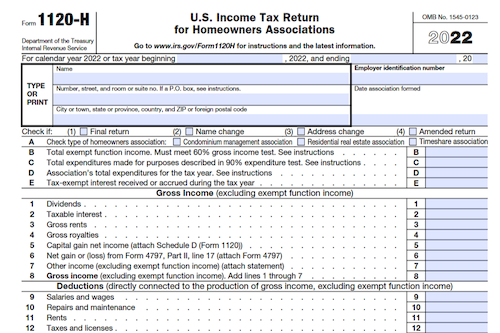

A homeowners association can take advantage of certain tax benefits by filing Form 1120-H, which provides a flat tax rate of 30%-32% (depending on the type of association) and excludes exempt function income from its gross income. However, if the association does not make the regulatory election to be treated as a homeowners association, it can get an automatic 12-month extension to make the election.

What is Form 1120-H?

A homeowners association should file Form 1120-H to take advantage of the tax benefits provided by Section 528. An election must be made each tax year to file Form 1120-H, with the due date including extensions, to receive the tax benefits. If the association fails to make a timely election, a 12-month extension can be requested provided corrective actions are taken. In addition, the taxable income of a homeowners association that files their tax return on Form 1120-H is taxed at a flat rate of 30%-32% depending on the type of association. To qualify as a homeowners association, at least 60% of their income and 90% of expenses must consist of exempt function income. Once the election is made, it cannot be revoked without the IRS consent. The association should compare their total tax on Form 1120-H vs Form 1120 to file the form that results in the lowest tax.

IRS Form 1120-H – Who Needs to Fill It Out?

A homeowners association should fill out Form 1120-H in order to take advantage of the tax benefits offered. It must make the election to do so separately for each tax year and by the due date, including extensions. Once Form 1120-H is submitted, it can only be revoked with IRS consent. The association should compare the total tax figured from both Form 1120-H and Form 1120 and file the one with the lowest tax rate. If the due date falls on a weekend or holiday, they may file on the next day. There is an automatic 12-month extension to make the election if the association fails to do so, under certain conditions. It must file the form either at either the Kansas City, MO or Ogden, UT address, depending on their location. It must be signed by the president, vice president, treasurer, assistant treasurer, chief accounting officer, or other authorized officer. Individuals who prepare the Form 1120-H but do not charge the association do not need to sign. Further, they may authorize the IRS to discuss the return with the paid preparer by checking the appropriate box.

Step-by-Step: Form 1120-H Instructions For Filling Out the Document

Filling out Form 1120-H for a homeowners association is essential to taking advantage of certain tax benefits. To begin, the association must file to make the election by the due date, including extensions, of the income tax return. However, if the association fails to make the election, it has 12 months to do so before needing IRS consent. Next, the taxable income of the association is taxed at a flat rate of 30% for condominium management associations and residential real estate associations, or 32% for timeshare associations. There are three types of homeowners associations eligible to file this form – condominium management, residential real estate, and timeshare. The association property must be used to benefit its residents, and exempt function income must amount to at least 60% of its gross income for the tax year. Exempt function income includes assessments to pay real estate taxes, and income that is not exempt function income is ineligible. The return must be filed on or before the 15th day of the 4th month after the end of the tax year, and the association must sign it. Lastly, it should be assembled with any other forms, schedules, and statements, and complete each applicable entry space.

Below, we present a table that will help you understand how to fill out Form 1120-H.

| Key Information for Form 1120-H | Details |

|---|---|

| Filing Requirement | File by the due date, including extensions, or within 12 months with IRS consent |

| Tax Rate | 30% for condominium management and residential real estate associations, 32% for timeshare associations |

| Eligible Associations | Condominium management, residential real estate, and timeshare associations |

| Income Criteria | Exempt function income must be at least 60% of gross income |

| Filing Deadline | On or before the 15th day of the 4th month after the tax year ends |

| Assembly | Assemble with other forms, schedules, and statements |

Do You Need to File Form 1120-H Each Year?

Homeowners associations must file Form 1120-H each year to take advantage of certain tax benefits that allow it to exclude exempt function income from its gross income. Generally, filing must be done by the due date (including extensions). An automatic 12-month extension may be granted if corrective action is taken within the extension’s time limit. Taxable income is determined by taking the gross income and subtracting all allowed deductions. Exempt function income consists of membership dues, fees, or assessments from its members. Homeowners associations must also file Form 7004 for an extension of time to file the form. The return must be signed and dated by the president or an authorized officer. If a preparer is used, it must be signed and filled in the “Paid Preparer Use Only” section. Furthermore, the association must assemble the return in a specific order, including any supporting statements and attachments.

Download the official IRS Form 1120-H PDF

On the official IRS website, you will find a link to download Form 1120-H. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1120-H

Sources: