Form 8966 is required to be filed for the 2022 calendar year by March 31, 2023. The filing requirement applies to a variety of entities such as PFFIs, U.S. branches, RDCFFIs, Sponsoring Entities, Trustee-Documented Trusts, Direct Reporting NFFEs and withholding agents. This article outlines who must file and the special rules for certain Form 8966 filers.

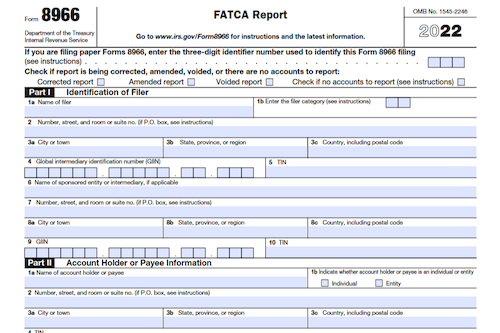

What is Form 8966?

Form 8966 is used to report information with respect to certain U.S. accounts, substantial U.S. owners of passive NFFEs, specified U.S. persons that own certain debt or equity interests in ODFFIs, and other accounts as applicable based on the filer’s chapter 4 status. All filers listed under “Who Must File” are subject to the reporting requirements of Form 8966. The form must be filed on or before March 31, 2023, and exceptions for the time to file may be granted. Special filing rules may apply for specific filers with respect to the form and chapter 61 reporting. Trustee-Documented Trusts must also report information on Form 8966 to the IRS with respect to each U.S. account maintained by the Trustee-Documented Trust. Mergers and bulk acquisitions of accounts may also have combined reporting requirements on Form 8966.

IRS Form 8966 – Who Needs to Fill It Out?

Form 8966 is required to be filed for the 2022 calendar year by anyone who is a Participating Financial Foreign Institution (PFFI) reporting on U.S. accounts, accounts held by Owner-Documented Financial Institutions, and certain aggregate information about accounts held by recalcitrant account holders; a Reporting Model 2 Financial Institution to report information with respect to U.S. accounts, accounts held by Owner-Documented Financial Institutions, and non-consenting U.S. accounts; a Qualified Intermediary, Withholding Foreign Partnership, or Withholding Foreign Trust filing on its accounts, beneficiaries, etc.; a Direct Reporting Non-Financial Foreign Entity filing on its substantial U.S. owners or reporting that it has none; a Sponsoring Entity filing on behalf of a Sponsored FFI or Direct Reporting NFFE; the trustee of a Trustee-Documented Trust; or a withholding agent not an FFI filing on behalf of a passive NFFE with a substantial U.S. owner, or an ODFFI with a specified U.S. person owning certain equity or debt interests. Generally, Form 8966 must be filed on or before March 31, 2023.

Step-by-Step: Form 8966 Instructions For Filling Out the Document

Form 8966 must be filed by those acting in any of the capacities outlined in these instructions – PFFIs, Reporting Model 2 FFIs, Trustee-Documented Trusts, U.S. branches of an FFI not treated as a U.S. person, etc. – and should be filed on or before March 31, 2023. For certain filers such as those undertaking mergers or bulk acquisitions of accounts, additional extensions to file might apply if the requirements laid out in Regulations section 1.1471-4T(d)(2)(ii)(G)(1)-(4) are met. Form 8966 serves to report information with respect to U.S. information, accounts held by ODFFIs, and other details as outlined in these instructions depending on the filer’s chapter 4 status.

Below, we present a table that will help you understand how to fill out Form 8966.

| Form 8966 | Instructions |

|---|---|

| Step-by-Step: Form 8966 Instructions For Filling Out the Document |

|

Do You Need to File Form 8966 Each Year?

Generally, Form 8966 is required to be filed by filers listed in the instructions, such as Participating FFIs (PFFIs), Registered Deemed-Compliant FFIs (RDCFFIs), Reporting Model 2 FFIs, Qualified Intermediaries (QIs), Withholding Foreign Partnership (WPs), Withholding Foreign Trusts (WTs), Direct Reporting NFFEs, Sponsoring Entities, Trustee-Documented Trusts and withholding agents, depending on their chapter 4 status. Generally, Form 8966 is to be filed by March 31st of the applicable year; however, filers may receive an extension of time to file. If a PFFI (including a Reporting Model 2 FFI) acquires accounts in a merger or bulk acquisition, the successor may assume the predecessor’s Form 8966 filing obligations subject to certain requirements.

Download the official IRS Form 8966 PDF

On the official IRS website, you will find a link to download Form 8966. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8966

Sources: