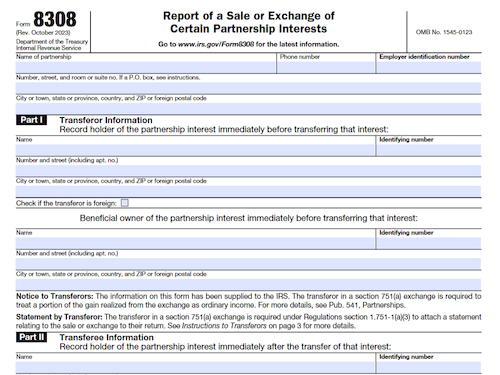

Form 8308 is used for various reporting purposes, including the transfer of a life insurance contract, closely held business, or a partnership interest between related persons. It also reports the transferor’s basis in the partnership interest, determined by reference to the property contributed to the partnership.

What is Form 8308?

Form 8308 is an Internal Revenue Service (IRS) form used to report the transfer of a life insurance contract or an interest in a closely held business. It is also used to report the transfer of a partnership interest when the transferor and transferee are related, and the transferor’s basis in the partnership interest is determined in part by reference to property contributed to the partnership. This form is used to inform the IRS of any transfer of a partnership interest in which the transferor and transferee are related, as well as any transfer where the transferor’s basis in the partnership is determined in part by reference to the property contributed to the partnership.

IRS Form 8308 – Who Needs to Fill It Out?

IRS Form 8308 is primarily used to report the transfer of a life insurance contract or any interest in a closely held business. It is also used to report similar transfers when the transferor and transferee are related and the transferor’s basis in the partnership interest is based off of property contributed to the partnership. Form 8308 is the perfect form to use for educating yourself about the process of selling a partnership interest and protecting both parties involved in the transaction. It is also considered important when the transferor and transferee are related and the transferor’s basis in the partnership interest is determined by reference to the transferor’s own basis in property contributed to the partnership. As such, anyone selling a life insurance contract or any interest in a closely held business should use this form to properly report the transfer.

Step-by-Step: Form 8308 Instructions For Filling Out the Document

When filling out Form 8308, you must indicate the type of transfer represented and provide detailed information on the transferor and transferee, including their interests, related basis in the partnership, and details of the property contributed to the partnership. You must be sure to provide accurate information about the transferor and transferee as this will affect how the basis in the partnership interest is determined. Additionally, you must include any documents relevant to the transfer, such as signed agreements, to ensure the smooth and successful completion of the form. To ensure you’ve met all requirements and submitted a complete form, refer to the accompanying instructions to learn more about Form 8308.

Below, we present a table that will help you understand how to fill out Form 8308.

| Information Required for Form 8308 | Details |

|---|---|

| Transfer Details | Providing information about the transferor, transferee, and property contributed |

| Documentation | Including relevant documents such as signed agreements |

Do You Need to File Form 8308 Each Year?

Form 8308 is required to be filed each year for a number of different scenarios. If a life insurance contract or any interest in a closely held business is transferred, Form 8308 must be completed. Additionally, this form must also be completed if the transfer of a partnership interest is related, and the transferor’s basis in the partnership interest is determined in part by reference to the transferor’s basis in property contributed to the partnership. Therefore, if any of these transfer scenarios occur, Form 8308 must be filed each year in order to accurately report and document these transactions.

Download the official IRS Form 8308 PDF

On the official IRS website, you will find a link to download Form 8308. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8308

Sources: