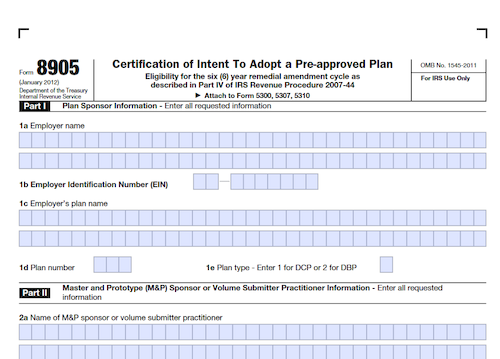

Form 8905 is used by an adopter of an individually designed or pre-approved plan to request that their 5-year remedial amendment cycle be converted to the 6-year cycle, as described …

Form 8717-A: User Fee for Employee Plan Opinion Letter Request

Filing taxes as a tax-exempt organization can be complicated, but IRS Form 8717 can help. It allows organizations to request up to six months of extra time to file their …

Tax Implications for a Sole Proprietorship

Operating a business as a sole proprietorship comes with unique tax implications. From calculating business revenue and expenditures to understanding self-employment tax, it is essential for sole proprietors to be …

Form 5768: Election/Revocation of Election By an Eligible Section 501(c)(3) Organization to Make Expenditures To Influence Legislation

Organizations exempt under section 501(c)(3) of the Internal Revenue Code can elect to make limited expenditures which can influence legislation, with certain restrictions. Organizations must report their actual and allowed …

Form 1041-QFT: U.S. Income Tax Return for Qualified Funeral Trusts

Find out what you need to know in order to properly file Form 1041-QFT to the IRS, including due dates, mailing addresses, who must sign, interest and penalty forms, and …

Form 4876-A: Election to Be Treated as an Interest Charge DISC

This article explains the necessary steps a corporation must take to make an election to be treated as an Interest Charge Domestic International Sales Corporation (IC-DISC). It describes the eligibility …

Form 8874: New Markets Credit

Investors looking for information about claiming the New Markets Credit for qualified investments in qualified Community Development Entities (CDEs) can find important details with Form 8874. This form outlines the …

Form 4970: Tax on Accumulation Distribution of Trusts

Beneficiaries who received an accumulation distribution from certain domestic trusts created before March 1, 1984, must file Form 4970 to compute any additional tax liability. Foreign trust beneficiaries must use …

Form 8288-C: Statement of Withholding Under Section 1446(f)(4) on Dispositions by Foreign Persons of Partnership Interests

The Form 8288-C is an IRS form used to report the transfer of a U.S. real property interest by a foreign person, and to calculate and report the withholding tax …

Form 1042-T: Annual Summary and Transmittal of Forms 1042-S

Form 1042-T is used to report U.S. source income payments made to foreign persons, such as wages, salaries, fees, commissions, interest, dividends, royalties, and scholarships or fellowship grants. It is …

Form 4461: Application for Approval of Standardized or Nonstandardized Pre-Approved Defined Contribution Plans

Filing for an IRS pre-approved plan requires Form 4461, which must be accompanied by a user fee and a power of attorney if necessary. Learn more about IRS pre-approved plans …

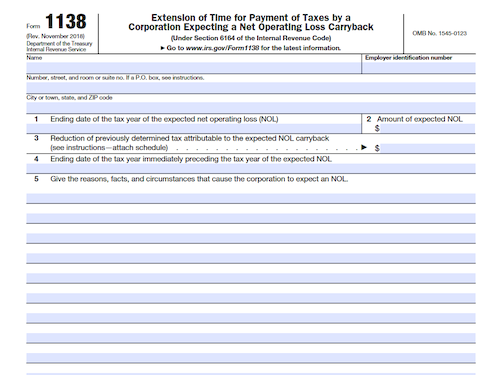

Form 1138: Extension of Time For Payment of Taxes By a Corporation Expecting a Net Operating Loss Carryback

Corporations expecting a Net Operating Loss (NOL) carryback can reduce the amount due for the prior year’s tax with Form 1138: an Extension of Time for Payment of Taxes. This …

Form 8923: Mine Rescue Team Training Credit

Form 8923 allows taxpayers who employ miners in U.S. underground mines to claim a credit of 20% of the training program costs paid or incurred for training of qualified mine …

Filing Your Own Taxes for a Small Business

Filing your own taxes for a small business can be a daunting task, but with the right information and guidance, it can be made easier. This article provides a step-by-step …

Form 2032: Contract Coverage Under Title II of the Social Security Act

Form 2032 is an application for Contract Coverage Under the Federal Employees’ Compensation Act (FECA) and allows American employers to extend Social Security coverage to U.S. citizens and resident aliens …

Form 5213: Election to Postpone Determination As To Whether the Presumption Applies That an Activity is Engaged in for Profit

Individuals, estates, trusts, partnerships, and S corporations can use Form 5213 to elect to postpone a determination as to whether they are engaged in an activity for profit and obtain …

Form 972: Consent of Shareholder to Include Specific Amount in Gross Income

A shareholder who agrees to report a consent dividend as taxable income in the form of a dividend on their own tax return must complete Form 972 for the corporation …

Form 851: Affiliations Schedule

Companies with affiliated groups must adhere to filing requirements for Form 851. Such requirements include knowing the definition of an affiliated group, addressing corporate numbers, and providing information on Principal …

Form 6252: Installment Sale Income

Form 6252 is an Internal Revenue Service (IRS) document used to report income from the sale of real estate or other property when payments are received over time, rather than …

Form W-4S: Request for Federal Income Tax Withholding from Sick Pay

This article explains how to use Form W-4S to request to have federal income tax withheld from sick pay payments received from a third-party payer. Learn how to determine the …