Anyone importing a gas guzzling automobile to the US may be liable for the gas guzzler tax. This guide outlines the requirements and procedures for filing and payment, including IRS Form 6197 and the one-time filing box on Form 720.

What is Form 6197?

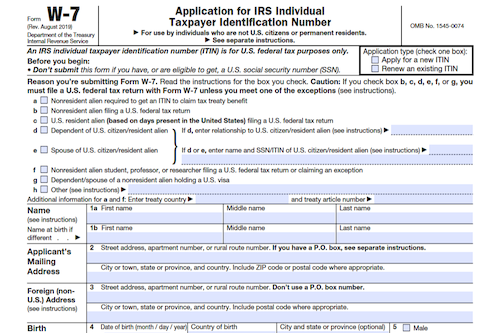

Form 6197 is part of the Instructions for Form 720, and is used to determine the amount of gas guzzler tax owed on imported cars that have a fuel economy rating of 15 mpg or less. Individuals must include their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on Form 720 and Form 720-V, and check the one-time filing box on Form 720 when filing Form 6197. Furthermore, they must pay the tax with the return, not requiring a deposit. All of this is further outlined in the Privacy Act and Paperwork Reduction Act Notice.

IRS Form 6197 – Who Needs to Fill It Out?

Form 6197 (Gas Guzzler Tax) is the form that individuals and businesses need to fill out if they are liable for the gas guzzler tax when importing a vehicle with a fuel economy rating of 15 mpg or less. Individuals who need to fill out the form must provide their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on both Form 720 and Form 720-V. Companies must provide their Employer Identification Number (EIN). One-time filing of Form 6197 can be done by checking the box on Line 40 of Form 720, and the tax can be paid with the return (no deposit required).

Step-by-Step: Form 6197 Instructions For Filling Out the Document

Filling out the Form 6197 can be a simple process. First, ensure that you pay any tax you may owe with your return. No deposits are required. If you do not have an employer identification number, then enter your social security number or individual taxpayer identification number in the space for an EIN on both Forms 720 and 720-V. On Form 720, check the one-time filing box on the reference line for IRS No. 40. Additionally, for detailed instructions and general information, please review Privacy Act and Paperwork Reduction Act Notice and the “Ordering forms and publications” section in the Instructions for Form 720.

Below, we present a table that will help you understand how to fill out Form 6197.

| Information Required for Form 6197 | Details |

|---|---|

| Payment | Pay any tax owed with your return |

| EIN or SSN | Enter the appropriate identification number |

| Form 720 | Check the one-time filing box for IRS No. 40 |

Do You Need to File Form 6197 Each Year?

Filing Form 6197 each year is a requirement for those liable to pay the gas guzzler tax. This form cannot be filed without accompanying Form 720, and if the individual does not have an EIN, they must include their SSN or ITIN. As long as the individual does not import gas guzzling automobiles in the course of their trade or business and is not otherwise required to file Form 720, the individual is eligible for a one-time filing. In this case, no deposits are required and payment can be made by submitting Form 720-V, Payment Voucher, with the return. Furthermore, the one-time filing box on Form 720 must be checked.

Download the official IRS Form 6197 PDF

On the official IRS website, you will find a link to download Form 6197. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 6197

Sources: