Form 8655 allows taxpayers to authorize reporting agents to sign and file certain returns, make deposits and payments, receive duplicate copies of tax information, and aid in penalty relief determinations. …

Form 5452: Corporate Report of Nondividend Distributions

Form 5452 is used to report the income and expenses of multiple S corporate entities throughout the tax year, such as QSub, QSST, ESBT, and QSC. What is Form 5452? …

Form 706-CE: Certification of Payment of Foreign Death Tax

For nonresident non-citizens of the United States, Form 706-CE is used to report the estate tax due on the transfer of property located in the United States. In addition to …

Form 8922: Third-Party Sick Pay Recap

Organizations are required to file Form 8922 under certain conditions; this article provides an overview of who must file the form, when they must file it, and instructions for completing …

Form 8834: Qualified Electric Vehicle Credit

IRS Form 8834 can be used to claim a wide variety of credits, including credits for increasing research activities, alternative minimum tax credit, investment tax credit, general business credit, and …

Form W-8CE: Notice of Expatriation and Waiver of Treaty Benefits

Americans who have relinquished their citizenship or long-term residents that have ceased to be lawful permanent U.S. residents must submit Form W-8CE to notify the payer of their covered expatriate …

Form 6781: Gains and Losses From Section 1256 Contracts and Straddles

Learn how to use Form 6781 to report gains and losses from section 1256 contracts and straddle positions. Discover mark-to-market rules, special rules for foreign currency contracts, mixed straddle elections, …

Form 9000: Alternative Media Preference

Do you have a print disability? With Form 9000 from the IRS, taxpayers can elect to receive written communications in an accessible format. Find out what forms can be requested, …

Form 8946: PTIN Supplemental Application For Foreign Persons Without a Social Security Number

Foreign persons without a Social Security Number (SSN) who need to prepare tax returns for compensation must file Form 8946 to establish their identity and status as foreign persons. To …

How to Complete a W-9 Form as a Private Contractor

As a small-business owner or a private contractor, it is crucial to understand how to properly fill out a Form W-9. This form is necessary for each person or entity …

Maximizing Tax Benefits: Adjusting Tax Exemptions for Mortgage Interest

Owning a home comes with the advantage of being able to write off mortgage interest payments. By adjusting the withholding on your W-4, you can reduce the amount of taxes …

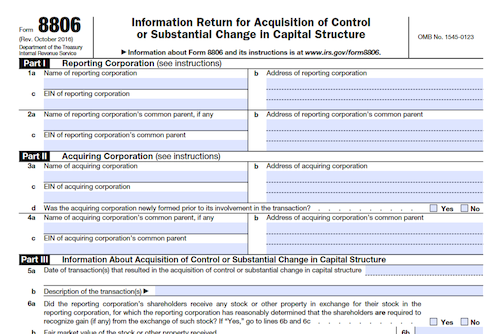

Form 8806: Information Return for Acquisition of Control or Substantial Change in Capital Structure

U.S. persons with certain foreign activities are required to file Form 8806 to report information related to foreign trusts, foreign partnerships, foreign corporations, and foreign disregarded entities, as well as …

Form 8932: Credit for Employer Differential Wage Payments

Employers are required to complete and file the Qualified Small Business Payroll Tax Credit for Paid Family and Medical Leave form with their federal income tax returns in order to …

Form 8882: Credit for Employer-Provided Child Care Facilities and Services

Employers who paid premiums for health insurance coverage for their employees must complete and sign Form 8882 in order to receive a credit and report any recapture of the credit. …

Form 4137: Social Security and Medicare Tax On Unreported Tip Income

With service jobs often paying hourly, tax time can be a daunting challenge for employees. In order to pay your Social Security and Medicare taxes on tip income, you may …

How to Report Patent Income on a Tax Return

Reporting patent income on a tax return can be a complex process. This article provides a step-by-step guide on how to accurately report patent income to the Internal Revenue Service …

Form 1125-A: Cost of Goods Sold

Form 1125-A is an important piece of paperwork for corporations filing their taxes. It provides details about the cost of goods sold and inventory, and is necessary for the accurate …

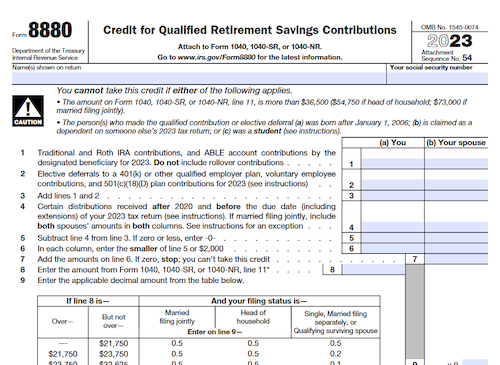

Form 8880: Credit for Qualified Retirement Savings Contributions

Form 8880 is used to claim the Retirement Savings Contributions Credit, which can be up to $2,000 for eligible taxpayers who make contributions to a qualified retirement plan or IRA. …

Form 2439: Notice to Shareholder of Undistributed Long-Term Capital Gains

Form 2439 is used to report the amount of undistributed capital gains from a variety of assets, such as stocks, bonds, real estate, and business interests, which have not been …

Form 8874-A: Notice of Qualified Equity Investment for New Markets Credit

An IRS Form 8874, New Markets Credit, is used by Community Development Entities (CDEs) to provide notice to taxpayers who invest in the CDE, entitling them to the new markets …