IRS has expanded the exception to the 10% additional tax for early distributions of certain retirement accounts, including for qualified public safety employees, correctional officers, and those with terminal illnesses. It has also increased the age to start required minimum distributions and clarified distribution rules.

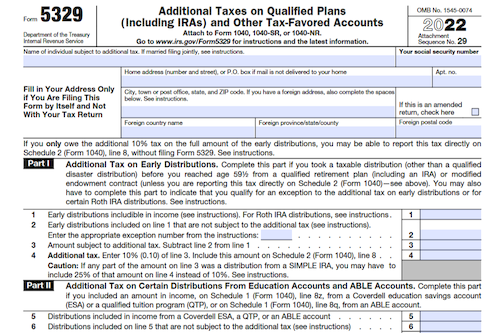

What is Form 5329?

Form 5329 is an Internal Revenue Service (IRS) form used to report additional taxes on IRAs, other qualified retirement plans, modified endowment contracts, Coverdell ESAs, qualified tuition plans, Archer MSAs, Health Savings Accounts, and Achieving a Better Life Experience accounts. Taxpayers must file Form 5329 if they received a distribution subject to the tax on early distributions from a qualified retirement plan, contributions for the year exceed the contribution limit, or RMDs are missed. Form 5329 must be filed by the due date including extensions along with an income tax return, or if a return isn’t due, by itself at the usual time and place. Various updates including exceptions to the 10% tax on early distributions, higher RMD ages, reduced excise tax for RMDs, and qualified disaster recovery distributions are applicable to the filing of Form 5329.

IRS Form 5329 – Who Needs to Fill It Out?

The IRS Form 5329 needs to be filled out by anyone who received a distribution from a Roth IRA, a distribution subject to the tax on early distributions from a qualified retirement plan, a taxable distribution from a Coverdell ESA, QTP or ABLE account, or who has contributions for the year beyond their maximum contribution limit. It must be filed with their tax return on its due date, including extensions. Those filing Form 5329 for a prior year must use the prior year’s version of the form. Instructions for filing form 5329 are included in the instructions for their tax form.

Step-by-Step: Form 5329 Instructions For Filling Out the Document

Form 5329 must be used to report additional taxes related to IRAs, other qualified retirement plans, modified endowment contracts, Coverdell ESAs, QTPs, Archer MSAs, HSAs, and ABLE accounts. It must be filed with your tax return or separately, if you are not required to file a return. The 10% additional tax on early distributions may have exceptions depending on your circumstances, so be sure to review the instructions carefully. Additionally, there are other tax laws and regulations related to distributions and rollovers from these accounts, so the relevant publications should be consulted for further information.

Below, we present a table that will help you understand how to fill out Form 5329.

| Information Required for Form 5329 | Details |

|---|---|

| Additional Taxes | Taxes related to various retirement accounts |

| Exceptions | Conditions where exceptions may apply |

| Related Regulations | Other tax laws and regulations to consider |

| Further Information | Where to find additional details |

Do You Need to File Form 5329 Each Year?

You must file Form 5329 if you received a distribution from a Roth IRA or a qualified retirement plan (other than a Roth IRA) subject to the tax on early distributions and you meet an exception to the tax on early distributions. You must also file if you received a taxable distribution from a Coverdell ESA, QTP, or ABLE account; your traditional IRAs, Roth IRAs, Coverdell ESAs, Archer MSAs, HSAs, or ABLE accounts contributions exceeded your maximum contribution limit; or you didn’t receive the minimum required distribution from your qualified retirement plan. File Form 5329 with your 2022 Form 1040, 1040-SR, or 1040-NR by the due date, including extensions, of your tax return.

Download the official IRS Form 5329 PDF

On the official IRS website, you will find a link to download Form 5329. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 5329

Sources: