Form 1099-Q is an IRS tax form for recipients of Coverdell education savings account (ESA) or 529 plan distributions. It’s crucial for reporting taxable distributions on federal and state tax …

Form 712: Life Insurance Statement

Form 712 is an IRS form used to report life insurance proceeds and other benefits received following the death of an insured. It is required to be completed and filed …

Form 8453-EMP: Employment Tax Declaration for an IRS e-file Return

Form 8453-EMP allows taxpayers to authenticate an electronic Form 940, 941, 941-PR, 941-SS, 943, 943-PR, 944, or 945, authorize an ERO or ISP to transmit, and provide consent to authorize …

Calculating Income Tax: A Step-by-Step Guide

Calculating income tax can be a daunting task for many working Americans. However, with the right forms and instructions, it can be a straightforward process. In this article, we will …

Form 8879: IRS e-file Signature Authorization

IRS Form 8879 is a mandatory requirement for taxpayers filing electronically, authorizing the IRS to accept their tax return. It must include the taxpayer’s name, address and Social Security number, …

Form 8896: Low Sulfur Diesel Fuel Production Credit

This article provides an overview of the low sulfur diesel fuel production credit offered to qualified small business refiners and explains the definitions of key terms such as “low sulfur …

Form 1099-PATR: Taxable Distributions Received From Cooperatives

Form 1099-PATR is an IRS form used to report distributions that taxpayers have received from a cooperative that may need to be included in their taxable income. Taxpayers who received …

Form 1099-OID: Original Issue Discount

Form 1099-OID: Original Issue Discount is an IRS document you receive when you must include an amount of original issue discount as taxable income. OID applies to certain debt instruments, …

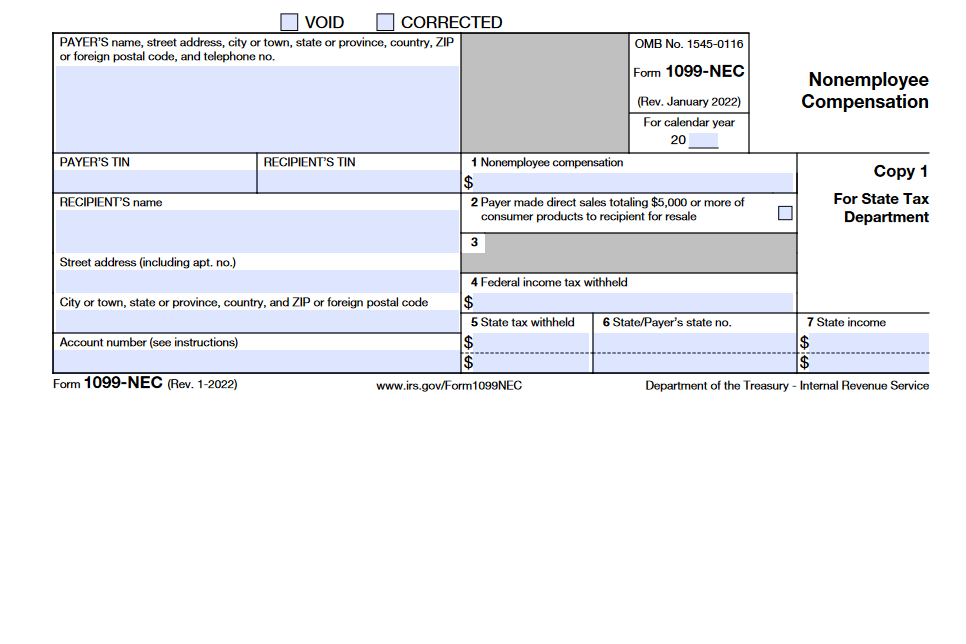

Form 1099-NEC: Nonemployee Compensation

Form 1099-NEC is an IRS form used by businesses to report payments made to independent contractors, freelancers, sole proprietors, and self-employed individuals. In 2020, the form was resurrected to address …

Form 1099-MISC: Miscellaneous Information

Form 1099-MISC is used to report miscellaneous compensation such as rent, royalties, prizes, awards, healthcare payments, and payments to an attorney to both the Internal Revenue Service (IRS) and the …

Form 1099-LTC: Long Term Care and Accelerated Death Benefits

Form 1099-LTC is an IRS form that helps individuals report long-term care (LTC) benefits and accelerated death benefits they’ve received in the previous year, including from providers such as insurance …

Form 1099-K: Payment Card and Third Party Network Transactions

Form 1099-K is an IRS form that taxpayers receive to report certain payment transactions from payment card and/or third-party network transactions above a threshold. If a taxpayer is self-employed or …

Form 1099-INT: Interest Income

Form 1099-INT is an IRS tax form commonly issued to taxpayers who receive interest income over $10. It reports important information such as Federal Income Tax Withheld and Tax-Exempt Interest. …

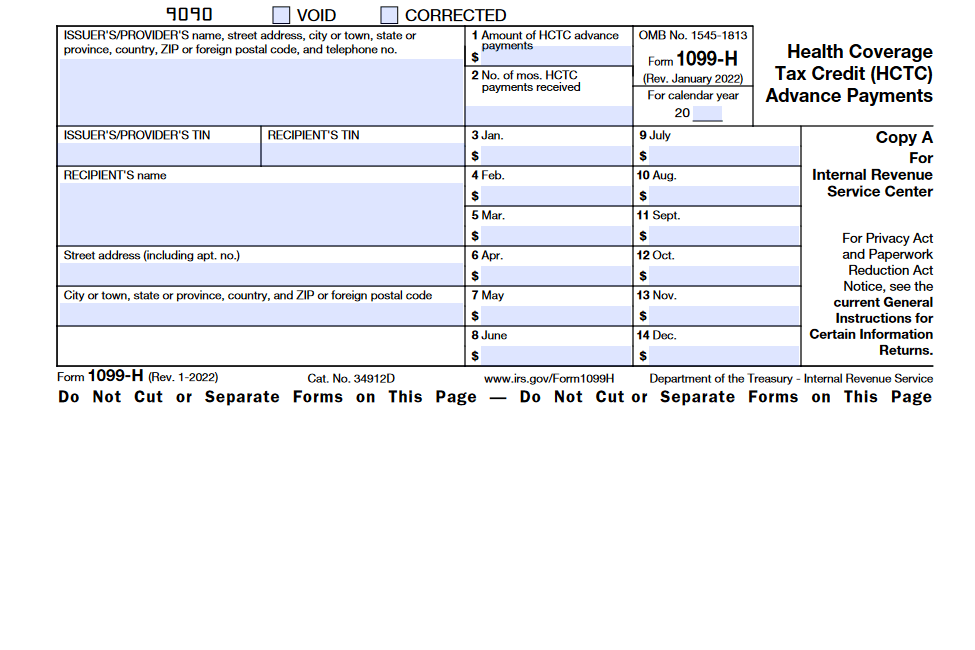

Form 1099-H: Health Coverage Tax Credit (HCTC) Advance Payments

Form 1099-H: Health Coverage Tax Credit Advance Payments is a U.S. federal income tax form used to report health insurance payments made to recipients of Trade Adjustment (TAA), Alternative TAA …

Form 1099-G: Certain Government Payments

Form 1099-G, Certain Government Payments is a form required by federal, state, and local governments to report payments made to taxpayers. It is used to report payments like unemployment compensation, …

Form 1099-DIV: Dividends and Distributions

Form 1099-DIV, Dividends and Distributions is an Internal Revenue Service (IRS) form that banks and other financial institutions provide to investors who receive dividends and distributions from any type of …

Form 1099-CAP: Changes in Corporate Control and Capital Structure

IRS Form 1099-CAP is used by corporations to report a significant change in control or capital structure to shareholders. It is important for shareholders to recognize any gains from cash, …

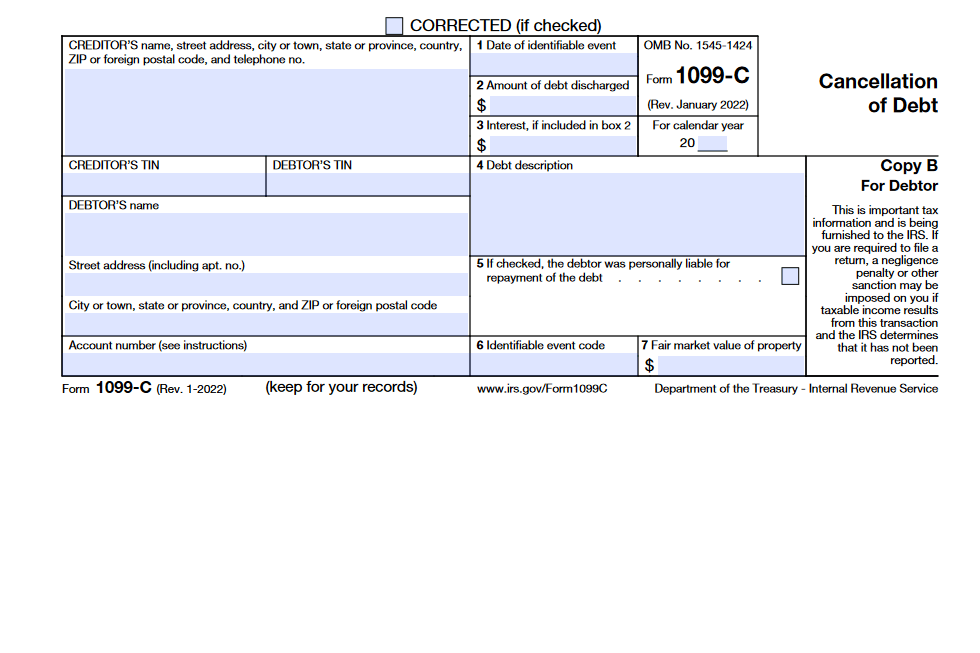

Form 1099-C: Cancellation of Debt

Form 1099-C is a required federal tax form sent to taxpayers by lenders and creditors whenever they cancel or forgive a debt worth $600 or more. Knowing when to file …

Form 1099-B: Proceeds from Broker and Barter Exchange Transactions

Form 1099-B is an IRS tax form used by brokerages and barter exchanges to report a customer’s gains and losses to them and the IRS. The information is then used …

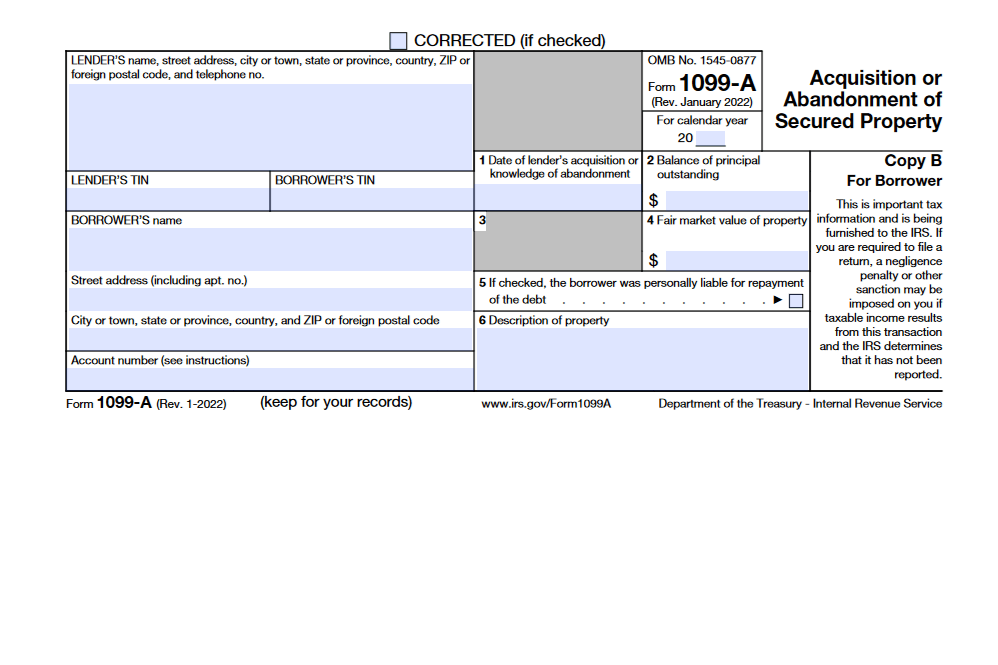

Form 1099-A: Acquisition or Abandonment of Secured Property

Form 1099-A is a federal tax form that lenders file with the IRS to report properties transferred due to foreclosure. The form provides details of the sale, including fair market …