Form 673 is used to report contributions of property with a value of $500 or more to qualified organizations, as well as to claim exemption from U.S. income tax withholding on foreign earned income for U.S. expatriates. This form provides a way for U.S. citizens and resident aliens working abroad to save money on taxes by claiming exemptions on foreign earned income, provided they meet the eligibility criteria.

What is Form 673?

Form 673 is a document used by U.S. taxpayers working outside of the U.S. to exempt themselves from U.S. income tax withholding on their foreign earned income. This form must be filed with the U.S. employer within 30 days of the contribution and requires both the donor and the donee organizations signatures. To be eligible, the taxpayer must provide a description of the property, the date of the contribution, and the fair market value of the property at the time of the contribution, along with a statement from the donee organization certifying the property was used for exclusively religious, charitable, scientific, literary, or educational purposes. This form allows taxpayers to save money on taxes by claiming exemptions on foreign earned income, thus benefiting U.S. citizens and resident aliens working abroad.

IRS Form 673 – Who Needs to Fill It Out?

Form 673 is used to report noncash contributions of property to qualified organizations with a value of $500 or more. It must be completed by the donor and the donee organization and filed with the Internal Revenue Service within 30 days of the contribution. U.S. citizens and resident aliens working abroad who wish to exempt their foreign earned income from U.S. income tax withholding must file Form 673 with their U.S. employer in order to meet the eligibility criteria for the foreign earned income exclusion and the foreign housing exclusion. This form provides an important tool for expatriates to help save money on taxes by taking advantage of these exemptions.

Step-by-Step: Form 673 Instructions For Filling Out the Document

Filling out Form 673 is straightforward and requires some simple steps. The donor must provide a description of the property, the date of the contribution, and the fair market value of the property at the time of the contribution. Donee organizations must enter a statement certifying that the property was used for exclusively religious, charitable, scientific, literary, or educational purposes. U.S. workers abroad filing Form 673 must also enter their U.S. employer’s name and the amount of income they have earned outside the U.S. eligible for the exclusion(s). Both parties must sign and date the form and the donor must submit it to the Internal Revenue Service within 30 days of the contribution. Once completed, U.S. expatriates can save money on taxes by claiming exemptions on foreign earned income, provided they meet the eligibility criteria.

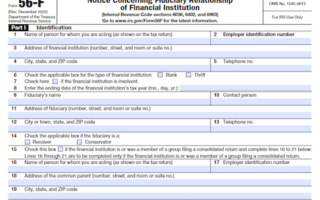

Below, we present a table that will help you understand how to fill out Form 673.

| Information Required for Form 673 | Details |

|---|---|

| Tax Withholding Exemption | Requesting a tax withholding exemption for US citizens living overseas |

| Qualification Criteria | Meeting IRS criteria for foreign earned income exclusion (FEIE) or foreign housing exclusion |

Do You Need to File Form 673 Each Year?

Form 673 is used to claim an exemption from U.S. income tax withholding on wages earned outside the U.S. for U.S. citizens and resident aliens who meet the eligibility criteria. This form needs to be filed each year by the taxpayer with their U.S. employer within 30 days of the income being earned. This form must be signed by both the donor and the donee organization and provide information such as the description of the property, date of contribution, and fair market value of the property at the time of the contribution. The donee organization must also provide a statement certifying that the property was used for exclusive religious, charitable, scientific, literary, or educational purposes, all for the purpose of claiming an exemption from U.S. income tax withholding.

Download the official IRS Form 673 PDF

On the official IRS website, you will find a link to download Form 673. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 673

Sources: