With the repeal of the American Jobs Creation Act of 2004, taxpayers may still claim an ETI exclusion for certain transactions under a binding contract before 2005. This article provides guidance on the rules and requirements for taxpayers to figure the amount of extraterritorial income excluded from gross income for the tax year.

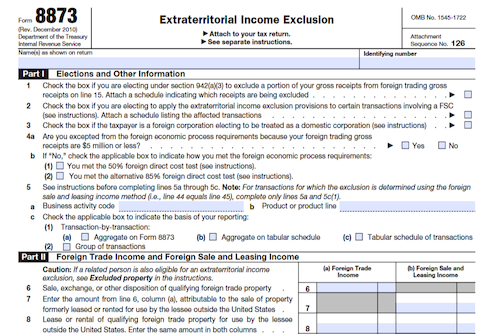

What is Form 8873?

The ETI exclusion is a way of reducing gross income by excluding extraterritorial income. This applies to individuals, corporations, partnerships, and other pass-through entities, if they have extraterritorial income. The exclusion generally applies to taxpayers with respect to transactions after Sept. 30, 2000, although pre-repeal ETI exclusion rules may also apply, including for transactions under a binding contract in effect on Sept. 17, 2003, and at all times thereafter. The rules establish definitions for extraterritorial income, foreign trading gross receipts, qualifying foreign trade property, foreign economic process requirements, foreign sale and leasing income, and related persons. An election to apply the exclusion rules may be made on line 2.

IRS Form 8873 – Who Needs to Fill It Out?

Individuals, corporations (including S corporations), partnerships, and other pass-through entities that have extraterritorial income from foreign trading gross receipts may need to fill out this form in order to figure the amount of extraterritorial income excluded from gross income for the tax year. The exclusion applies to taxpayers with respect to transactions after September 30, 2000, although a binding contract exception applies to taxpayers for transactions before 2005. In some cases, a total of $5 million may be exempt from the foreign economic process requirement, as determined on an annualized basis.

Step-by-Step: Form 8873 Instructions For Filling Out the Document

If a taxpayer wants to exclude extraterritorial income from their gross income for the tax year, they should use Form 8873 to figure that amount. This form must be attached to the taxpayer’s income tax return. Taxpayers may only be able to claim the ETI exclusion for transactions under a binding contract that meets specific requirements. Eligibility depends on the tax year beginning date: prior to May 18, 2006, transactions must satisfy certain criteria and have been in effect on September 17, 2003; on or after May 18, 2006, ETI exclusion is not available. The taxpayer must also understand the specific requirements for Qualifying Foreign Trade Property, Foreign Economic Process Requirements, and Foreign Trade Income, among others. By entering the relevant data and following the instructions, taxpayers should be able to figure the ETI exclusion amount on this form.

Below, we present a table that will help you understand how to fill out Form 8873.

| Form 8873 | Instructions |

|---|---|

| If a taxpayer wants to exclude extraterritorial income from their gross income for the tax year, they should use Form 8873 to figure that amount. This form must be attached to the taxpayer’s income tax return. Taxpayers may only be able to claim the ETI exclusion for transactions under a binding contract that meets specific requirements. Eligibility depends on the tax year beginning date: prior to May 18, 2006, transactions must satisfy certain criteria and have been in effect on September 17, 2003; on or after May 18, 2006, ETI exclusion is not available. The taxpayer must also understand the specific requirements for Qualifying Foreign Trade Property, Foreign Economic Process Requirements, and Foreign Trade Income, among others. By entering the relevant data and following the instructions, taxpayers should be able to figure the ETI exclusion amount on this form. |

|

Do You Need to File Form 8873 Each Year?

Generally, taxpayers may claim an extraterritorial income exclusion if the transaction is conducted under a binding contract that meets certain requirements and is in effect by September 17, 2003. Otherwise, the exclusion applies for transactions before 2005. For tax years beginning after May 17, 2006, the ETI binding contract exception has been repealed. It is important to remember that all qualifying foreign trade property must meet the foreign economic process requirements, and that the $5 million gross receipts exception is only applicable if all related people are treated as one taxpayer.

Download the official IRS Form 8873 PDF

On the official IRS website, you will find a link to download Form 8873. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8873

Sources: