Form 1098 is a document used by lenders and businesses to report mortgage interest payments of $600 or more to the IRS. It can also be used to report tuition expenses, student loan interest, and qualified vehicle donations. This article explains the types of Form 1098, who it applies to, and how to file it.

What is Form 1098-T?

IRS Form 1098 is a mortgage interest statement used by businesses and lenders to report mortgage interest paid of $600 or more. It reports the interest received from individuals or sole proprietors, mortgage insurance premiums, points, and more. Homeowners may receive more than one Form 1098 if they have multiple mortgages or have refinanced during the tax year. The form is not required to be filed by homeowners earning interest from a personal residence, however it can assist with claiming eligible deductions. There are several different types of 1098 Form, such as 1098-E for student loan payments, 1098-T for tuition expenses, and 1098-C for qualified vehicle donations. Forms can be obtained from the mortgage lender or from an online portal, and can be e-filed. While straightforward to complete, it’s important to check for accuracy to ensure there are no issues come tax season.

IRS Form 1098-T – Who Needs to Fill It Out?

Form 1098 is an IRS document for businesses and lenders to report mortgage interest payments of $600 or more that they received from individuals in a year. Homeowners commonly receive Form 1098 from mortgage lenders to report mortgage interest payments and premiums. Businesses must file Form 1098 if they receive the required interest payments from individuals. There are multiple types of Form 1098, such as 1098-E for student loan payments and 1098-C for vehicle donations. These forms are usually sent in the mail before tax season, but call your lender if you don’t receive it. Form 1098 is fairly easy to file and shouldn’t cause any complications.

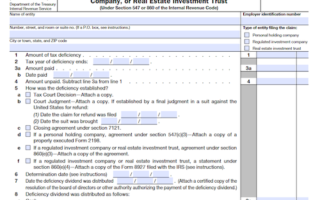

Step-by-Step: Form 1098-T Instructions For Filling Out the Document

Filling out a Form 1098 is relatively straightforward. It is an IRS tax form that businesses and lenders use to report mortgage interest payments, tuition payments, student loan interest payments, certain charitable contributions, and other mortgage-related premiums. This form should only be filed if the payments made to a lender or business total $600 or more throughout the year. The form can be obtained in the mail from mortgage lenders, online portals, and by calling the lender directly. Once the form has been obtained, the information should be filled out and submitted when filing an annual tax return. The form must be accurate and can be e-filed if the company has the software to do so. A Form 1098 facilitates the claiming of the mortgage interest deduction if the taxpayer plans to itemize. It is an important tax form that should be filed correctly to ensure no complications come tax season.

Below, we present a table that will help you understand how to fill out Form 1098-T.

| Information Required for Form 1098 | Details |

|---|---|

| Form Purpose | Report mortgage interest payments, tuition payments, student loan interest payments, etc. |

| Threshold Amount | $600 or more in payments made to a lender or business throughout the year |

| How to Obtain | Mail from mortgage lenders, online portals, or by calling the lender directly |

| Filing Process | Fill out and submit when filing an annual tax return; can be e-filed if software is available |

| Tax Benefits | Facilitates claiming the mortgage interest deduction for itemizing taxpayers |

Do You Need to File Form 1098-T Each Year?

Yes, businesses must file IRS Form 1098 each year if they receive $600 or more in mortgage interest from an individual in a year. Homeowners should also keep an eye out for this form in the mail, as it is typically sent out by lenders to report mortgage interest payments of $600 or more. You might receive more than one Form 1098 for a single tax year if you refinanced the property. For taxpayers, Form 1098 is relatively straightforward when filing taxes and shouldn’t cause any complications. E-filing Form 1098 can make the process easier and quicker.

Download the official IRS Form 1098-T PDF

On the official IRS website, you will find a link to download Form 1098. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: IRS Form 1098-T

Sources:

https://www.irs.gov/forms-pubs/about-form-1098-t

https://www.irs.gov/instructions/i1098et