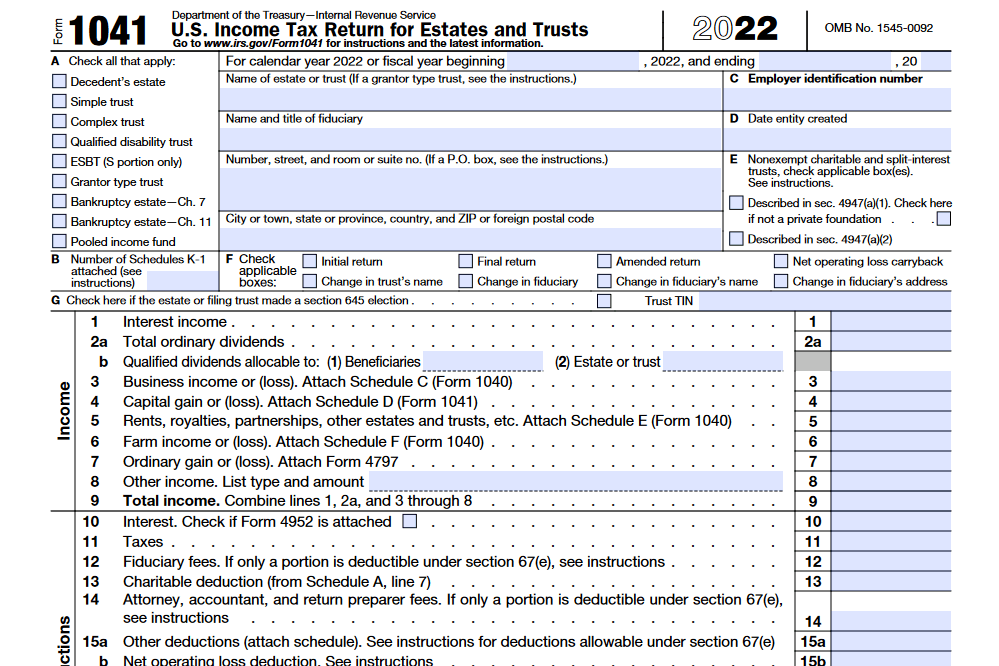

Form 1041 is an IRS income tax return filed by the trustee or representative of a deceased individual’s estate or trust to declare any taxable income earned before assets are transferred to beneficiaries. Filing requirements and instructions vary depending on the estate, trust, or beneficiary status.

What is Form 1041?

Form 1041 is an income tax return filed by the trustee or representative of a decedent’s estate, trust, or bankruptcy estate to declare any taxable income generated after the decedent passed away and before designated assets were transferred to beneficiaries. It applies to federal taxation, and for some estates and trusts, taxes may also have to be paid at the state level. The executor, trustee, or representative must file the form if the assets generate an annual gross income (AGI) of $600 or more, or if one of the beneficiaries is a nonresident alien. The form must be filed by the fifteenth day of the fourth month after the close of the tax year and can be sent electronically or by mail. It is important to read the line-by-line instructions provided by the IRS to ensure errors are not made, as mistakes can lead to costly and unwanted consequences.

IRS Form 1041 – Who Needs to Fill It Out?

Form 1041 is a three-page Internal Revenue Service (IRS) tax return filed by the executor, trustee, or personal representative of an estate or trust that produces an annual gross income (AGI) exceeding $600, or if one of the beneficiaries is a nonresident alien. The form details any taxable income generated after the decedent passed away and before designated assets were transferred to beneficiaries, including stocks, bonds, mutual funds, savings accounts, rents, and royalties. Income and deductions can be reported on Form 1041, with certain income or deductions requiring additional complementary forms. The return must be filed by the fifteenth day of the fourth month after the close of the tax year, and can be sent electronically or by mail.

Step-by-Step: Form 1041 Instructions For Filling Out the Document

Filing Form 1041 is an important step when a decedent’s estate, trust, or bankruptcy estate has generated income after the decedent’s date of death and before assets have been transferred to beneficiaries. The executor, trustee, or personal representative of the estate or trust is responsible for filing the form, and should take care to follow the IRS’ line-by-line instructions when filling it out. Form 1041 consists of three pages, featuring sections for identifying the estate, filing income and deductions, and determining tax owed and payments. Instructions for filling out the form can be found online, and related documents such as Schedule A (Charitable Deduction), B (Income Distribution Deduction), and G (Tax Computation and Payments) should also be used. In addition, money transferred to beneficiaries must be disclosed. Form 1041 is due by the fifteenth day of the fourth month after the close of the tax year and can be sent electronically or by mail. According to the IRS instructions, trusts or estates must file Form 1041 if the assets they oversee generated an annual gross income of greater than $600 or if the beneficiary is a nonresident alien.

Below, we present a table that will help you understand how to fill out Form 1041.

| Aspect of Form 1041 | Description |

|---|---|

| Purpose | Filing when a decedent’s estate, trust, or bankruptcy estate generates income after the decedent’s date of death and before assets are transferred to beneficiaries. |

| Responsible Party | Executor, trustee, or personal representative of the estate or trust. |

| Form Structure | Three pages with sections for estate identification, income and deductions, and tax calculation. |

| Instructions | Available online with line-by-line guidance from the IRS. |

| Related Documents | Schedule A (Charitable Deduction), B (Income Distribution Deduction), G (Tax Computation and Payments) should also be used. |

| Beneficiary Disclosure | Required for money transferred to beneficiaries. |

| Filing Deadline | Due by the fifteenth day of the fourth month after the close of the tax year. |

| Filing Methods | Can be sent electronically or by mail. |

| Filing Threshold | Trusts or estates must file Form 1041 if assets generated an annual gross income of greater than $600 or if the beneficiary is a nonresident alien. |

Do You Need to File Form 1041 Each Year?

If you’re an executor or trustee of an estate or trust with annual gross income (AGI) of greater than $600, or one of your beneficiaries is a nonresident alien, you’re legally required to file Form 1041. This form collects information on all income earned by the estate or trust from the decedent’s passing until assets are distributed to beneficiaries, as well as deductions and payments. Instructions on how to complete Form 1041 are available in line-by-line instructions on the IRS website. It can be filled out and sent electronically or by mail, but make sure to follow the due date – April 15 for a calendar year or the fifteenth day of the fourth month after the close of the tax year for a fiscal year.

Download the official IRS Form 1041 PDF

On the official IRS website, you will find a link to download Form 1041: U.S. Income Tax Return for Estates and Trusts. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 1041

Sources:

https://www.irs.gov/forms-pubs/about-form-1041

https://www.irs.gov/instructions/i1041