Form 2439 is used to report the amount of undistributed capital gains from a variety of assets, such as stocks, bonds, real estate, and business interests, which have not been reported on the taxpayer’s income tax return.

What is Form 2439?

Form 2439 is an important document used to report all kinds of undistributed long-term capital gains. It is primarily used to report capital gains from stocks, bonds, mutual funds, real estate, business interests, and other investments to the taxpayer. The form also details the amount of capital gains that have been distributed to the taxpayer but not reported on their income tax returns. Therefore, Form 2439 is essential for any taxpayer to accurately report and declare all kinds of capital gains.

IRS Form 2439 – Who Needs to Fill It Out?

IRS Form 2439 is a necessary tax form for anyone who has not reported capital gains from the sale of certain types of property, such as stocks, bonds, mutual funds, real estate, business interests, and/or other investments. This form is used to report these undistributed long-term capital gains amounts, which the taxpayer has either not yet received or received but not reported on their income tax return. Failing to file this form could result in potential penalties and costs, so knowledge and filing of this form is essential.

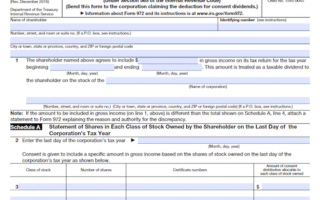

Step-by-Step: Form 2439 Instructions For Filling Out the Document

Form 2439 is used to report undistributed long-term capital gains from the sale of various types of assets, such as stocks, bonds, mutual funds, real estate, business interests, and other investments. The form is also used when capital gains have been distributed to the taxpayer but have not been reported on their income tax return. The form must include the total amount of capital gains distributed, not just those which have not been reported. Additionally, taxpayers must include any capital gains distributed that have not been reported on their income tax return in order to accurately file Form 2439.

Below, we present a table that will help you understand how to fill out Form 2439.

| Information Required for Form 2439 | Details |

|---|---|

| Reporting Capital Gains | Details on reporting undistributed long-term capital gains |

| Reporting Distributed Gains | Information on reporting distributed capital gains |

Do You Need to File Form 2439 Each Year?

FORM 2439 is required to report capital gains from the sale of certain types of property, such as stocks, bonds, mutual funds, and other investments, as well as gains from the sale real estate, business interests, and other assets. It must be filed each year to report the amount of distributed and undistributed capital gains, and to ensure the accurate reporting of the taxpayers income taxes. Failure to file Form 2439 can result in penalties and interest being assessed on the taxpayer.

Download the official IRS Form 2439 PDF

On the official IRS website, you will find a link to download Form 2439. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 2439

Sources: