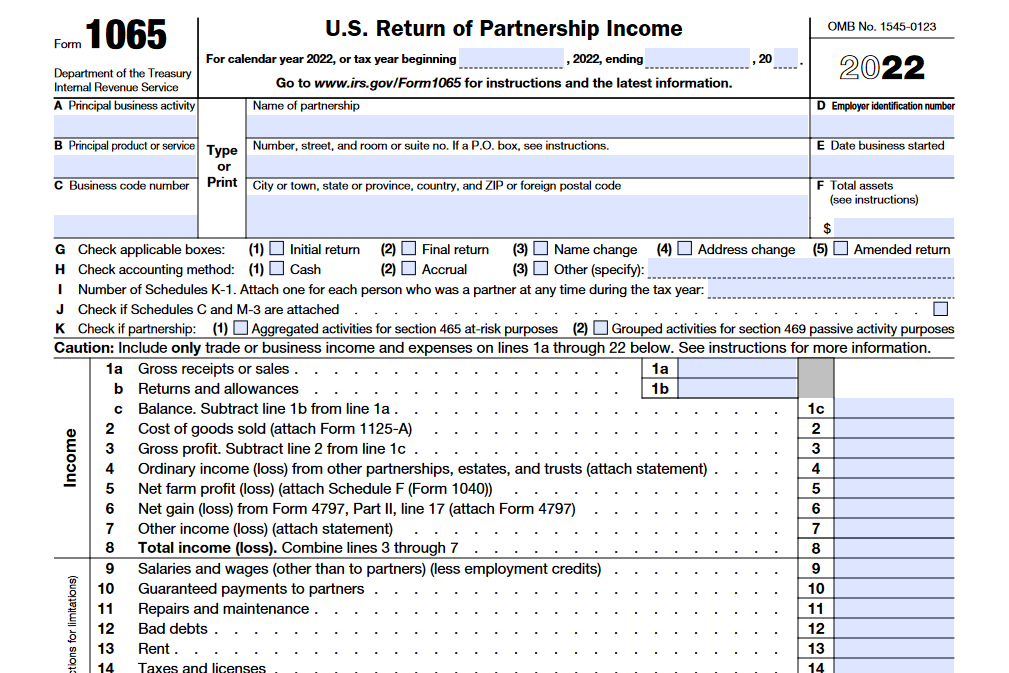

Form 8082 is an important form for individuals who are partners in a TEFRA or BBA partnership, S corporation shareholders, beneficiaries of an estate or trust, foreign trust owners, and residual interest holders in a real estate mortgage investment conduit. It is used to provide notification to the IRS if the individual’s tax treatment of an item does not match the entity’s treatment and reporting the same item on its return. It is also used in cases where someone did not receive a Schedule K-1, Schedule Q, or foreign trust statement by the filing deadline (or in cases where an ELP was required to provide a Schedule K-3 but did not). Additionally, the form is used in filing a request for credit or refund for current litigation or expected changes in tax law through a protective AAR by the TMP or PWA. Depending on the nature of the adjustment, the time period to file a petition may be extended with Form 9248. For partnerships with a tax year beginning after 2017, the form is also used if the partnership representative is filing an AAR to adjust a previously e-filed Form 1065.

IRS Form 8082 – Who Needs to Fill It Out?

The IRS Form 8082 is to be completed in certain situations by partners in a TEFRA or BBA partnership, S corporation shareholders, beneficiaries of an estate or trust, owners of a foreign trust, and residual interest holders in a real estate mortgage investment conduit. It should be used to inform the IRS of any discrepancies between the way the individual reports items on their taxes and how those same items were reported to them by the pass-through entity. Form 8082 is also used if filing an AAR, typically by the Tax Matters Partner (for TEFRA) or Partnership Representative (for BBA), to correct items on the original entity return. In some cases, protective AARs are permitted, which are requests for credit or a refund that may be dependent on pending litigation or changes in federal or other legislation. When this is the case, the AAR must specify the line item to be protected.

Step-by-Step: Form 8082 Instructions For Filling Out the Document

To fill out Form 8082 properly, first read the general instructions regarding Internal Revenue Code sections 6221 through 6241, and understand the purpose of the form. This form is to be used when someone who is a partner in a TEFRA/BBA partnership, a S Corporation shareholder, a beneficiary of an estate or trust, an owner of a foreign trust, or a residual interest holder in a REMIC, wishes to report items differently than they were reported to them on a Schedule K-1 or K-3, or a Foreign Trust Statement. Additionally, you must use this form to notify the IRS if you did not receive the required documents by their due date. Lastly, you may also use the form during a TEFRA or BBA proceeding when correcting items on an e-filed Form 1065, as further outlined in the instructions for the form.

Below, we present a table that will help you understand how to fill out Form 8082.

| Information for Form 8082 | Details |

|---|---|

| Correcting Reporting | Used to report items differently than on K-1 or K-3 |

| Required Documents | Use if required documents were not received |

| TEFRA/BBA Proceeding | For correcting items on e-filed Form 1065 |

Do You Need to File Form 8082 Each Year?

For most taxpayers, it is necessary to file Form 8082 each year to both notify the IRS of any inconsistencies between the way they report items and the way they are reported to the taxpayer on Schedule K-1, Schedule K-3, Schedule Q, and/or a foreign trust statement, as well as to notify the IRS of any Schedule K-2 or Schedule K-3 that the pass-through entity failed to provide. Additionally, under the TEFRA and BBA proceedings Form 8082 is used for filing an AAR electronically to correct a previously e-filed form or to make a protective AAR. BBA creates a centralized partnership audit regime which applies in most cases for partnership tax years beginning after 2017.

Download the official IRS Form 8082 PDF

On the official IRS website, you will find a link to download Form 8082. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8082

Sources: