Form 2106: Employee Business Expenses is a tax form distributed by the Internal Revenue Service (IRS) used by employees to deduct ordinary and necessary expenses related to their jobs. Starting in the tax year 2018, unreimbursed employee business expenses can no longer be claimed as a tax deduction for the majority of taxpayers. Currently, the only people who can use Form 2106 are Armed Forces reservists, qualified performing artists, fee-based state and local government officials, and employees with impairment-related work expenses. This form includes two parts. Part I tabulates all employee business expenses and reimbursements. Part II deals more specifically with vehicle expenses. Filers can either use the standard mileage rate, which is multiplied by the number of business-qualifying miles driven, or they can calculate actual expenses. Commuting to and from work is not considered an eligible business expense.

What is Form 2106?

Form 2106: Employee Business Expenses is an IRS tax document that individuals use to claim deductions for job-related expenses. This form comprises two sections: Part I, which summarizes all employee business expenses and reimbursements, and Part II, which provides a detailed breakdown of vehicle-related expenses. The form outlines which expenses are eligible for tax deductions, including vehicle costs, parking fees, tolls, transportation charges, and other essential business expenditures. Notably, this form is accessible only to Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses. It’s worth noting that the simplified version of this form, Form 2106-EZ: Unreimbursed Employee Business Expenses, was discontinued after 2018 due to tax reform changes.

IRS Form 2106 – Who Needs to Fill It Out?

Form 2106: Employee Business Expenses is an IRS form for Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses. They are able to claim their job-related expenses as an above-the-line deduction on their taxes. Those looking to claim a tax deduction for unreimbursed work expenses must fill out Form 2106. This form is divided into two parts, one tabulating expenses and unreimbursed reimbursements, and one dealing more specifically with vehicle expenses and employment. Commuting expenses are not included in this deduction. Instructions and more information are available on the IRS website.

Step-by-Step: Form 2106 Instructions For Filling Out the Document

Form 2106: Employee Business Expenses is an IRS form used by certain employees, such as Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses, to deduct ordinary and necessary business expenses related to their job. This form consists of two parts: Part I, which tabulates and calculates qualified deductions; and Part II, which covers vehicle-related expenses, such as gasoline, repairs, insurance, and depreciation. Additionally, it is important to note that prior to 2018, Form 2106-EZ: Unreimbursed Employee Business Expenses was a simplified version available to all employees. However, after 2018, when the Tax Cuts and Jobs Act (TCJA) went into effect, taxpayers could only take an above-the-line deduction and not an itemized deduction for W-2 income. The form is available for download on the IRS website.

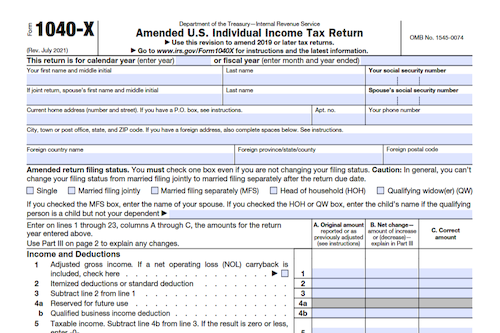

Below, we present a table that will help you understand how to fill out Form 2106.

| Form 2106: Employee Business Expenses Information | Details |

|---|---|

| Form Purpose | Deduction of ordinary and necessary business expenses |

| Eligible Employees | Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses |

| Form Parts |

|

| Form History | Prior to 2018: Form 2106-EZ (simplified version) available to all employees

After 2018: Tax Cuts and Jobs Act (TCJA) changed the deduction rules |

| Availability | Form is available for download on the IRS website |

Do You Need to File Form 2106 Each Year?

Filing Form 2106: Employee Business Expenses is no longer necessary for most taxpayers, as the Tax Cuts and Jobs Act (TCJA) went into effect in 2018. Currently, only Armed Forces reservists, qualified performing artists, fee-basis state or local government officials, and employees with impairment-related work expenses can use Form 2106 to deduct their ordinary and necessary business expenses related to their jobs. These offf-set their taxable income. The IRS website contains instructions to complete the two-part form, which requires taxpayers to claim and calculate either their standard mileage rate or their actual transportation expenses. It is important to note that commuting to and from work is not considered an eligible business expense and is not deductible.

Download the official IRS Form 2106 PDF

On the official IRS website, you will find a link to download Form 2106. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 2106

Sources:

https://www.irs.gov/forms-pubs/about-form-2106

https://www.irs.gov/instructions/i2106