Use Form 8910 to figure your credit for alternative motor vehicles placed in service during your tax year, which is treated as either a general business or personal credit. Partnerships and S corporations must file this form; all other taxpayers can report it directly on Form 3800.

What is Form 8910?

Form 8910 is used to claim the credit for alternative motor vehicles placed in service during the tax year. This applies to partnerships and S corporations, while other taxpayers can report the credit directly on Form 3800. Qualifications include at least four wheels, converting chemical energy to electricity by combining oxygen and hydrogen fuel, use in the US, ownership by the taxpayer, and the original use of the vehicle also belonging to the taxpayer. Furthermore, the IRS must certify the make, model, and model year for the vehicle. Other requirements include providing written disclosure to purchasers when selling to a tax-exempt organization and reducing the basis of each vehicle by the amounts entered on lines 6 and 10. Finally, if the vehicle qualifies for another credit from Form 8936, it cannot also qualify for the alternative motor vehicle credit.

IRS Form 8910 – Who Needs to Fill It Out?

Form 8910 must be completed by partnerships and S corporations to claim the credit for alternative motor vehicles placed in service during the tax year. Individuals have the option of reporting the credit directly on Form 3800, while businesses that have sold a vehicle to a tax-exempt organization are required to disclose the credit amount in writing to the recipient. In order to qualify for the credit, the IRS has a few requirements, including that the vehicle must be used primarily in the United States, the original use of the vehicle must have started with the owner, and the vehicle must not have been purchased for resale. For further information, please see available resources from the IRS.

Step-by-Step: Form 8910 Instructions For Filling Out the Document

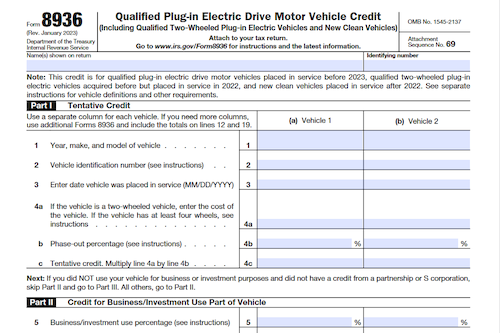

Form 8910 is used to calculate the credit available for alternative motor vehicles placed in service during the tax year. The credit can either be a general business credit or a personal one, depending on the depreciable property used. Partnerships and S corporations must file the form, but other taxpayers can claim the credit directly on line 1r in Part III of Form 3800. The January 2022 revision must be used for tax years beginning in 2021 or later, unless another revision is issued. To qualify for the credit, specific criteria must be met, including the vehicle must have 4 wheels, must be used/leased not resold, must be purchased on or before the IRS published the withdrawal announcement, and must primarily be used in the US, among others. In some cases, basis reduction or recapturing may apply. Coordinating the qualified plug-in electric drive motor vehicle credit on Form 8936 must also be considered.

Below, we present a table that will help you understand how to fill out Form 8910.

| Form 8910 | Instructions |

|---|---|

| Form 8910 is used to calculate the credit available for alternative motor vehicles placed in service during the tax year. |

|

Do You Need to File Form 8910 Each Year?

All taxpayers need to file Form 8910 each year if the credit is attributable to depreciable property, and partnerships and S corporations must file this form regardless. However, other taxpayers need not complete or file it if their sole source of the credit is a partnership or S corporation; instead, they can report the credit directly on Line 1r of Part III of Form 3800. Use the January 2022 revision of Form 8910 for tax years beginning in 2021 or later, and prior revisions for earlier tax years. Details are available at IRS.gov/Form8910.

Download the official IRS Form 8910 PDF

On the official IRS website, you will find a link to download Form 8910. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8910

Sources: