Form 4852 is a document designed to report substitute payments for wages, compensation for services, and other income when the taxpayer’s employer does not have the necessary information to report the income. It is used to report income to the IRS, Social Security Administration, state, local, and other agencies, as required.

What is Form 4852?

Form 4852 serves as a replacement for the more commonly used Forms W-2, W-2c, and 1099-R (original or corrected) when they are not available from the employer or payer of record. It is used to report substitute payments for wages or other compensation for services when the payer does not have the exact figures. This form is used to report income to the IRS, the Social Security Administration, as well as the state or local tax authorities. It is also used to report to the payee, payer (if they must withhold taxes), and state or local unemployment insurance, workers’ compensation, and disability insurance agencies.

IRS Form 4852 – Who Needs to Fill It Out?

Form 4852 is a substitute form that must be used if a taxpayer or their representative does not have the appropriate Form W-2 or 1099-R from their employer/payer, or if the employer or payer has issued an incorrect Form W-2 or 1099-R. It is used to report substitute payments for wages or services, as well as income to the IRS, SSA, state/local tax authorities, unemployment insurance agency, workers’ compensation agency, and disability insurance agency. Taxpayers or their representatives must complete this form to ensure that all the necessary information is reported accurately to the appropriate entities.

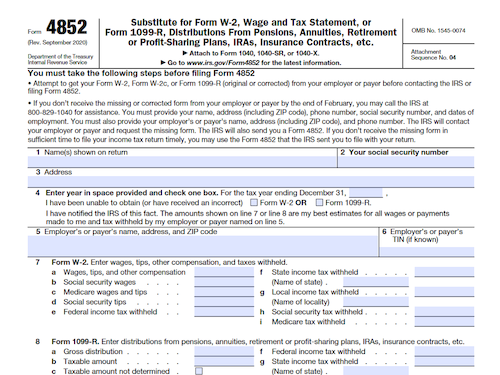

Step-by-Step: Form 4852 Instructions For Filling Out the Document

Form 4852 is used as a substitute for Form W-2, Form W-2c or Form 1099-R when the taxpayer or representative does not receive it from their employer or payer, or if the form issued is incorrect. It is used to report income to the IRS, Social Security Administration, state or local tax authorities, payee, payer, and payee’s state or local unemployment, disability, or worker’s compensation agency. When filling out Form 4852, taxpayers or their representatives should make sure they have the correct information to report the income accurately.

Below, we present a table that will help you understand how to fill out Form 4852.

| Information Required for Form 4852 | Details |

|---|---|

| Substitute for Missing Forms | Using Form 4852 when you don’t receive Form W-2 or Form 1099-R |

| Reporting Income | Providing accurate income information |

Do You Need to File Form 4852 Each Year?

Although Form 4852 serves as a substitute for Form W-2, Form W-2c, and Form 1099-R, it is required to be filed on an annual basis if your employer or payer does not have the correct information to report the income on Form W-2, or if you received income from a decedent’s final wages or other compensation for services. It is important to note that this form is used not only to report income to the IRS and the Social Security Administration but also to report income to your state or local tax authorities, as well as their unemployment insurance agency, workers’ compensation agency, and disability insurance agency.

Download the official IRS Form 4852 PDF

On the official IRS website, you will find a link to download Form 4852. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 4852

Sources: