Employers affected by qualified disasters may be eligible to claim the employee retention credit for 2018 through 2019 using Form 5884-A. This form allows employers to claim a credit equal to 40% of up to $6,000 of qualified wages paid to or incurred for each eligible employee.

What is Form 5884-A?

Form 5884-A is a tax document used to claim the employee retention credit for employers affected by qualified disasters in 2018 or later. This credit, provided by Public Law 116-94, Division Q, consists of two parts– the 2018 through 2019 qualified disaster employee retention credit (Form 5884-A, Line 1a) and the 2020 qualified disaster employee retention credit. Partnerships, S corporations, cooperatives, estates, and trusts must use this form, while other taxpayers may report the credit directly on Form 3800, General Business Credit. Qualified wages include those subject to FUTA, medical or hospitalization expenses for sickness or accident disability, and up to the first $6,000 of wages paid to agricultural employees. Employers may not receive the credit for wages paid to their dependents or related parties. The available qualified disasters are listed in the source text.

IRS Form 5884-A – Who Needs to Fill It Out?

IRS Form 5884-A must be completed and filed by employers affected by a 2018-2019 qualified disaster. This includes partnerships, S corporations, cooperatives, estates, and trusts. All other taxpayers are not required to fill out or file this form if their only source of the credit is one of these entities and can report the credit directly on Form 3800. The March 2021 revision of Form 5884-A should be used for tax years beginning in 2018 or later, while prior revisions should be used for earlier years. This form can be used to claim a credit of up to 40% of qualified wages paid or incurred for up to $6,000 per employee. Qualified disasters can be found in Public Law 116-94, Division Q, sections 201 and 203.

Step-by-Step: Form 5884-A Instructions For Filling Out the Document

Filing Form 5884-A provides employers affected by qualified disasters the opportunity to claim the employee retention credit. This form is used for tax years beginning in 2018 or later; prior revisions of the form should be used for earlier tax years. Eligible employers must conduct an active trade or business in a qualified disaster zone; qualified wages paid to or incurred for each eligible employee up to $6,000 are taken into account. Qualified wages may include wages paid for medical or hospitalization expenses due to sickness or disability. Employers may also claim qualified wages paid by third-party payers. For more information, please refer to Public Law 116-94, Division Q, sections 201 and 203, for more details.

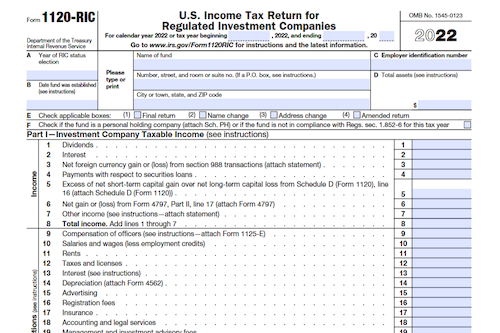

Below, we present a table that will help you understand how to fill out Form 5884-A.

| Information | Details |

|---|---|

| Filing Form 5884-A | Provides employers affected by qualified disasters the opportunity to claim the employee retention credit. |

| Applicable Tax Years | Tax years beginning in 2018 or later |

| Eligible Employers | Employers conducting active trade or business in a qualified disaster zone |

| Qualified Wages | Up to $6,000 per eligible employee taken into account, may include wages for medical or hospitalization expenses due to sickness or disability. |

| Third-Party Payers | Employers may also claim qualified wages paid by third-party payers. |

| Legal Reference | Public Law 116-94, Division Q, sections 201 and 203 |

Do You Need to File Form 5884-A Each Year?

Yes, employers affected by one of the 2018-2019 qualified disasters must file Form 5884-A to claim the employee retention credit. The credit consists of two different parts – the 2018-2019 qualified disaster employee retention credit (Form 5884-A, Line 1a), and the 2020 qualified disaster employee retention credit. Partnerships, S corporations, cooperatives, estates, and trusts must complete and file this form to claim the credit. All other taxpayers can report the credit directly on Form 3800, General Business Credit. The IRS recommends the use of the March 2021 revision for tax years beginning in 2018 or later, until a later revision is issued. Earlier revisions are also available for earlier tax years.

Download the official IRS Form 5884-A PDF

On the official IRS website, you will find a link to download Form 5884-A. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download Form 5884-A

Sources: