This article provides detailed instructions on Form CT-1, which is used to report taxes imposed by the Railroad Retirement Tax Act (RRTA). It explains who must file Form CT-1, how to complete it line by line, and when and where to file it. It also outlines employer and employee taxes, different tax rates and compensation bases for 2022, rules related to withholding employee taxes, and tips.

What is Form CT-1?

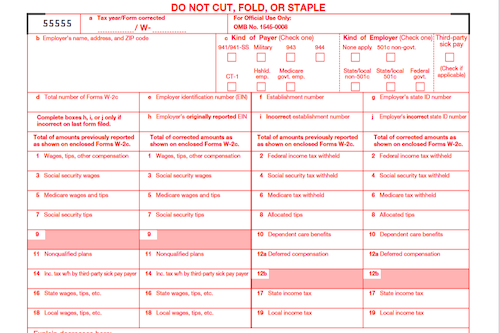

Form CT-1 is used to report taxes imposed by the Railroad Retirement Tax Act (RRTA). It must be filed annually by February 28th. Employers must pay both Tier 1 and Tier 2 taxes (unless qualified sick and family leave compensation is paid), while employees must pay Tier 1 and Tier 2 taxes on their income and report tips to their employer to be taxed if over $20 in any month. Employers must determine if they need to be monthly schedule depositors or semiweekly schedule depositors based on the amount of taxes they reported on Form CT-1 for the calendar year lookback period (the second calendar year preceding the current calendar year).

IRS Form CT-1 – Who Needs to Fill It Out?

Any employer who paid one or more employees compensation subject to taxes under the Railroad Retirement Tax Act must file Form CT-1. Eligible single-owner disregarded entities and Qualified Subchapter S Subsidiaries are treated separately for employment tax purposes. Employers must pay both Tier 1 and Tier 2 taxes, with taxes divided into two parts based on different compensation bases. Employers must also withhold their employees’ part of the taxes, or else they must pay the tax themselves. The individual employee must also report cash tips to the employer by the 10th day of the month following the month the tips are received. The employer must determine what deposit schedule to follow when a tax liability arises, using the lookback period of the second preceding year.

Step-by-Step: Form CT-1 Instructions For Filling Out the Document

Step-by-Step: Form CT-1 Instructions For Filling Out the Document Filing Form CT-1 is a complex process. These instructions provide you with essential information, such as who must file, how to complete the form line by line, and when and where to file it. Additionally, as Notice 2021‐24, 2021‐18 I.R.B. 1122, available at IRS.gov/irb/2021-18_IRB#NOT-2021-24, as modified by Notice 2021-65, may have reduced deposits of taxes, these instructions provide information regarding this particular situation. It is of utmost importance to understand who must file, where they must file, and when they must file as well as how to calculate the taxes correctly, which includes understanding the terms ’employer’ and ’employee’ and what type of payments are considered as ‘compensation’. Being able to differentiate between Tier 1 and Tier 2 taxes and understanding when the Employee Additional Medicare Tax are important pieces of information as well. This is especially true considering the rules about cash tips, where the taxes must be deducted from the payroll and when employees must report their tips to the employer.

Below, we present a table that will help you understand how to fill out Form CT-1.

| Form CT-1 | Instructions |

|---|---|

| Filing Form CT-1 is a complex process, and these instructions provide essential information. |

|

Do You Need to File Form CT-1 Each Year?

Yes, after you file your first Form CT-1, you must file a return for each year, even if you didn’t pay taxable compensation during the year, until you file a final return. The lookback period of two years is taken into account to determine which deposit schedule to follow for depositing tax – based on either total taxes of $50,000 or less reported on the Form CT-1 for that period, or more than $50,000. New employers are considered monthly schedule depositors for the first two years.

Download the official IRS Form CT-1 PDF

On the official IRS website, you will find a link to download Form CT-1. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form CT-1

Sources: