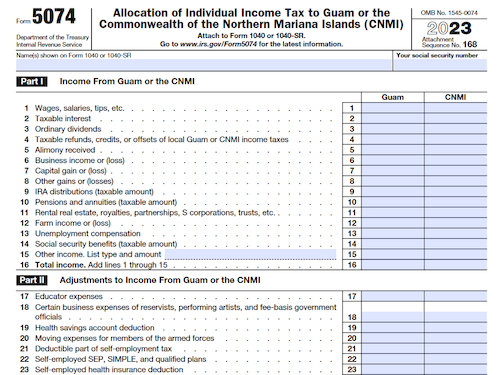

Filing Form 5074 is required for U.S. citizens or resident aliens reporting at least $50,000 in Adjusted Gross Income (AGI) and $5,000 or more from Guam or CNMI sources. Learn …

Form 976: Claim for Deficiency Dividends Deductions by a Personal Holding Company, Regulated Investment Company, or Real Estate Investment Trust

Adoptive parents and legal guardians need to complete Form 976, Application for Taxpayer Identification Number for Pending U.S. Adoptions, in order to obtain a Taxpayer Identification Number (TIN) for a …

Form CT-2: Employee Representative’s Quarterly Railroad Tax Return

Form CT-2, issued by the Internal Revenue Service (IRS), is a federal corporate income tax form used to report the railroad retirement taxes imposed on the compensation received by designated …

Business Incurs a Loss: How to Handle Taxes?

Running a business comes with its fair share of challenges, and sometimes, your business may experience a negative profit. However, there is a silver lining – you won’t have to …

Form 8586: Low-Income Housing Credit

Pass-through entities, such as partnerships, S corporations, estates, and trusts, can claim the low-income housing credit on Form 8586, although individual taxpayers are not required to complete the form. Owners …

Form 730: Monthly Tax Return for Wagers

Businesses and organizations conducting wagers or lotteries must file Form 730 and pay the associated tax to the Department of Treasury. Learn here how to properly complete Form 730 and …

Understanding the Taxation of a Professional LLC

A professional limited liability company (PLLC) is a popular business structure among professionals such as doctors, lawyers, and accountants. While it offers personal asset protection, understanding how a PLLC is …

Form 5884-C: Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans

The IRS Form 8949 is used to report the gain or loss from the sale or exchange of a wide variety of capital assets, such as stocks, bonds, mutual funds, …

Form 2063: U.S. Departing Alien Income Tax Statement

For taxpayers wishing to report income earned in a foreign country and claim exclusions, deductions, and exemptions, Form 2063 offers a means to do so. This form can be used …

Form 8826: Disabled Access Credit

Form 8826 can be used by eligible small businesses to claim the disabled access credit, a part of the general business credit. This form details instructions and definitions related to …

How to Claim Losses From a Small Business on Taxes

If you operate a small business and have experienced losses, you may be eligible to claim those losses on your taxes. By following a few simple steps, you can offset …

Form 8870: Information Return for Transfers Associated With Certain Personal Benefit Contracts

This article provides an overview of Form 8870, which is required to be filed by charitable organizations who paid premiums on certain life insurance, annuity, and/or endowment contracts after February …

Tax Filing Requirements for a LLC

When it comes to tax filing, it is important for limited liability companies (LLCs) to understand their obligations. Depending on the number of members and the desired tax treatment, an …

A Guide to Filing Taxes for Owner-Operators: Guide

Filing taxes as an owner-operator can be a complex process, but with the right knowledge and preparation, it can be done efficiently. This article will provide a step-by-step guide on …

The Impact of Taxation on Entrepreneurs’ Net Profit

Taxation can have significant implications for entrepreneurs, as it can lower their overall net profit. Factors such as the type of business, number of employees, location, and revenue generated all …

Federal Adjusted Gross Income (AGI): Maximizing Your Tax Savings

Understanding your federal adjusted gross income (AGI) is crucial for minimizing your tax liability. By carefully calculating your AGI, which is your total income minus deductions and credits, you can …

Filing Taxes When Hiring Freelance Software Developers

Filing taxes can be a complex process, especially when you’re hiring a freelance software developer. In this article, we will provide you with a comprehensive guide on how to file …

The Advantages of Tax Benefits in a Limited Liability Partnership

Limited liability partnerships (LLPs) have gained popularity among business professionals, particularly lawyers, due to their unique business structure. While LLPs may not offer the same level of liability protection as …

Difference Between Gross and Net Income Taxes for Businesses

When it comes to filing taxes for your small business, it is important to understand the distinction between gross and net income. The Internal Revenue Service (IRS) requires businesses to …