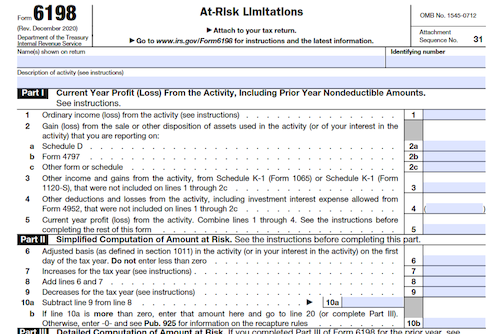

Form 6198 should be filed by those engaged in an activity listed in the At-Risk Activities section of the source text. The form helps individuals, estates, trusts, and certain closely held C corporations figure their profit or loss on an at-risk activity for the current year, as well as the amount at risk for the year and deductible losses.

What is Form 6198?

Form 6198 is a form used to determine the amount of profit, loss, and deductible loss that may be reported in regards to an at-risk activity. It is required to be filed by individuals, estates, trusts, and certain closely held C corporations that have amounts not at risk invested in at-risk activities that incured a loss. At-risk activities include holding, producing, or distributing motion-picture films or videotapes, farming, oil and gas exploration, geothermal depostis, and more. Amounts not at risk include nonrecourse loans, cash and property protected against loss, and amounts borrowed from related persons. Certain exceptions and qualifications apply – make sure to read Pub. 925 for details.

IRS Form 6198 – Who Needs to Fill It Out?

IRS Form 6198 is used to figure the profit or loss from an at-risk activity, the amount at risk, and the amount of the loss that is deductible for individuals (including filers of Schedules C, E, and F), estates, trusts, and certain C corporations. These entities must all file Form 6198 if they have an investment in an at-risk activity such as holding, producing, or distributing motion picture films or videotapes, farming, leasing section 1245 property, or exploring for or exploiting oil and gas resources. Individuals are not considered at risk for certain types of financing, cash, property, or borrowed amounts used in the activity. Additionally, there are special exceptions to these rules for certain activities and closely held corporations.

Step-by-Step: Form 6198 Instructions For Filling Out the Document

Form 6198 must be filed by individuals, estates, trusts, and certain closely held C corporations who had any non-at-risk investments in an at-risk activity which incurred a loss. It is used to figure: the profit or loss from the at-risk activity for the current year, the amount at risk for the current year, and the deductible loss for the current year. Activities subject to the at-risk limitation rules include holding, producing, or distributing motion picture films or videotapes, farming, leasing section 1245 property, certain equipment leasing activities, exploring for or exploiting oil and gas resources, and others. Amounts not considered at-risk include nonrecourse loans, cash or property protected against loss, and amounts borrowed from someone related to the activity. A special exception applies to qualifying businesses of qualified C corporations. When filing, activities should be combined or separated based on the aggregation or separation rules.

Below, we present a table that will help you understand how to fill out Form 6198.

| Information Required for Form 6198 | Details |

|---|---|

| Purpose | File for individuals, estates, trusts, and certain closely held C corporations with non-at-risk investments in at-risk activities |

| At-Risk Limitation Rules | Activities subject to at-risk limitation rules, exclusions, and exceptions |

| Non-At-Risk Amounts | Amounts not considered at-risk and special exceptions |

| Aggregation Rules | Combine or separate activities based on aggregation or separation rules |

Do You Need to File Form 6198 Each Year?

DYou may have to file Form 6198 each year if you, a partnership in which you were a partner, or an S corporation in which you were a shareholder have any amounts invested in an at-risk activity that incurred a loss. The activities subject to the at-risk rules include holding, producing, or distributing motion picture films or videotapes, farming, leasing of section 1245 property, exploring for or exploiting oil and gas resources, exploring for or exploiting geothermal deposits, and other activities not included in those listed previously. Certain exceptions exist for qualified businesses of a qualified C corporation and for real property placed in service before 1987. Form 6198 is filed by individuals (including filers of Schedules C, E, and F (Form 1040 or 1040-SR)), estates, trusts, and certain closely held C corporations. For more details, see Pub. 925, Passive Activity and At-Risk Rules.

Download the official IRS Form 6198 PDF

On the official IRS website, you will find a link to download Form 6198. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 6198

Sources: