Form 1023-EZ is the streamlined version of Form 1023, allowing certain organizations to apply for recognition of federal tax exemption under Section 501(c)(3). This article breaks down who is eligible to file, the user fee, how to file, and more.

What is Form 1023-EZ?

Form 1023-EZ is a streamlined version of Form 1023, the application for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is only available to certain organizations and requires an associated user fee. It can be filed electronically through IRS.gov or Pay.gov. If an incorrect or incomplete form is submitted, the application may be rejected. Important annual filing requirements and signature requirements to obtain and maintain tax-exempt status are outlined in the form instructions. There may be applicable state registration requirements to consider as well.

IRS Form 1023-EZ – Who Needs to Fill It Out?

IRS FORM 1023-EZ requires organizations applying for recognition of exemption from federal income tax under Section 501(c)(3) of the Internal Revenue Code to fill it out. To be eligible to file, the organization must complete the Form 1023-EZ Eligibility Worksheet with all “No” answers, and churches, certain organizations with gross receipts of normally not more than $5,000, and other organizations may be considered tax exempt without completing the form. Payment of the required user fee must be made electronically when submitting the form. During the application process, organizations may be contacted for additional information, and IRS publishes resources to help. An officer, director, or trustee must sign and an annual return or electronic notice may be required.

Step-by-Step: Form 1023-EZ Instructions For Filling Out the Document

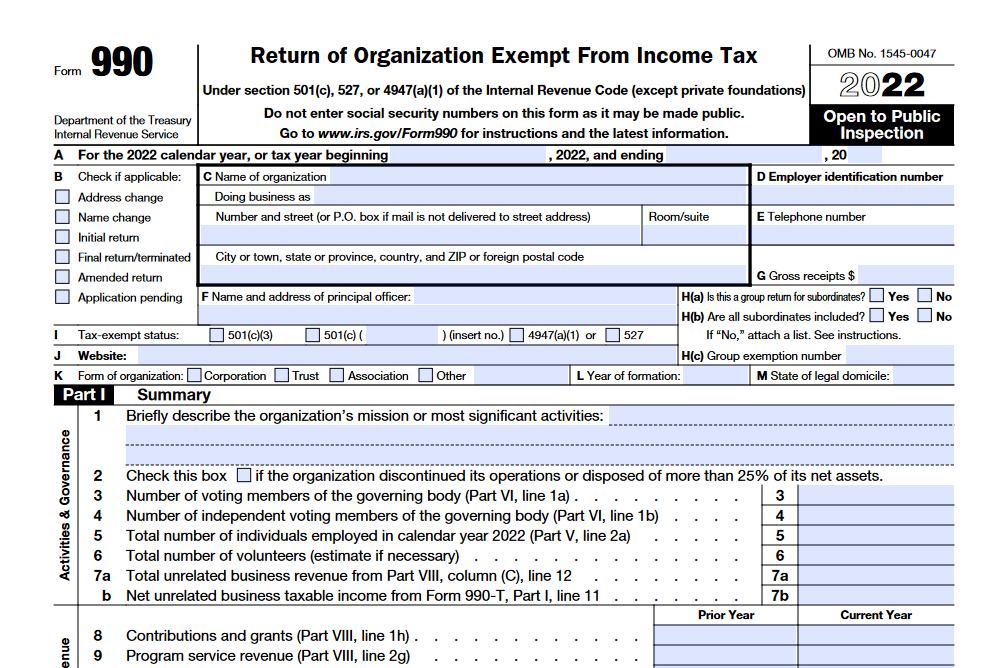

To fill out the Form 1023-EZ document, complete the Form 1023-EZ Eligibility Worksheet first, to determine eligibility to apply. Then, file electronically via IRS.gov/Form1023EZ or Pay.gov, paying the applicable user fee either by direct bank transfer or by credit/debit card. Read the “Life Cycle of an Exempt Organization” guide before filing for more detail on the application process. Certain material must be signed by an officer, director, or trustee listed in Part I, line 8, with the title or authority of the signer and the date. After submitting the application, be sure to file an annual Form 990/990-N if applicable; a request for an exception to this filing may be made with Form 8940. IRS and government resources are available for further assistance.

Below, we present a table that will help you understand how to fill out Form 1023-EZ.

| Information Required for Form 1023-EZ | Details |

|---|---|

| Eligibility Worksheet | Completing the eligibility worksheet |

| Filing Process | Steps to file electronically or by paper |

| Annual Filing | Requirements for annual Form 990/990-N filing |

| IRS Resources | Where to find IRS and government assistance |

Do You Need to File Form 1023-EZ Each Year?

Do You Need to File FORM 1023-EZ Each Year? No – Form 1023-EZ must only be completed when first applying for recognition of tax-exempt status under section 501(c)(3). For subsequent years, organizations must complete the 990 series of returns or the 990-N (e-Postcard) for smaller organizations. Failure to do so may result in automatic revocation of your organization’s tax-exempt status. Access additional information about annual filing requirements at IRS.gov/Charities.

Official IRS Form 1023-EZ

Revised Version In order to file Form 1023-EZ, you are required to:

- Review the guidance provided in the Instructions for Form 1023-EZ and fill out the Eligibility Worksheet located at the conclusion of the instructions. (If you do not meet the eligibility criteria for Form 1023-EZ, you may still proceed to file Form 1023.)

- If you meet the eligibility requirements for Form 1023-EZ, create an account on Pay.gov.

- Enter “1023-EZ” into the search bar.

- Complete the necessary form.

Sources: