Employers must file IRS Form 945 if they have withheld taxes from certain non-payroll payments, such as qualifying pensions, gambling profits, and military retirement and pay. Form 945 is used to report the withheld taxes to the IRS and the payee.

What is Form 945?

IRS Form 945 is an annual return filed by employers to report any federal income taxes they have withheld from non-employees, such as independent contractors and individuals accepting pensions, gambling profits, and military retirement or pay. This form is also associated with backup withholding, when employers have to take taxes out of individuals’ pay if they do not provide a correct taxpayer identification number or Social Security Number. Even if no taxes were withheld, employers must still file Form 945 to report non-payroll payments, available online and in IRS offices.

IRS Form 945 – Who Needs to Fill It Out?

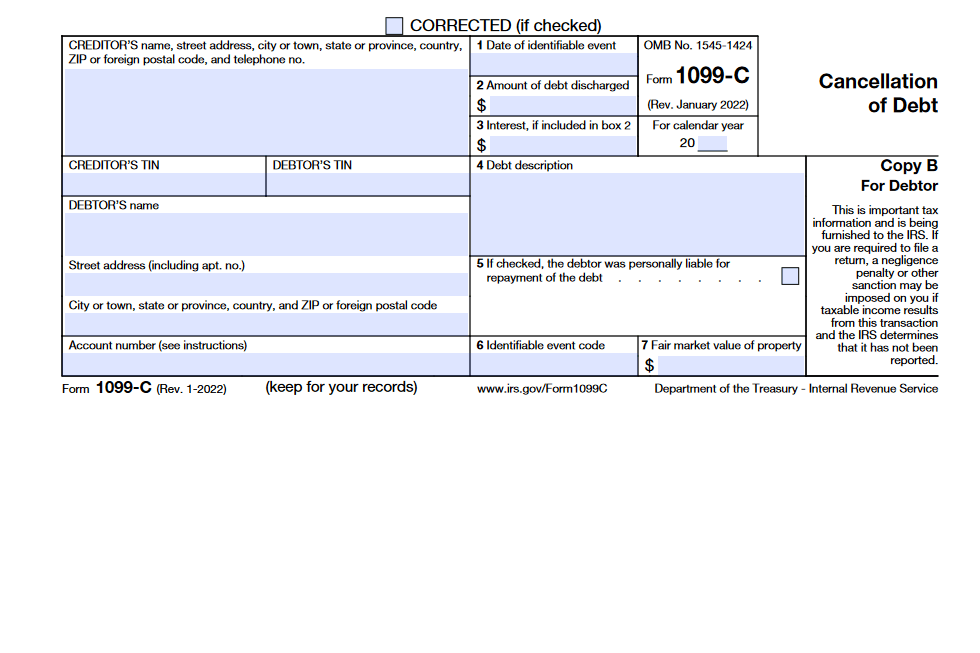

IRS Form 945 is used by employers to report federal income taxes withheld from non-employee payments such as independent contractor payments, pensions, gambling profits, and military retirement and pay. Businesses may also have to withhold on payments that are reported to the payee and the IRS on Form 1099-NEC (for non-employee compensation) or Form 1099-MISC (for other types of payments like prizes, rents, and royalties). Generally, such withholdings occur when taxpayers fail to give a correct TIN or Social Security number. Form 945 is available online and can be e-filed, and employers must provide the IRS with a summary of all payments withheld from non-payroll sources.

Step-by-Step: Form 945 Instructions For Filling Out the Document

Form 945 is an annual return that employers use to report to the IRS all federal income taxes withheld from non-payroll payments to non-employees such as independent contractors, pensions, gambling profits, and military retirement and pay. The form is available online and can be e-filed. When filling out the form, employers need to provide the total amount of federal income taxes withheld from all individuals subject to backup withholding, the total amount of all backup withholding deposits during the year, and the balance due or overpayment. Employers must also break down the total into monthly tax liability if they pay more than $2,500 in backup withholding during the year. When filing, employers must also fill out a 1099-NEC or 1099-MISC to report payments to non-employees to the payee and the IRS. Payments for other types of payments, such as prizes, rents, and royalties, would be reported on Form 1099-MISC. Employers can make deposits semi-weekly or monthly and should submit Form 945 at the same time they would submit W-2 forms and 1099 forms.

Below, we present a table that will help you understand how to fill out Form 945.

| Information Required for Form 945 | Details |

|---|---|

| Total Federal Income Taxes Withheld | Sum of federal income taxes withheld from non-payroll payments to non-employees, including independent contractors, pensions, gambling profits, and military retirement and pay. |

| Total Backup Withholding Deposits | Total amount of all backup withholding deposits made during the year. |

| Balance Due or Overpayment | The net balance due to the IRS or any overpayment that needs to be returned to the employer. |

| Monthly Tax Liability (if applicable) | If more than $2,500 in backup withholding was paid during the year, break down the total into monthly tax liability. |

| Related Forms | Employers must also fill out a 1099-NEC or 1099-MISC to report payments to non-employees to the payee and the IRS. Payments for other types of payments, such as prizes, rents, and royalties, would be reported on Form 1099-MISC. |

| Submission Deadline | Form 945 should be submitted at the same time as W-2 forms and 1099 forms. |

Do You Need to File Form 945 Each Year?

IRS Form 945 must be filed annually by employers as it summarizes all the federal income taxes withheld under backup withholding requirements from non-employees. All payments to non-employees must be reported on Form 1099-NEC for non-employee compensation, or Form 1099-MISC for other types of payments like prizes, rents and royalties. Employers must take backup withholding from payments to independent contractors if they fail to provide a correct tax identification or Social Security number. Form 945 can be filled out online and is available on the IRS website. Electronic filing is available and payments to the IRS can be made electronically via the EFTPS system.

Download the official IRS Form 945 PDF

On the official IRS website, you will find a link to download Form 945. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 945

Sources:

https://www.irs.gov/forms-pubs/about-form-945

https://www.irs.gov/instructions/i945