Corporations can apply for a quick refund of taxes through Form 1139, including those from a Net Operating Loss, a capital loss, an unused general business credit, or more. Qualified new members of consolidated groups must also follow certain procedures when filing Form 1139.

What is Form 1139?

Form 1139 is an application used by a corporation (other than an S corporation) to request a refund of taxes resulting from their carryback of a net operating loss (NOL), net capital loss, unused general business credit, claim of right adjustment, or election under section 53(e)(5). Tax-exempt organizations claiming a refund of taxes reported on Form 990-T should follow the Instructions for Form 990-T. For NOLs arising in tax years beginning after December 31, 2020, a corporation may elect to waive the entire carryback period and carry the NOL forward to future tax years. The corporation must file Form 1139 within 12 months of the end of the tax year and must also attach certain forms and schedules as part of their application. The IRS processes these applications within 90 days and may need to contact the corporation for more information.

IRS Form 1139 – Who Needs to Fill It Out?

Form 1139, otherwise known as the Corporation Application for Quick Refund of Overpayment of Taxes, is a form used by corporations (other than S Corporations) to apply for a quick refund of taxes from carryback claims for net operating losses (NOLs), net capital loss, unused general business credit, overpayments due to a claim of right adjustment, or elections under Section 53(e)(5). Tax-exempt organizations can refer to the Instructions for Form 990-T for information on how to claim a refund. Additionally, corporations that experienced an NOL for tax years beginning after December 31, 2020 can elect to waive the entire carryback period in certain cases, and must do so by either checking the box on the applicable form and filing the return on time or filing an amended return within 6 months of the date the return is due. Lastly, to further process the application, the corporation must file Form 1139 within 12 months of the tax year and submit any applicable forms and schedules.

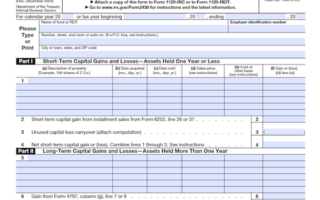

Step-by-Step: Form 1139 Instructions For Filling Out the Document

Form 1139 is used by corporations (except for S-corporations) to apply for a quick refund of taxes as the result of a net operating loss (NOL) carryback, net capital loss carryback, carryback of an unused general business credit, or an election to claim 100% of prior year minimum tax. It must be sent to the IRS Center where the corporation files its income tax return, and should include the first two pages of the tax return, any relevant forms and schedules, Forms 8886, applicable election statements, and Form 8302 for refunds of at least $1 million. The corporation has 12 months from the end of the tax year to file the Form 1139. If Form 1138 is filed, the corporation has until the last day of the month that includes the due date for filing the return. The IRS typically processes the application within 90 days after the last day of the month. However, if the IRS needs more information, it may contact the corporation or its representative.

Below, we present a table that will help you understand how to fill out Form 1139.

| Form Name | Information Required | Details |

|---|---|---|

| Form 1139 | Instructions for Form 1139 | Instructions for corporations to apply for a quick refund of taxes as a result of net operating loss (NOL) carryback, net capital loss carryback, or other factors using Form 1139. |

Do You Need to File Form 1139 Each Year?

Form 1139 is typically filed within 12 months of the end of the tax year in which an NOL, net capital loss, unused credit, or claim of right adjustment arose. Special rules apply for a corporation that timely filed its return without the election, or for a consolidated group making the election. Further, certain corporations can waive the entire carryback period – filing Form 1138 may be necessary and certain additional documents must be attached to the form. Any amendments to the form must include the statement required by Regulations section 1.1502-21(b)(3). An extension of time to file Form 1139 may be granted if Form 1138 is filed by the due date of the incomne tax return.

Download the official IRS Form 1139 PDF

On the official IRS website, you will find a link to download Form 1139. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1139

Sources: