Are you a business owner wondering about the intricacies of tax forms, specifically the Schedule K-1? Are terms like “form 1065,” “tax deduction,” and “irs schedule k-1” making your head spin? Fret not, for you’ve stumbled upon the ultimate guide that will unravel the mysteries of the Schedule K-1 tax form and help you navigate your tax obligations with confidence. In this comprehensive article, we’ll delve deep into the world of Schedule K-1, covering its purpose, filing requirements, common pitfalls, and much more. Whether you’re a seasoned entrepreneur or a first-time filer, this article is worth reading to ensure you’re well-prepared for tax season.

What is the Schedule K-1?

The Schedule K-1 tax form is a crucial component of a partnership’s tax return, including Limited Liability Companies (LLCs) and S corporations. It is used to report the income, deductions, and credits allocated to each partner or shareholder. Unlike a traditional tax return, which is filed by an individual or business entity, the Schedule K-1 is not submitted to the IRS. Instead, it is provided to each partner or shareholder, who then uses the information to report their share of the partnership’s income on their personal tax return.

Who needs to file a Schedule K-1?

Partnerships and S corporations are required to file a Schedule K-1 for each partner or shareholder. This form is essential for maintaining transparency and ensuring that each partner or shareholder reports their allocated income accurately.

Why is it essential to understand Schedule K-1?

Understanding Schedule K-1 is vital for business owners because it directly affects their tax obligations. Failing to correctly report income, deductions, and credits from Schedule K-1 can lead to IRS scrutiny and potential penalties. Moreover, a thorough understanding of Schedule K-1 allows you to optimize your tax strategy and maximize deductions.

Exploring the various types of K-1 forms

Schedule K-1 comes in various types, depending on the entity’s structure and the type of income generated. The most common types include:

- Form 1065: Used by partnerships.

- Form 1120S: Used by S corporations.

- Form 1041: Used by trusts and estates.

Each type of K-1 form serves a specific purpose and requires accurate reporting based on the entity’s activities.

Which K-1 form is right for your business?

Choosing the correct K-1 form is essential for accurate tax reporting. It depends on the legal structure of your business. Partnerships and multi-member LLCs typically use Form 1065, while S corporations use Form 1120S. Trusts and estates, on the other hand, use Form 1041. Selecting the right form ensures that you report income and deductions accurately.

Filling out the correct K-1 form: Key considerations

When it comes to filling out the K-1 form, it’s absolutely crucial to provide precise and detailed information while adhering to the guidelines set forth by the IRS. Your first step should be gaining a comprehensive understanding of your entity’s structure and the income it generates, as this will be the cornerstone in determining the type of K-1 form you need to file.

When and how to file Schedule K-1

The requirements for filing Schedule K-1 can vary significantly depending on the type of entity you are dealing with. Typically, businesses are obligated to furnish each partner or shareholder with a copy of the K-1 form by the tax filing deadline. Moreover, partnerships and S corporations must not forget to submit a complete set of K-1 forms to the IRS itself.

Important deadlines you need to be aware of

Meeting filing deadlines is a non-negotiable aspect of this process, as failure to do so can lead to undesirable penalties. In general, partnerships and S corporations must provide their partners or shareholders with K-1 forms by the 15th of March, with an extension option available up to the 15th of September. Meanwhile, trusts and estates that utilize Form 1041 need to observe different deadlines altogether.

Penalties for late or incorrect filings

It’s important to emphasize that tardiness or inaccuracies in filing Schedule K-1 forms can have severe consequences, including financial penalties and potential legal ramifications. Staying organized and diligently adhering to all filing requirements and deadlines is absolutely essential.

How Schedule K-1 impacts your tax deductions

Now, let’s explore how Schedule K-1 can significantly influence your eligibility for tax deductions. These deductions have the power to substantially reduce your taxable income, which in turn can lead to a lower overall tax liability.

In conclusion, navigating the intricacies of the K-1 form is a task that requires both precision and diligence. By understanding the nuances of your entity’s structure, meeting filing deadlines, and ensuring accurate submissions, you can not only avoid penalties but also optimize your tax deductions to your advantage.

Remember to consult with tax professionals or use tax software to streamline this process, especially if you are dealing with partnerships, S corporations, or trusts and estates. These tools can help you stay on the right track when filing your annual tax return, be it using Form 1120-S, Form 1065, or any other applicable IRS forms.

Maximizing deductions for your business

To maximize your deductions, you must understand the deductions available to your business and how they apply to your specific situation. Common deductions include

- business expenses,

- depreciation,

- interest expenses.

Common tax deduction mistakes to avoid

When it comes to managing your finances and preparing your taxes, avoiding common tax deduction mistakes is crucial. Failing to keep proper records of expenses, mixing personal and business expenses, or misclassifying expenses can lead to costly errors. To ensure that you make the most of your tax deductions, it’s essential to understand the rules and guidelines surrounding them.

Reporting your share of income or loss on Schedule K-1

Schedule K-1 plays a pivotal role in your tax journey, as it reports your share of income or loss from a partnership’s tax return. This information directly impacts your personal tax return, making accurate reporting imperative. By ensuring that you report this income correctly, you can guarantee that you pay the appropriate amount of taxes and avoid potential penalties.

How income reported on K-1 affects your personal tax return

Income reported on Schedule K-1 is typically subject to individual income tax rates, and understanding how this income affects your personal tax return is essential for effective tax planning. By comprehending the tax implications of your K-1 income, you can make informed decisions about deductions, credits, and other strategies to optimize your tax liability.

Strategies for minimizing your tax liability

Minimizing your tax liability is a common goal for many taxpayers, and it can be achieved through various strategies, such as tax credits, deductions, and income management. Proper tax planning is key to keeping more of your hard-earned money in your pocket. Exploring these strategies can help you make informed financial decisions that align with your goals.

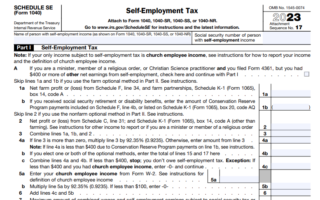

A step-by-step guide to filling out the Schedule K-1 form

A step-by-step guide to filling out the Schedule K-1 tax form is essential for anyone navigating the complexities of partnership tax returns. Whether you’re a business owner or a partner in a partnership, understanding this crucial document is vital to accurately report your income and tax liability for the year.

To begin, you’ll need to file Form 1065, the partnership’s tax return. This form is the starting point for generating Schedule K-1. Many individuals opt to use tax software to streamline the process, ensuring accuracy and efficiency.

Once you’ve filed Form 1065, the IRS will provide you with Schedule K-1 to report your share of the partnership’s income, deductions, and credits. It’s important to note that different types of K-1 forms exist, tailored to specific situations, so make sure you have the correct version.

When you receive a Schedule K-1 form, it’s crucial to review it carefully, as it contains vital information on the income you need to report on your individual tax return. The income reported on Schedule K-1 is subject to self-employment tax, so understanding the details is essential to calculate your tax liability accurately.

Many individuals and businesses also use Form 7004 to request a 6-month extension to file their tax returns if they need more time. However, keep in mind that this extension only applies to the filing deadline, not the payment deadline. You must pay the tax owed by the original due date to avoid penalties and interest.

Schedule K-1 is a tax form used to report income from partnerships, and it’s crucial for individuals who have invested in a business or are part of a partnership structure. It differs from Form 1120-S, which is used to report income from S corporations, and IRS Form 1040, which individuals use for their personal tax returns.

In summary, Schedule K-1 is a vital component of your annual tax return, and understanding how to fill it out correctly is essential for compliance with IRS regulations. Whether you’re a partner in a partnership or an investor in a business, having the right information and using the correct tax forms is key to accurately reporting your income and tax liabilities.

Common pitfalls when completing the form and how to resolve them

Completing Schedule K-1 is not without its challenges, and there are common pitfalls that many individuals encounter. Errors in reporting income or deductions can lead to complications with the IRS. However, learning how to identify and resolve these issues is essential to prevent unnecessary scrutiny and ensure a smooth tax filing process.

Tips for using tax software to simplify the process

Tax software can be a valuable tool to streamline the process of filling out Schedule K-1 forms. It can help you input information accurately, perform calculations, and e-file your returns with ease. It’s essential to choose the right tax software that suits your needs and preferences, as this can save you time and reduce the likelihood of errors.

In conclusion, navigating the complexities of tax deductions, Schedule K-1, and overall tax planning requires a comprehensive understanding of the tax landscape. By avoiding common mistakes, accurately reporting income, and employing effective tax strategies, you can optimize your financial situation and make the most of your annual tax return.

Tips for Smooth Tax Filing

Organizational strategies for stress-free tax filing

Stay organized throughout the year to make tax filing a breeze. Learn about effective record-keeping and document management.

How to maintain accurate records throughout the year

Find out how to maintain accurate financial records to simplify tax preparation and ensure compliance.

Resources and tools for staying informed about tax changes

Stay up-to-date with the latest tax changes, laws, and regulations by utilizing online resources and tools.

Conclusion: Who Need to File Schedule K-1?

In conclusion, Schedule K-1 is a vital component of the tax landscape for businesses structured as partnerships, LLCs, and S corporations. It’s crucial to understand the nuances of Schedule K-1, including its various forms, filing requirements, and implications for both business and personal taxes. By following the guidelines in this comprehensive guide, you’ll be well-equipped to navigate the complexities of Schedule K-1 and ensure accurate and compliant tax filings. Remember to stay informed about tax changes, seek professional guidance when necessary, and maintain organized records to make the tax-filing process as smooth as possible.

Key Takeaways:

- Schedule K-1 is a critical tax form for partnerships, LLCs, and S corporations.

- Choosing the correct K-1 form and meeting filing deadlines is essential.

- Understanding deductions, reporting income accurately, and minimizing tax liability are key considerations.

- Navigating Schedule K-1 requires attention to detail and may benefit from tax software.

- Seek professional guidance when needed, and stay organized throughout the year for stress-free tax filing.