Form 8848 must be filed on or before the due date of the corporation’s income tax return and attached to the return, and signed by an authorized person. Executing a consent to extend the time to assess the branch profits tax can still be done by filing an amended return within 6 months.

What is Form 8848?

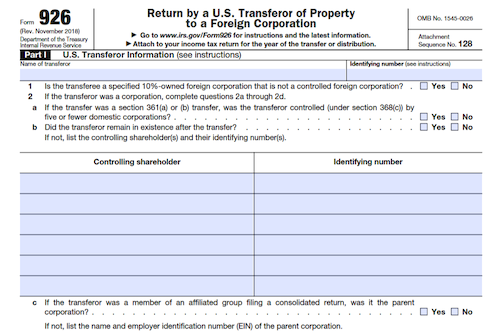

Form 8848 is a form filed by foreign corporations and domestic transferee corporations in certain situations. Foreign corporations must file Form 8848 if they have completely terminated all of their US trade or business, while domestic transferee corporations must file if US assets have been transferred to them from a foreign corporation. Form 8848 must be filed on or before the due date (including extensions) prescribed for filing the corporation’s income tax return. The form must be signed by the person authorized to sign the income tax returns, and a copy of the power of attorney must also be included if signed by an agent.

IRS Form 8848 – Who Needs to Fill It Out?

Form 8848 must be filled out and filed by foreign corporations if they have completely terminated all U.S. trade or business in the tax year, and by domestic transferee corporations if U.S. assets have been transferred to it from a foreign corporation in a section 381(a) transaction. It should be attached to the corporation’s return and signed by the person authorized to sign it. See instructions for the tax return to comply with the Internal Revenue laws of the United States and for information regarding estimates of the time needed to complete the form.

Step-by-Step: Form 8848 Instructions For Filling Out the Document

Filing Form 8848 is mandatory for either a foreign corporation if it has completely terminated its U.S. trade or business, or a domestic transferee corporation if U.S assets have been transferred to it from a foreign corporation in a transaction described in section 381(a). The form should be attached to the corporation’s return for the tax year during which the complete termination or section 381(a) transaction occurred. If the corporation failed to execute a consent to extend the time to assess the branch profits tax at the time the return was filed, they have 6 months to file an amended return. Along with Form 8848, all filings must be signed by the person authorized to sign the corporation’s income tax returns. Furthermore, all documents pertaining to the form must be retained in administrative records for later use. Consult the instructions for the tax return to which Form 8848 is submitted for additional information.

Below, we present a table that will help you understand how to fill out Form 8848.

| Information Required for Form 8848 | Details |

|---|---|

| Termination or Section 381(a) Transaction | File if a foreign corporation completely terminated its U.S. trade or business, or if U.S. assets were transferred from a foreign corporation |

| Form Submission | Attach to the appropriate tax return and send to the specified address |

Do You Need to File Form 8848 Each Year?

Yes, Form 8848 must be filed each year on or before the due date of the income tax returns. This is the case if a foreign corporation has completely terminated all of its U.S. trade or business during the tax year, or if U.S. assets have been transferred to it from a foreign corporation in a transaction described in section 381(a). If the corporation timely filed its return without executing a consent to extend the time to assess the branch profits tax, it can still do so by filing an amended return within 6 months. All necessary paperwork should be attached and signed, as specified in the instructions.

Download the official IRS Form 8848 PDF

On the official IRS website, you will find a link to download Form 8848. However, to make it easier for you, we are providing the link in our article, which comes directly from the official irs.gov website! Click to download: Form 8848

Sources: