Form 1099-NEC is an IRS form used by businesses to report payments made to independent contractors, freelancers, sole proprietors, and self-employed individuals. In 2020, the form was resurrected to address confusion related to dual filing deadlines for certain income and compensation. This article outlines who should file this form and how to do so.

What is Form 1099-NEC?

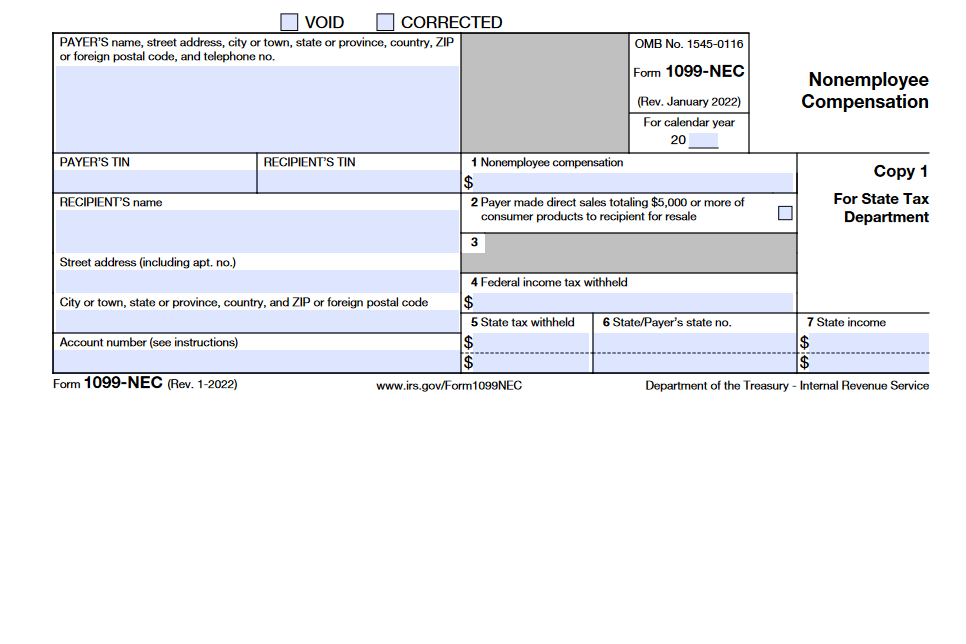

Form 1099-NEC is an Internal Revenue Service (IRS) form used by businesses to report payments made to nonemployees (independent contractors, freelancers, sole proprietors, and self-employed individuals). Payers must provide the form to recipients by Jan. 31 of the following year if they were paid more than $600 in nonemployee compensation. Federal income tax withheld during the year is also reported on the form. Filing Form 1099-NEC is an important step for businesses to properly pay taxes owed for nonemployee compensation. The information on the 1099-NEC is used for filing taxes correctly and must be provided by the business according to the IRS regulations.

IRS Form 1099-NEC – Who Needs to Fill It Out?

IRS 1099-NEC Form 2022 is necessary for businesses to fill out and report payments made to independent contractors, freelancers, sole proprietors, self-employed individuals, and other nonemployees if their payments have exceeded $600 in a given year. The form details the amount of money paid to the recipient, any federal income taxes withheld, and State income taxes purposes. Businesses must provide recipients with their copies of 1099-NEC by Jan. 31st, and the form can be used to determine the appropriate reporting of income on tax returns.

Step-by-Step: Form 1099-NEC Instructions For Filling Out the Document

Form 1099-NEC is due to recipients by January 31st, and businesses must complete it for any nonemployee paid at least $600 in the year. To file, businesses designate the type of income in box 1 and if applicable, box 2. Box 3 should remain blank, and box 4 should report any federal income tax withheld. Information for state tax purposes is in boxes 5-7. Recipients use the information on 1099-NEC to complete the appropriate sections of their tax return – for example, sole proprietors use it on Schedule C and F, while partnerships use it to complete Form 1065 & Schedule K-1. It’s important to note that 1099-MISC is used for compensation not subject to self-employment tax while 1099-NEC is used for compensation that is subject to self-employment tax.

Below, we present a table that will help you understand how to fill out Form 1099-NEC.

| Information for Form 1099-NEC | Details |

|---|---|

| Due Date to Recipients | January 31st |

| Minimum Payment Amount | $600 per year |

| Income Type | Box 1 – Type of income |

| Federal Income Tax Withheld | Box 4 – Report any federal income tax withheld |

| State Tax Information | Boxes 5-7 – Information for state tax purposes |

| Recipient’s Use | Used by recipients for tax return purposes |

| Tax Return Forms | Sole proprietors use Schedule C and F; partnerships use Form 1065 & Schedule K-1 |

| Self-Employment Tax | Subject to self-employment tax |

Do You Need to File Form 1099-NEC Each Year?

Businesses must file Form 1099-NEC with the Internal Revenue Service (IRS) if they paid $600 or more in nonemployee compensation to an independent contractor, freelancer, sole proprietor, or self-employed individual in a given tax year. The due date for payers to file is Jan. 31. Recipients of Form 1099-NEC can then use the information provided on the form to fill out the appropriate sections on their tax returns. Before 2020, this form was not used and all nonemployee compensation was reported in box 7 on Form 1099-MISC, which experienced issues with dual-filing deadlines of Jan. 31 and March 31 that caused much confusion for many payers.

Download the official IRS Form 1099-NEC PDF

On the official IRS website, you will find a link to download Form 1099-NEC: Nonemployee Compensation. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1099-NEC

Sources:

https://www.irs.gov/forms-pubs/about-form-1099-nec

https://www.irs.gov/instructions/i1099mec