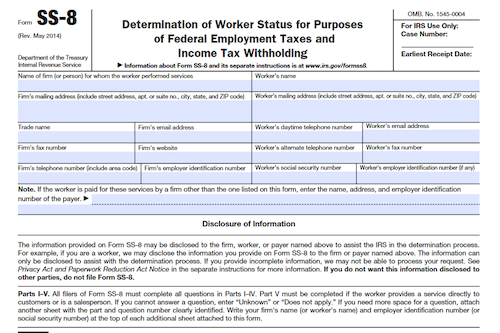

This article covers the Form SS-8, a form used to request a determination of a worker’s employment status for federal tax purposes. The article goes over how to fill out the form, who can sign it, when to file it, how the determination process works, and other relevant information.

What is Form SS-8?

Form SS-8 is an Internal Revenue Service (IRS) form that firms and workers use to request a determination of the status of the worker under the common law rules for federal employment taxes and income tax withholding. Generally, if the firm has the right to control and direct what will be done and how it will be done, the worker is an employee. The form must be completed and submitted with supporting documentation, and a fee is not required for submitting the request. Depending on the facts, the IRS will either issue a formal determination or an information letter, which is only advisory and not binding on the IRS. If the worker disagrees with the determination, they can submit additional information and request reconsideration. Form SS-8 is available to download on IRS.gov, and any questions can be directed to the IRS at 800-829-1040.

IRS Form SS-8 – Who Needs to Fill It Out?

If you are a business or worker looking to request a determination of a worker’s status under the common law rules for federal employment taxes, you may need to fill out IRS Form SS-8. Generally, the form must be completed by the firm, providing complete and accurate information including documents such as Forms 1099-MISC, Forms 1099-NEC, and Forms W-2 for all years in question. For service providers or salespersons, additional information in Part V may also be required. If the worker is a government worker, the State Social Security Administrator should be consulted with to determine if that worker is subject to social security and Medicare tax. Form SS-8 is free to request and should be signed and dated by the taxpayer. A determination letter or information letter is subsequently issued to the firm and copied to the worker. The determination process does not constitute an audit and appeal rights from an examination cannot be applied. Although a determination may not reduce current or prior tax liability, a Form 1040-X can be filed to protect the statute of limitations for a potential refund.

Step-by-Step: Form SS-8 Instructions For Filling Out the Document

To fill out this document, begin by providing the purpose of the form and the definition of ‘Firm’. Then, move onto the SS-8 Determination Process, completing Form SS-8, noting the signature and filing requirements, and instructions for both workers and firms. Ensure that all information is given and accurate to avoid dismissal of the form. Be sure to include the years of service provided, any changes to the relationship, and any relevant documents to help support the request. There is no fee for this form and, upon completion, submit the form through either mailing or faxing it to the IRS in Holtsville, NY.

Below, we present a table that will help you understand how to fill out Form SS-8.

| Form Name | Form SS-8 |

|---|---|

| Purpose | Request a determination of worker classification for tax purposes. |

| Filing Requirements | Provide accurate information and relevant documents. Submit the form through mailing or fax to the IRS in Holtsville, NY. |

| Additional Information | There is no fee for this form. Ensure completeness to avoid dismissal. |

Do You Need to File Form SS-8 Each Year?

In order to resolve federal tax matters, firms and workers may file Form SS-8 to request a determination of the status of a worker under the common law rules for purposes of federal employment taxes and income tax withholding. The form must be completed and signed by the taxpayer, with additional information supplied for service providers or salespersons. If any litigation involving the worker or firm is ongoing, the IRS will not provide a ruling. A determined status does not necessarily reduce any current or prior tax liability, but workers can file Form 1040-X to reserve the time to file for a possible refund. There is no fee to request a determination and the IRS will send a copy of the ruling to both the firm and the worker.

Download the official IRS Form SS-8 PDF

On the official IRS website, you will find a link to download Form SS-8. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form SS-8

Sources: