Foreign persons are generally required to provide Form W-8ECI to establish that they are not U.S. persons and to claim that their income from U.S. sources is effectively connected with the conduct of a trade or business in the United States. Failure to provide this form may lead to U.S. withholding tax being taken out of payments.

What is Form W-8ECI?

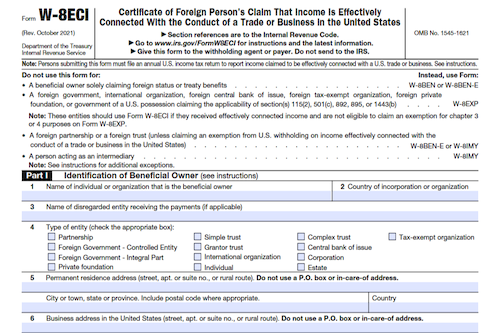

Form W-8ECI is used by foreign persons when they are the beneficial owner of U.S. source income that is, or is deemed to be, effectively connected with the conduct of a trade or business in the United States. This form must be given to the withholding agent or payer in order to claim an exemption from withholding under sections 1441, 1442, 1471, or 1472, as the income is effectively connected with the conduct of a trade or business in the United States, or if the income is subject to withholding under section 1446(a) and (f). An expiration date is set on Form W-8ECI, so if a change in circumstances, such as income not being effectively connected anymore, occurs, a new form must be submitted.

IRS Form W-8ECI – Who Needs to Fill It Out?

Form W-8ECI is necessary for any foreign person looking to receive income from US sources that is effectively connected with the conduct of a trade or business in the US. This form is necessary to establish that the recipient is a non-US person and the beneficial owner of the income, as well as to claim that the income is effectively connected with a US trade or business. This form should be provided to the withholding agent or payer before income is received, credited, or allocated. Should the form not be provided, the withholding agent is required to withhold at the 30% rate or the backup withholding rate, and may be subjected to penalties for inaccurate or unacceptable forms.

Step-by-Step: Form W-8ECI Instructions For Filling Out the Document

To ensure you do not overpay on your taxes, it is important to read and understand the instructions for correctly filling out Form W-8ECI. If you are a foreign person receiving US sourced income that is or is deemed to be effectively connected with the conduct of a trade or business in the US, you must provide Form W-8ECI to establish you are not a US person, claim you are the beneficial owner of the income, and claim the income is effectively connected with the conduct of a trade or business. For this purpose, you should provide separate forms for effectively connected and non-effectively connected income. Other instances such as foreign partnerships, foreign simple trusts, or foreign grantor trusts may also require Form W-8ECI to claim exemption from withholding. Lastly, don’t forget to provide the form to the withholding agent or contactor before the payment is made or credited, as failure to submit Form W-8ECI may lead to 30% or backup withholding.

Below, we present a table that will help you understand how to fill out Form W-8ECI.

| Information for Form W-8ECI | Details |

|---|---|

| Foreign Income | For foreign persons with US sourced income |

| Exemptions | May apply to foreign partnerships, trusts, etc. |

| Withholding | Submit to withholding agent before payment |

| Backup Withholding | Failure to submit may lead to 30% withholding |

Do You Need to File Form W-8ECI Each Year?

If you are a foreign person receiving U.S. source income from your engagement in a U.S. trade or business, or effectively connected income, you must submit Form W-8ECI to the withholding agent or payer. This form is necessary to establish that you are not a U.S. person, to claim that you are the beneficial owner, and to claim that the income is effectively connected with your trade or business within the U.S. Generally, Form W-8ECI will remain valid for 3 years from the time it is signed; however, you must notify the withholding agent or payer when circumstances change and new forms should be submitted.

Download the official IRS Form W-8ECI PDF

On the official IRS website, you will find a link to download Form W-8ECI. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form W-8ECI

Sources: